20 Policy

Objectives

- Know the policy goal of fiscal and monetary policy

- Map effects of expansionary and contractionary fiscal policy

- Map effects of expansionary and contractionary monetary policy

- Identify optimal fiscal and monetary policy

- Understand unconventional monetary policy

- Forward guidance

- Quantitative easing

20.1 Introduction

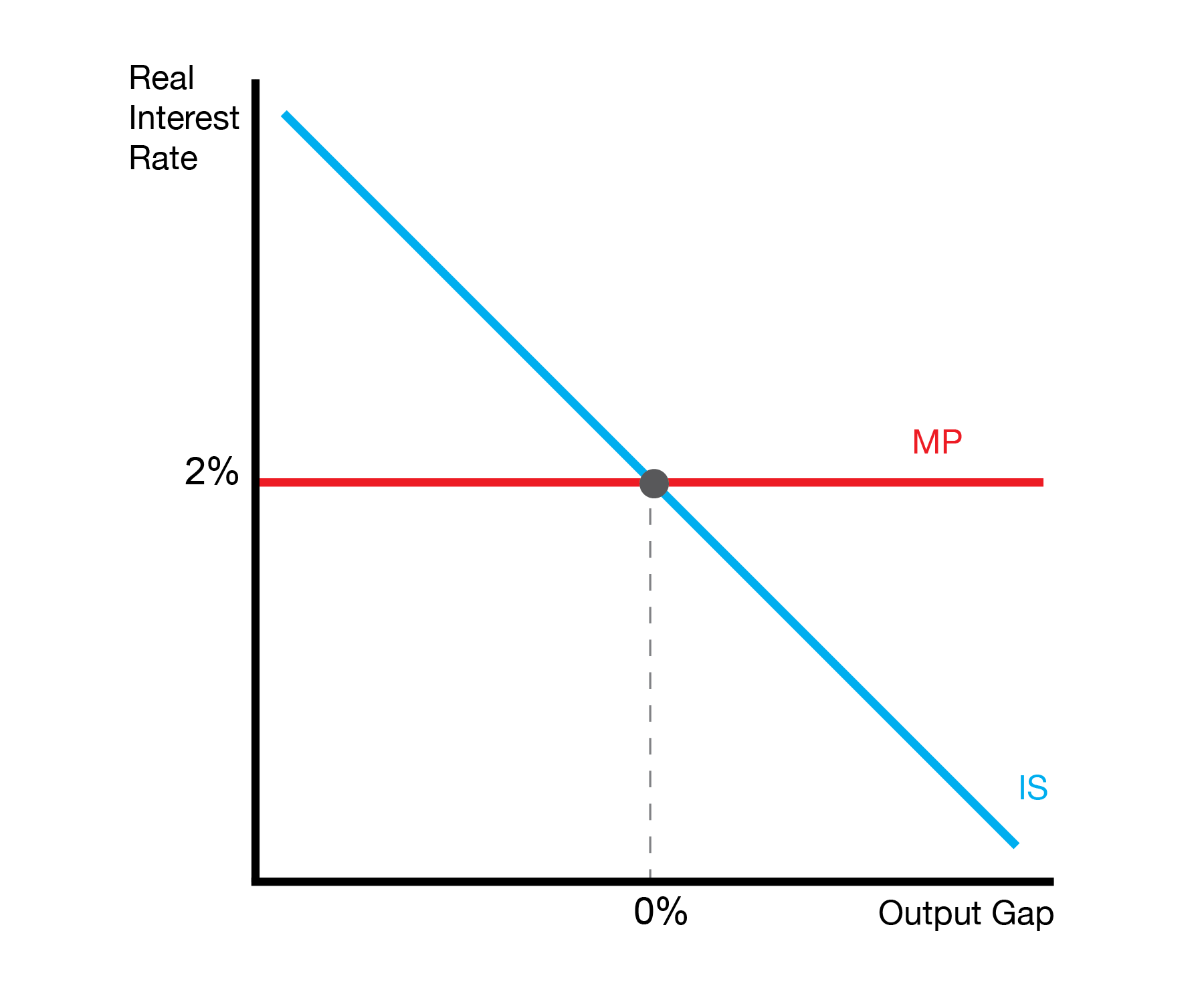

This section develops the optimal responses of fiscal and monetary policy. The goal of each policy is to ‘stabilize’ the economy. Within our model, we express this as a 0% output gap.

20.1.1 Booms and Busts

20.2 Fiscal Policy

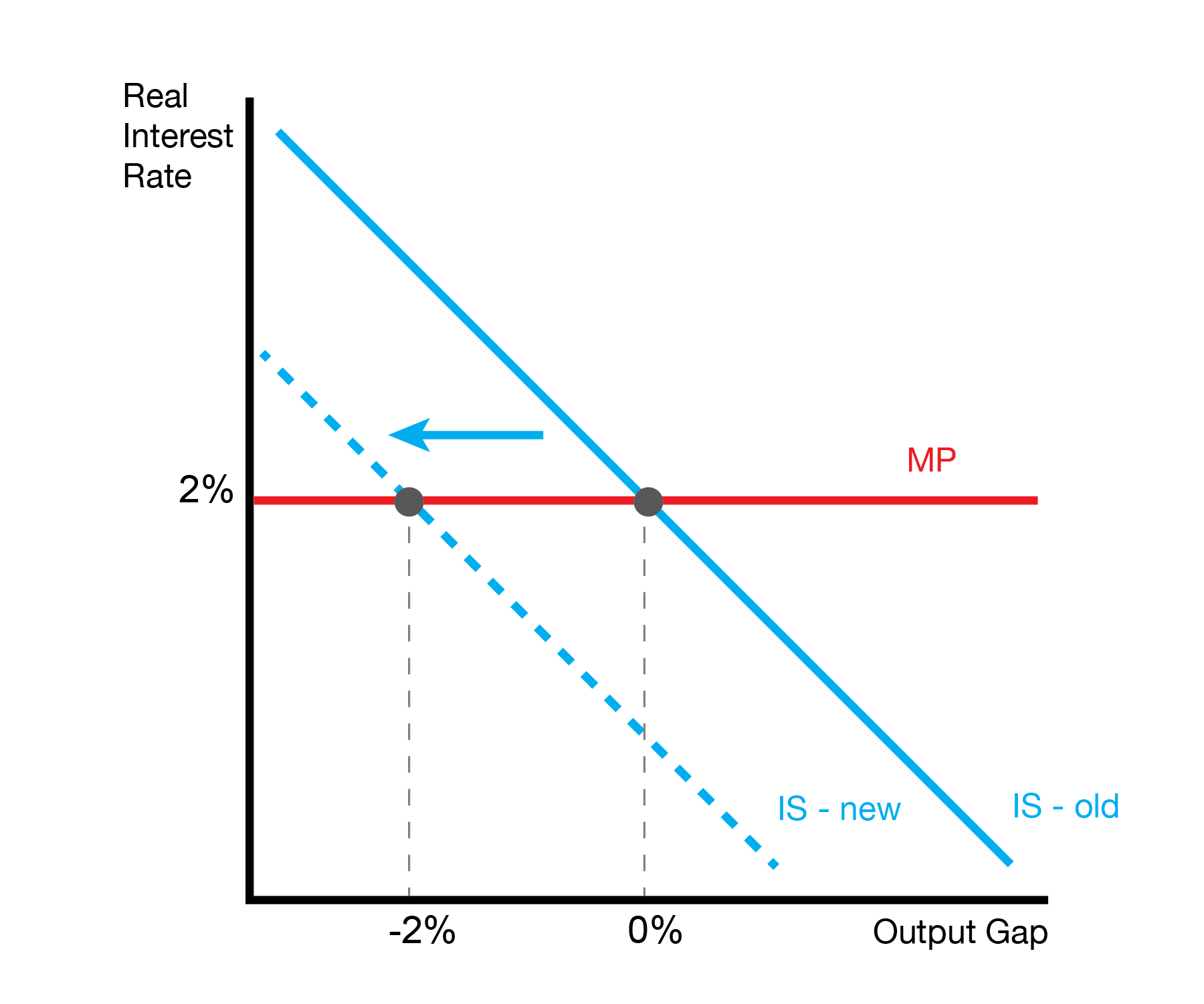

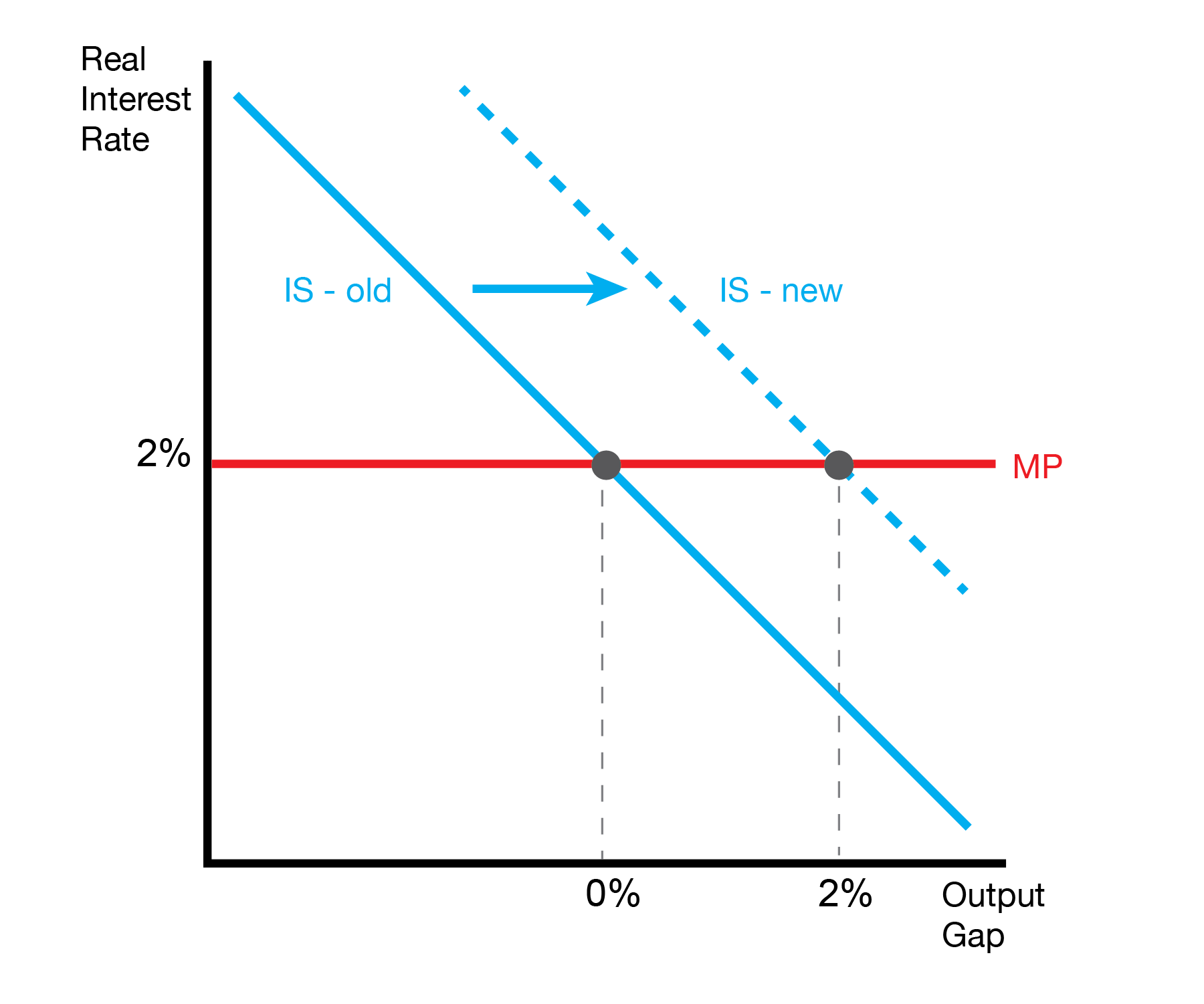

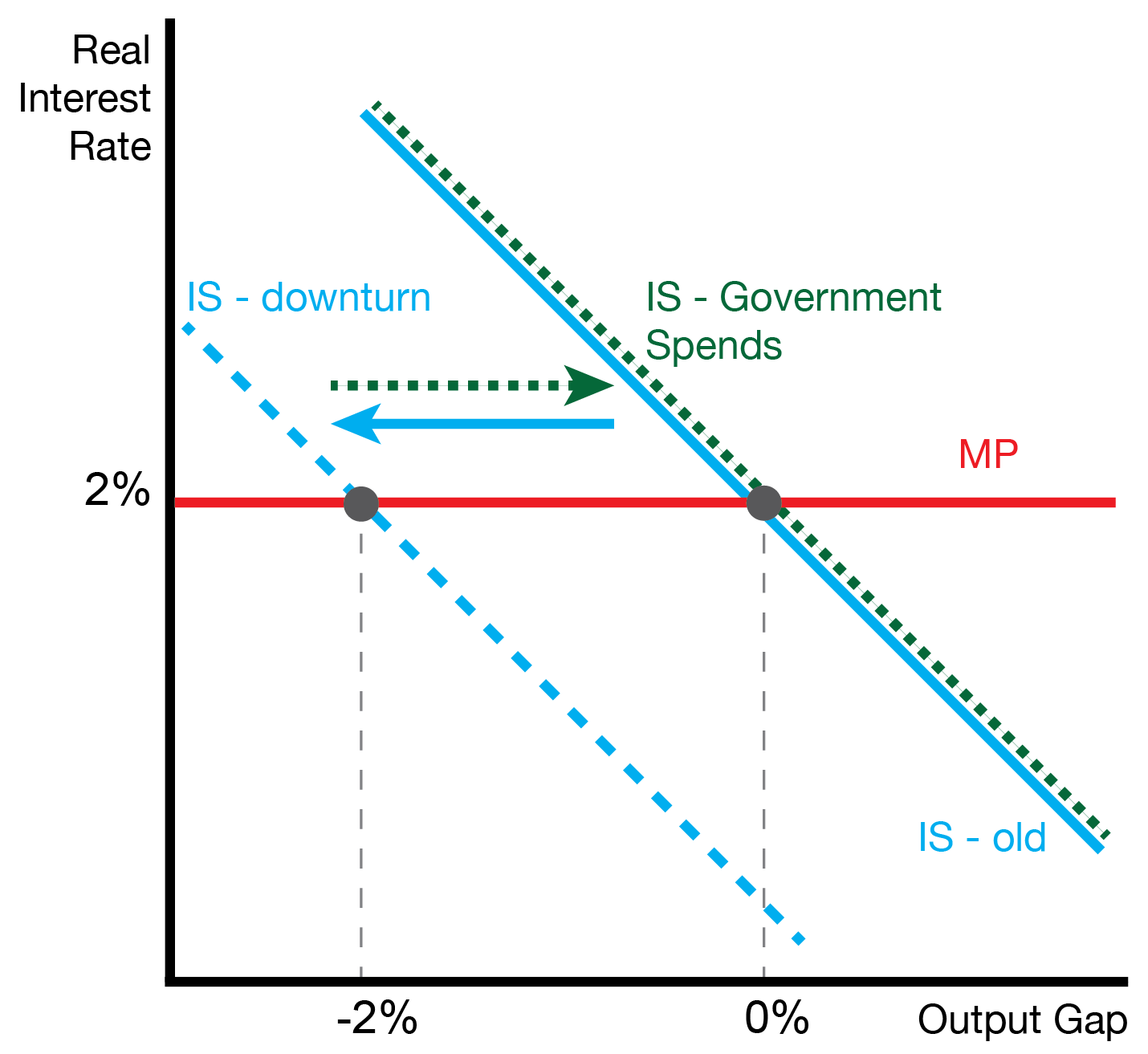

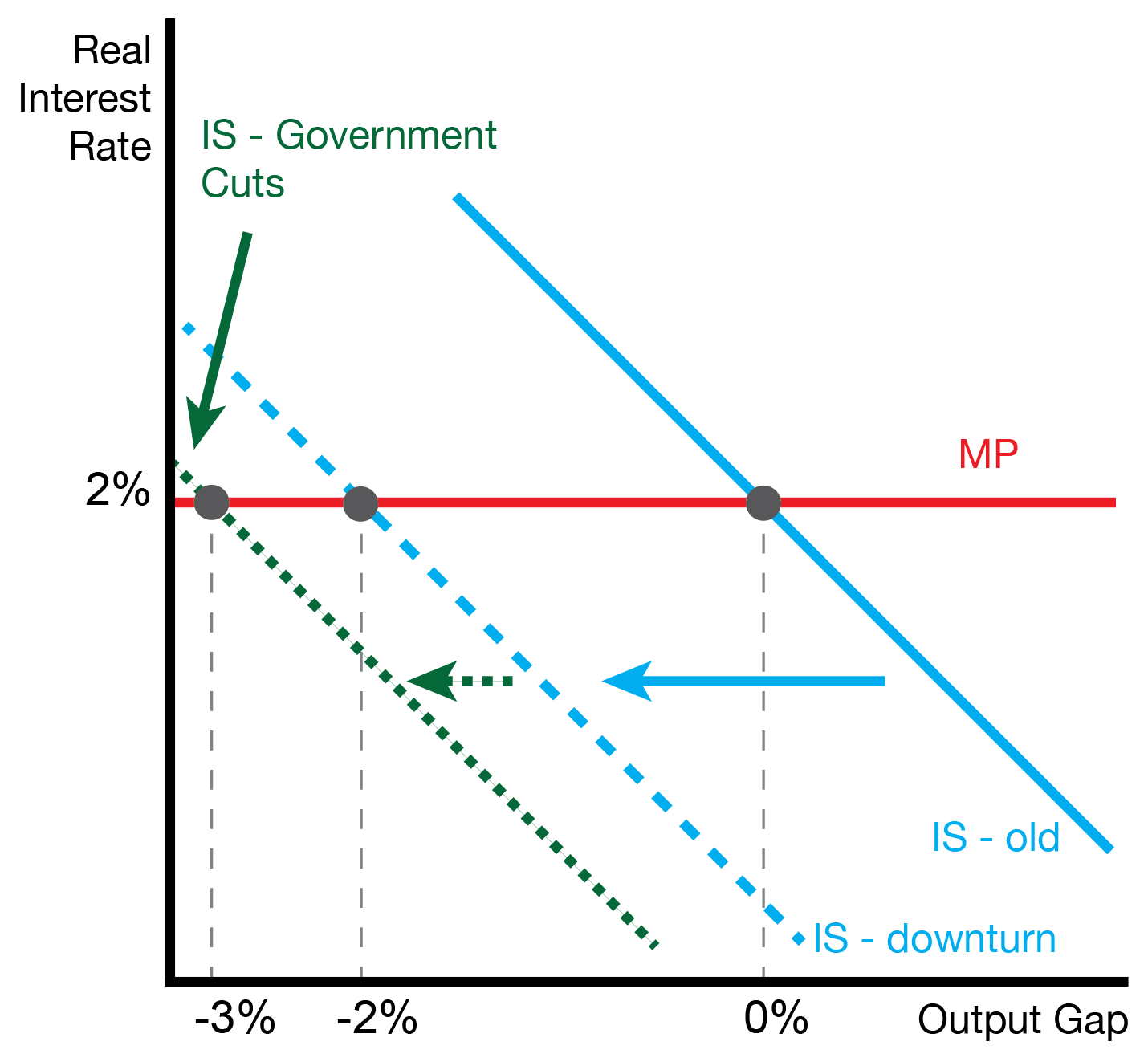

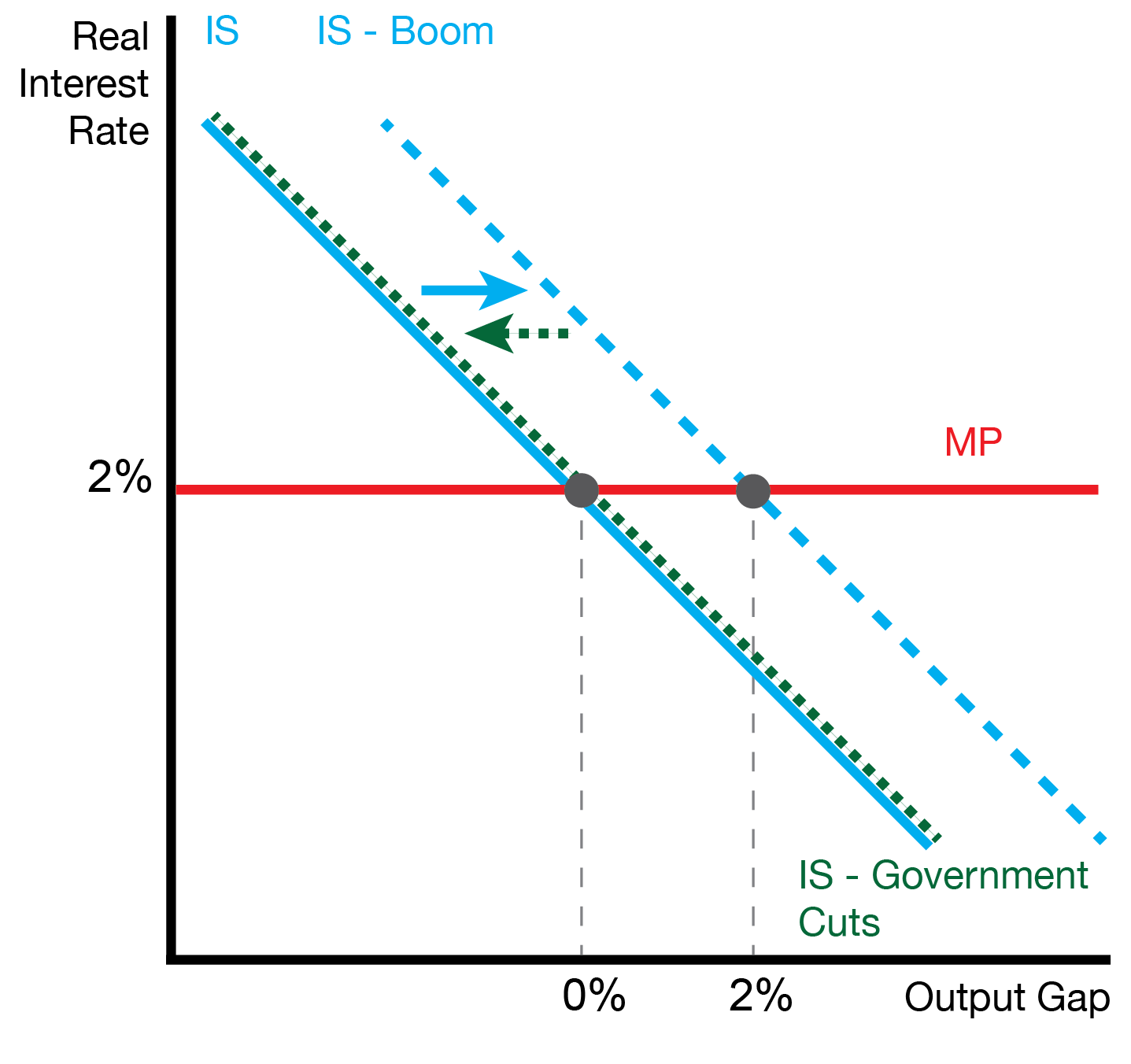

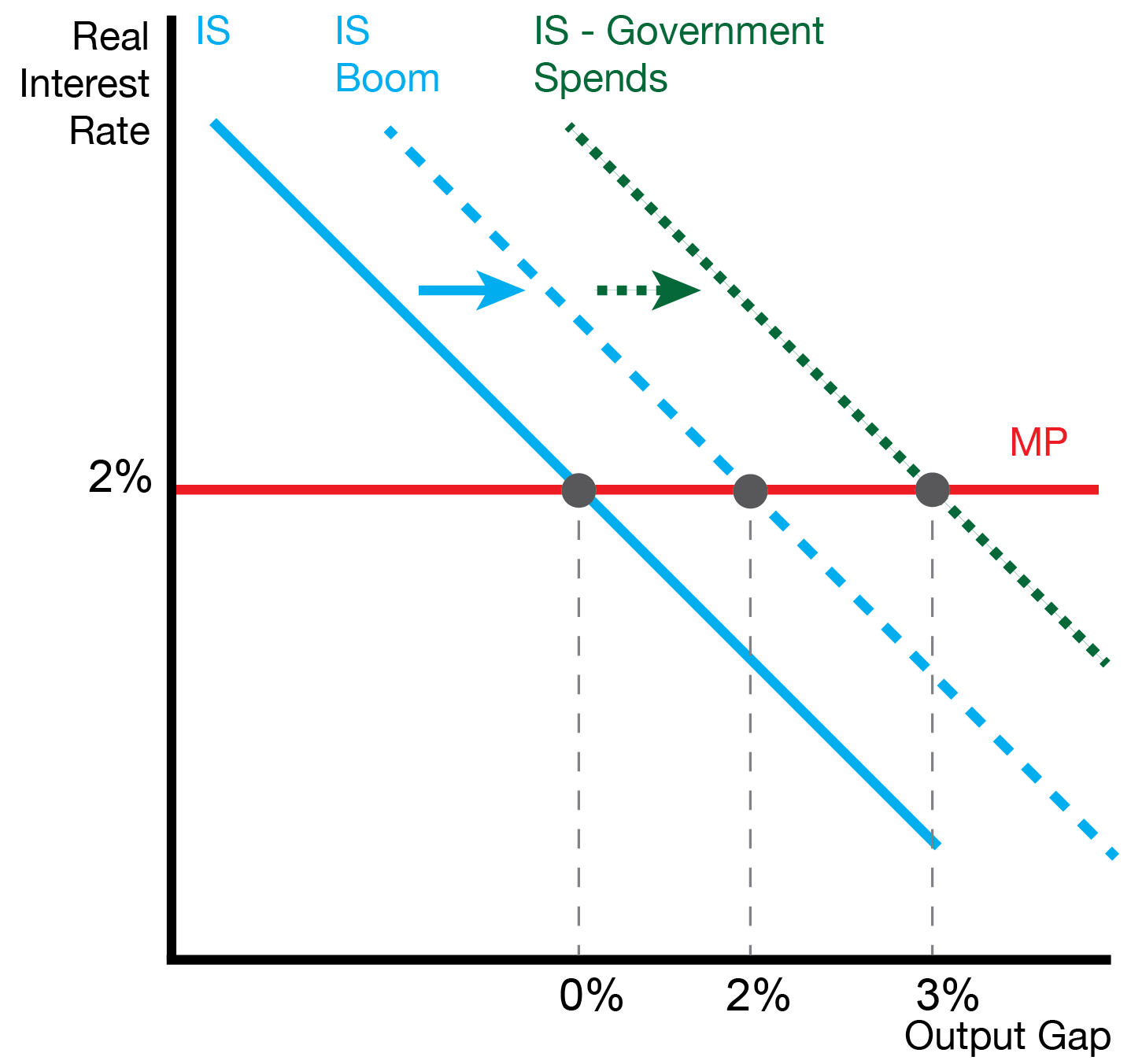

We first examine fiscal policy. Fiscal policy is changes in government expenditures \(G\). Because the government can increase or decrease \(G\), it can indirectly shift the IS curve left and right. The goal of fiscal policy is to appropriately change \(G\) so that we reach our goal of output stabilization (Output Gap = 0).

20.2.1 Downturns

20.2.2 Booms

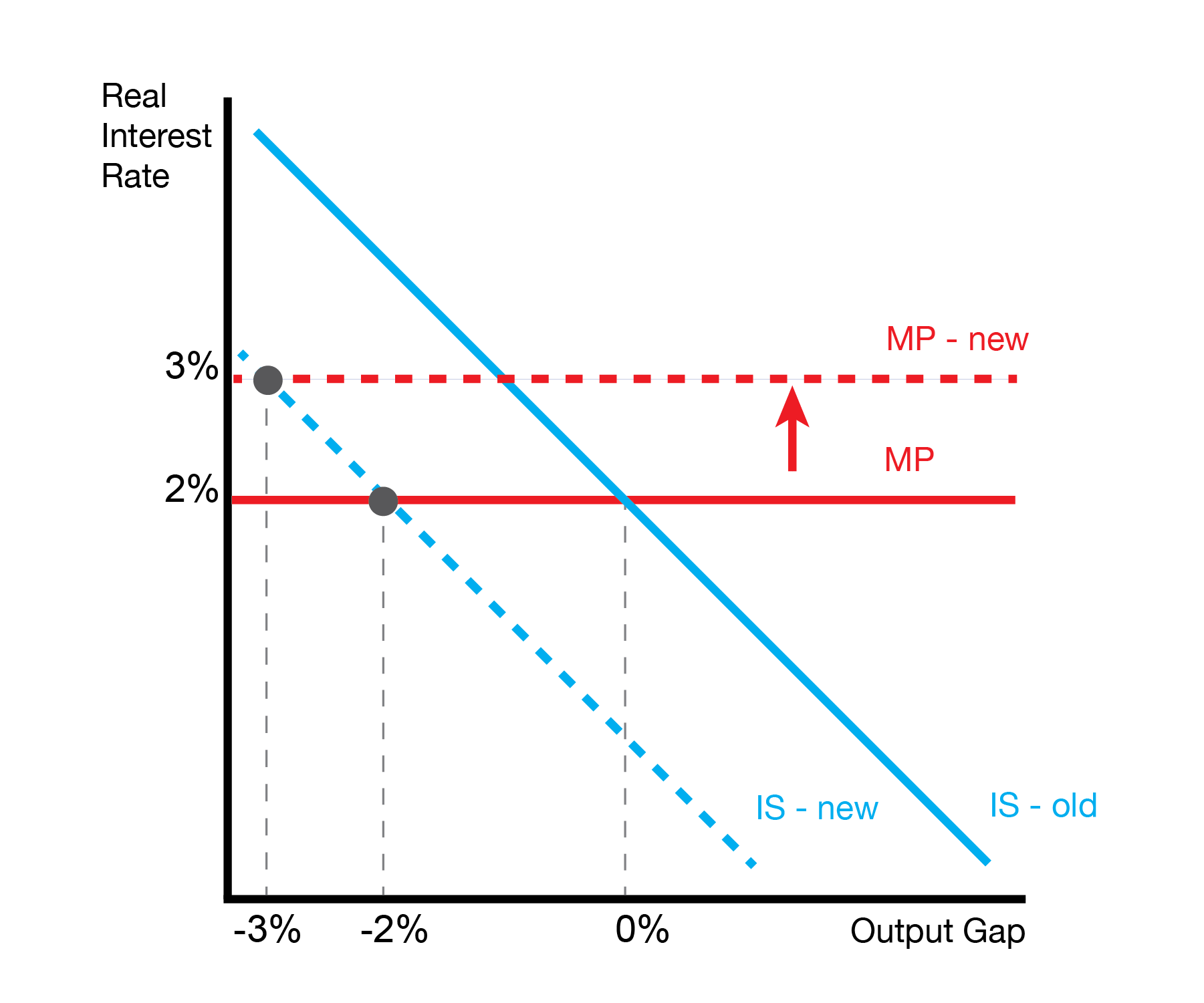

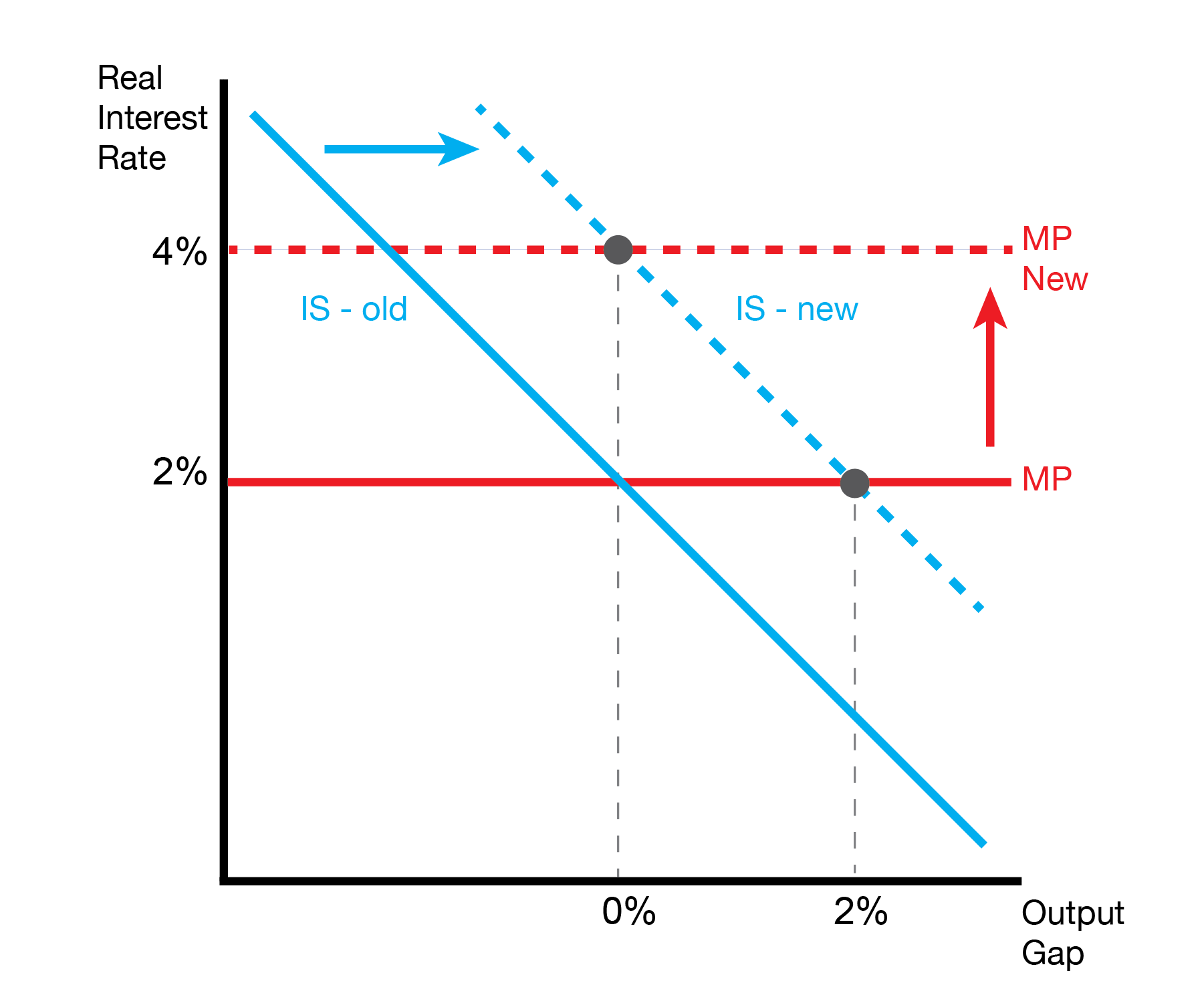

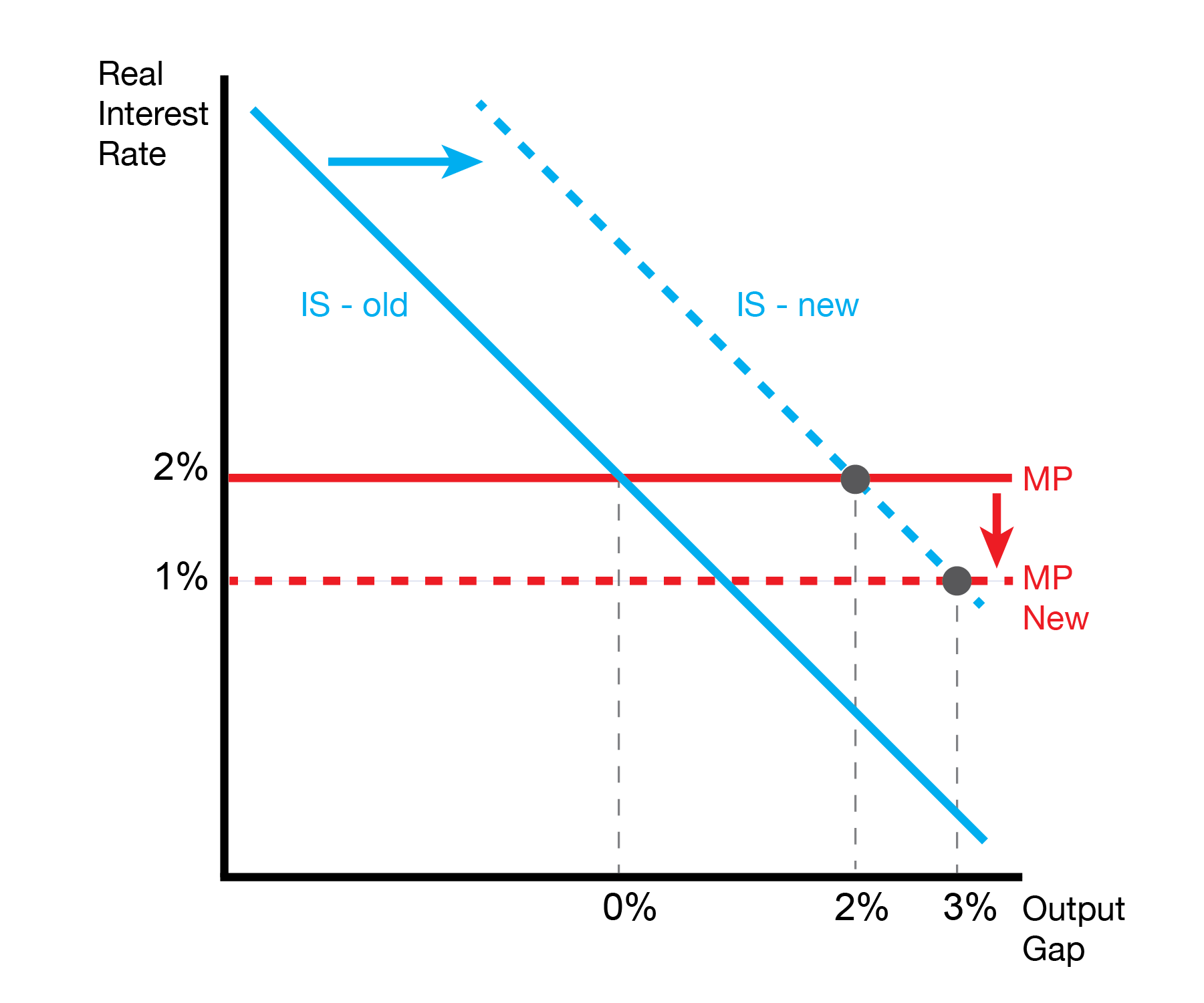

20.3 Monetary Policy

20.3.1 Busts

20.3.2 Booms

20.4 Unconventional Monetary Policy

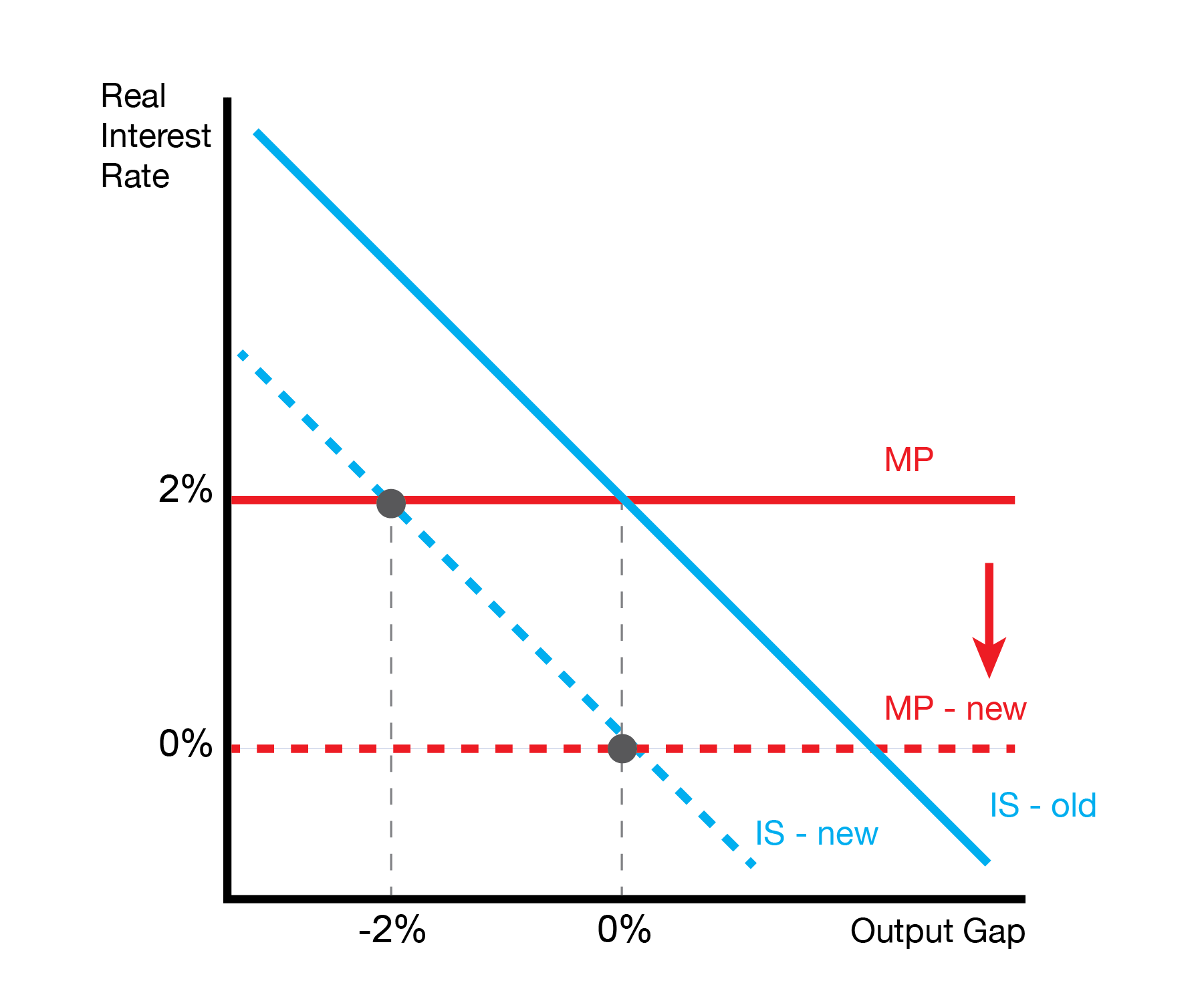

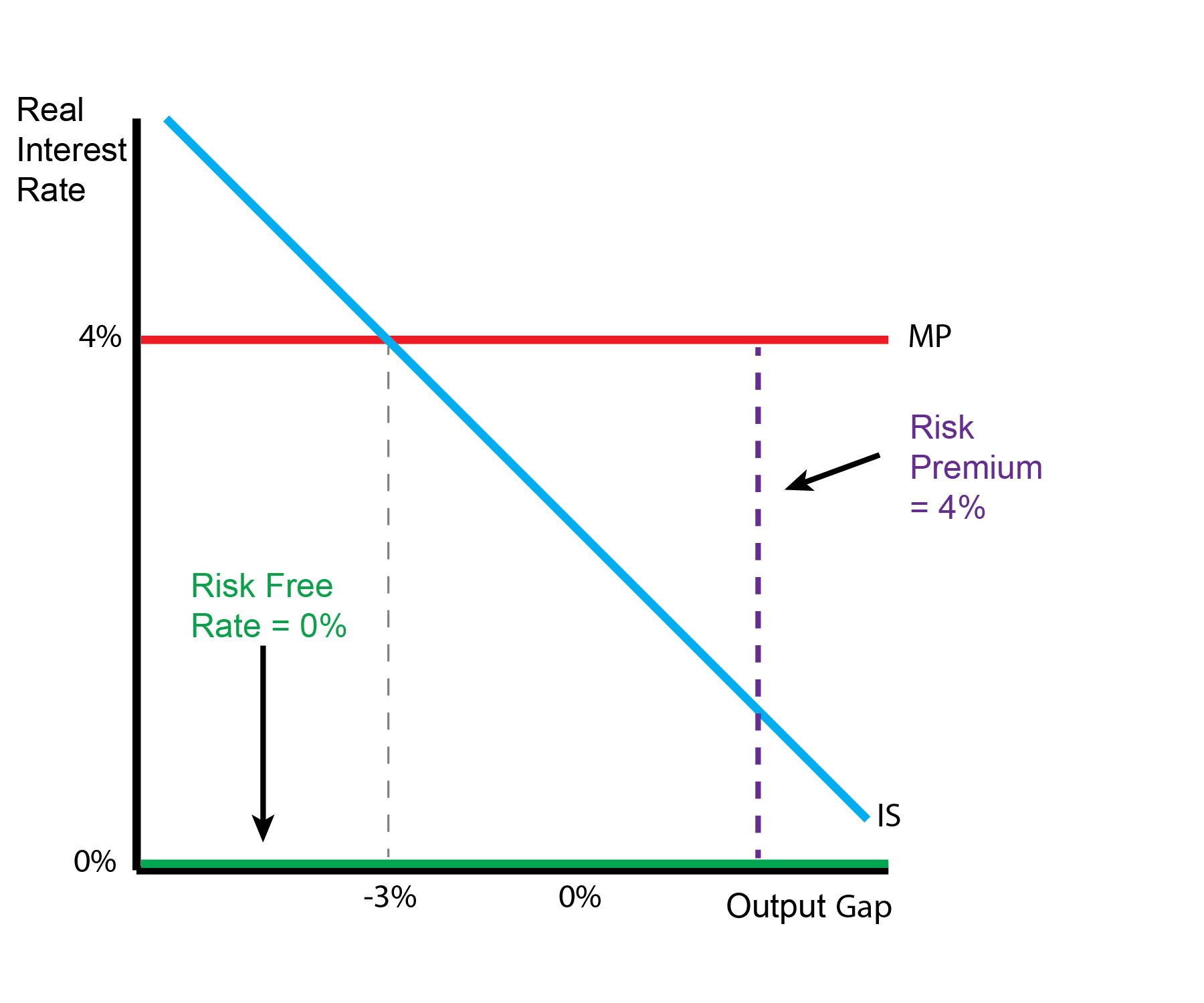

We now examine unconventional monetary policy. We can consider the case where the economy is in a bust. The standard choice of monetary policy is to lower the interest rate, possibly as low as 0%. A problem arises when the risk premium is too high. Even though the risk free rate is at its lowest possible level, the risk premium is too high. The result is that the economy remains in a downturn.

Central banks get around this problem by using unconventional monetary policy. We will examine two forms: forward guidance and quantitative easing.

20.4.1 Forward Guidance

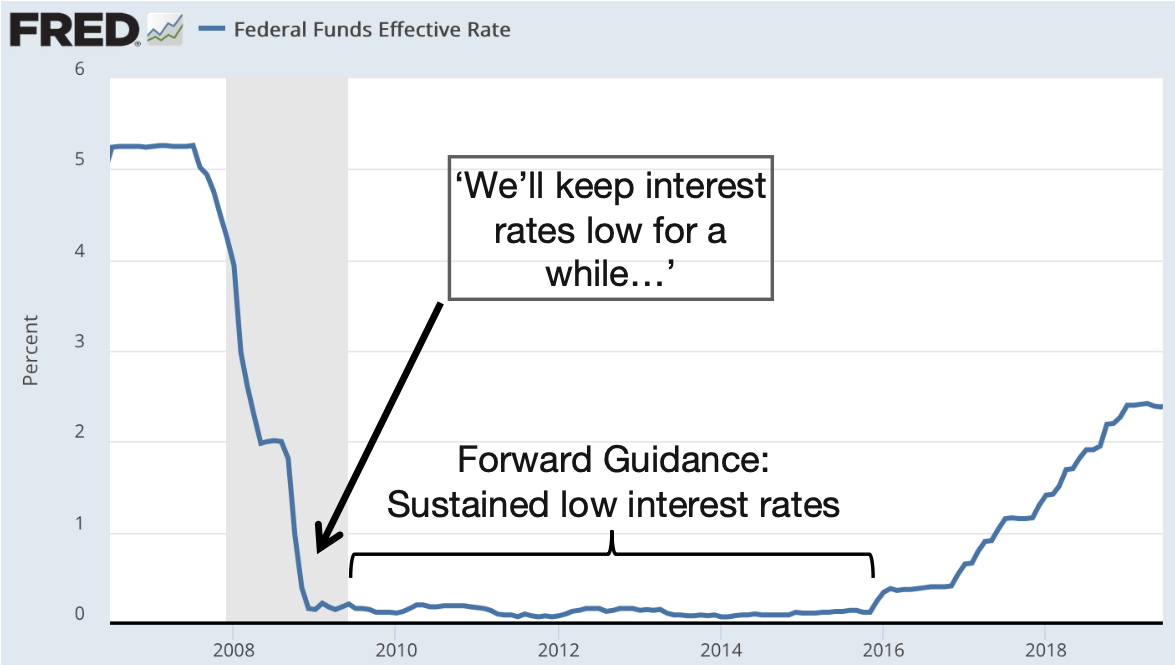

The basic risk free rate is for overnight saving and borrowing of banks. At the zero lower bound, the risk free rate is at its minimum of zero.

Under forward guidance, the central bank ‘promises’ to keep interest rates for a long period of time. This lowers the interest rate of long term loans such as cars and mortgages. The result is that people spend more today because they pay less on long term interest rates.

This was seen following the Great Recession. Even though the great recession had resolved, the Federal Reserve kept interest rates low up to 2016.

20.4.2 Quantitative Easing

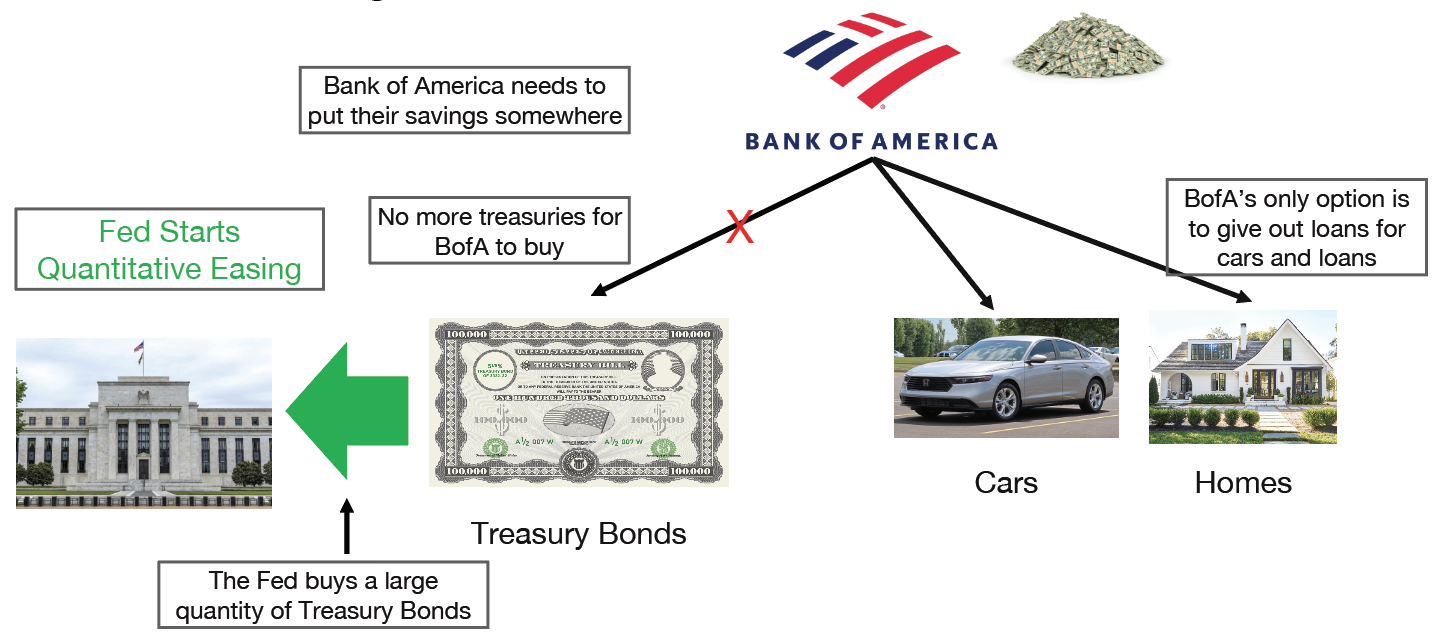

When the financial market is risky, banks stop lending to consumers and prefer to save in safe investments like treasuries. Under quanitative easing, the Federal Reserve buys large quantities of safe investments such as treasuries from banks. Because the bank no longer holds a treasury, they must lend their money out elsewhere. This incentivizes them to lend to consumers. Once it is easier for consumers to receive a loan, they can spend more, which boosts the economy.

20.5 Conclusion

| Optimal Policy | ||

|---|---|---|

| Economic condition | Fiscal policy (optimal) | Monetary policy (optimal) |

| Bust | Increase government spending | Lower policy rate (expansionary) |

| Boom | Decrease government spending | Raise policy rate (contractionary) |

- This section introduces optimal fiscal and monetary policy

- Fiscal: spend more during downturns, less during booms

- Monetary: decrease interest rate during downturns, increase rate during booms

- We study two tools in ‘unconventional’ monetary policy: quantitative easing and forward guidance