19 IS-MP - Shocks

Objectives

- Identify spending (IS curve) shocks

- Consumption

- Investment

- Government expenditures

- Identify financial (MP curve) shocks

- Monetary policy

- Risk premium

19.1 Introduction

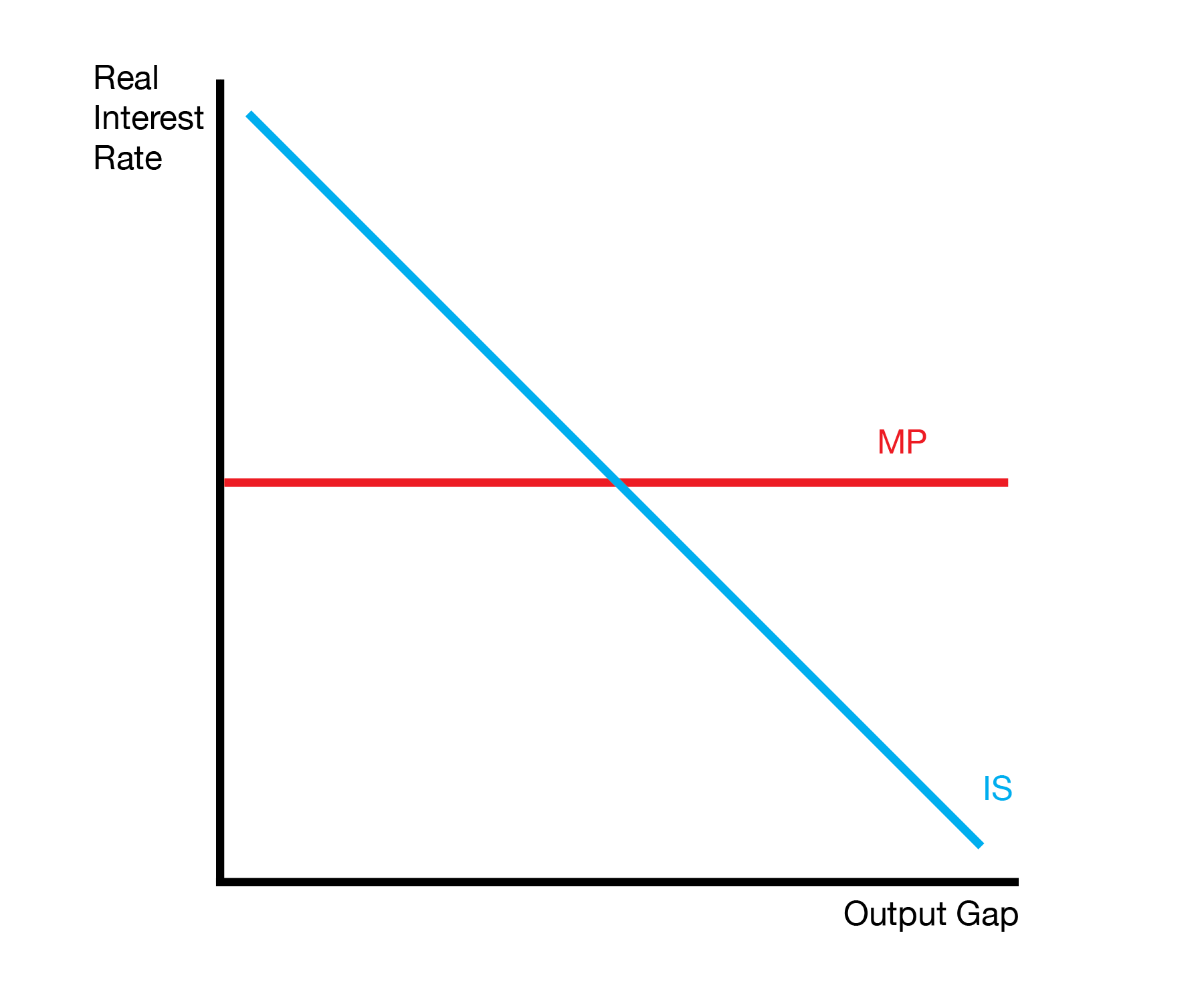

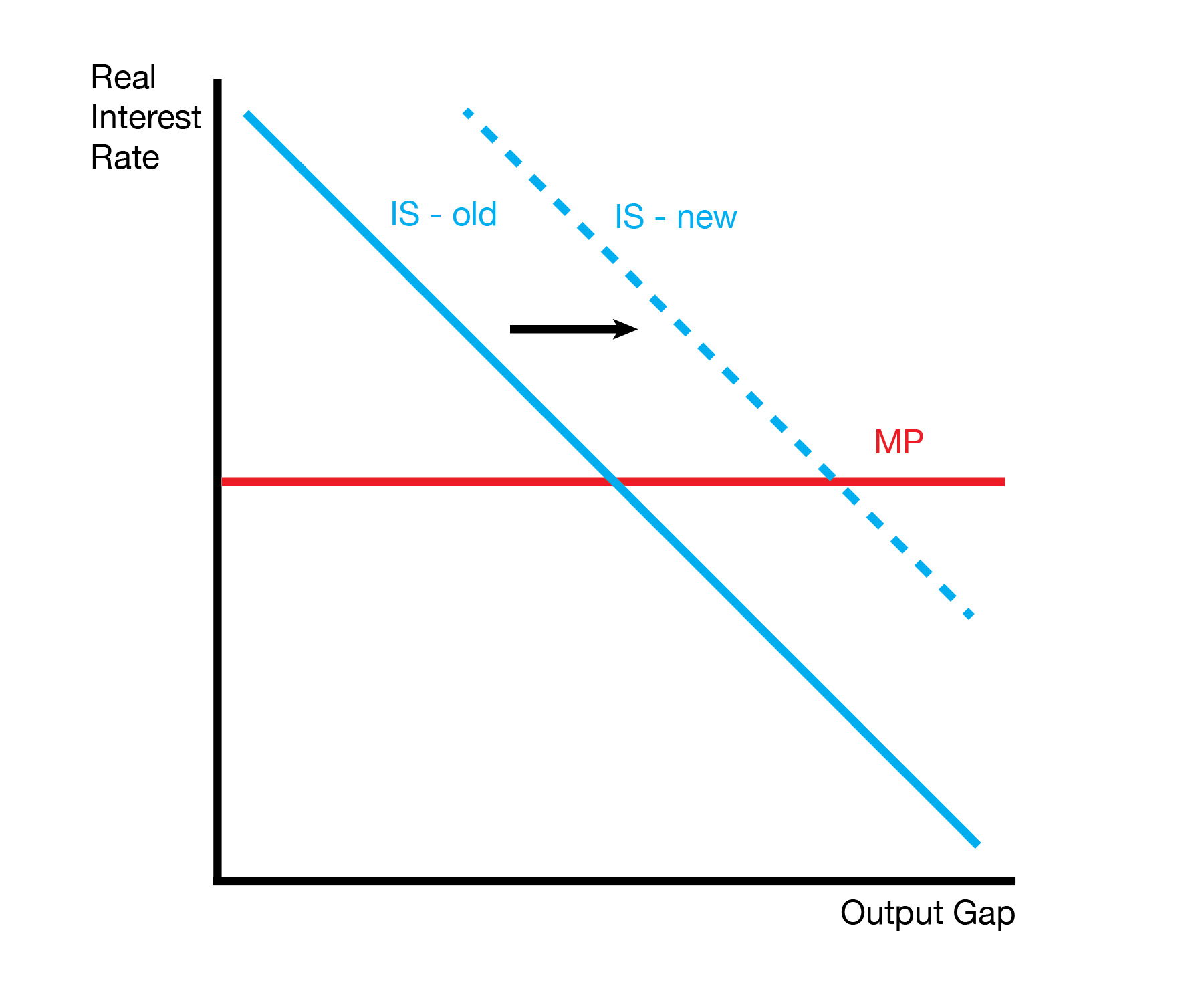

In the previous lecture, we developed our model of equilibrium in the macro economy. This involved building a macro demand curve (IS curve) and macro supply curve (MP curve). When we combine the two curves, we can identify the equilibrium real interest rate (price) and output gap (quantity).

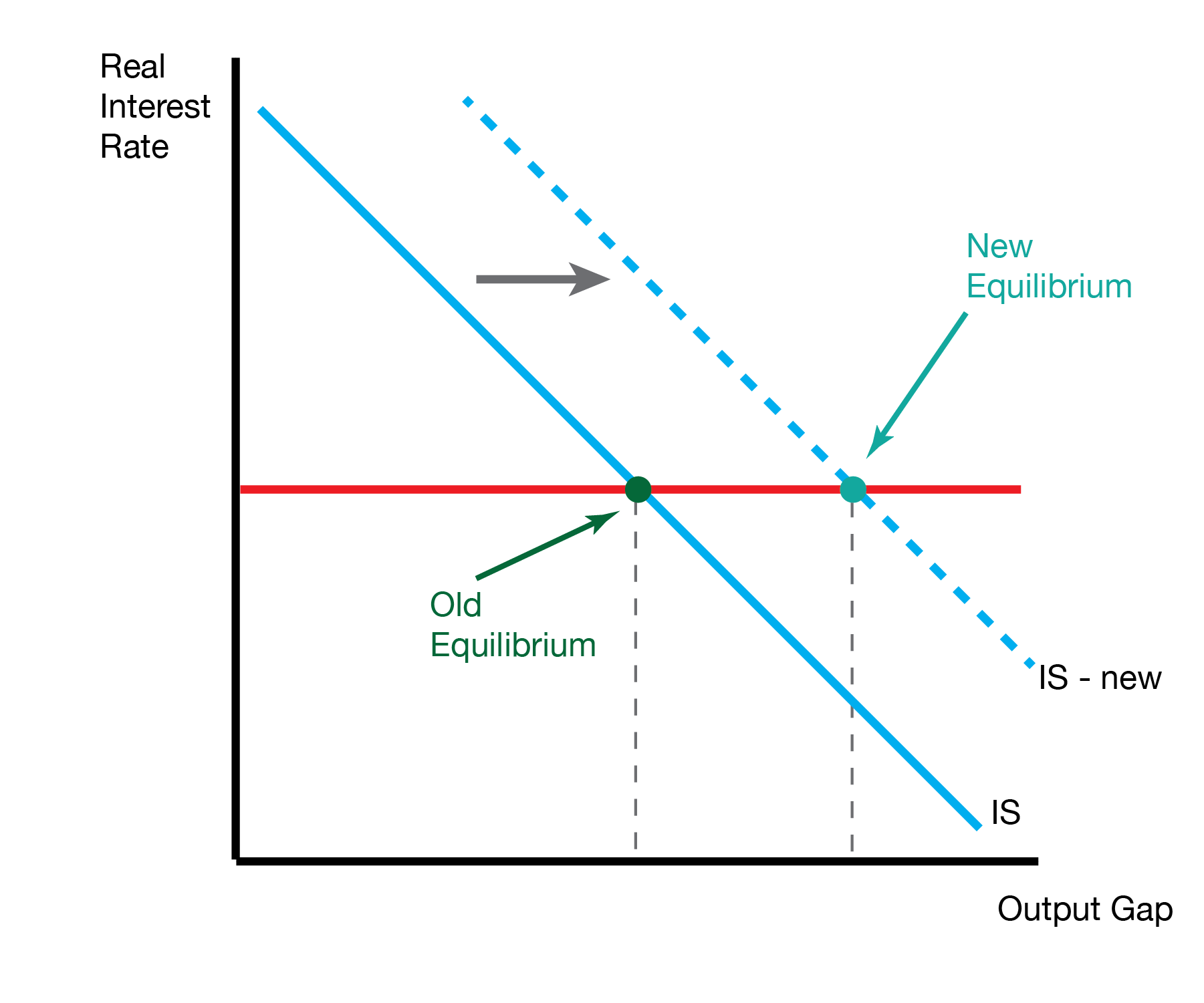

Our next objective is to introduce shocks to the macro model: what happens when something other than the real interest rate changes? Our treatment will be now different than in microeconomics: either the demand (IS) or supply (MP) curve shifts, we then identify the new equilibrium and effects on the price (real interest rate) and quantity (output gap).

19.2 IS Curve - Shocks

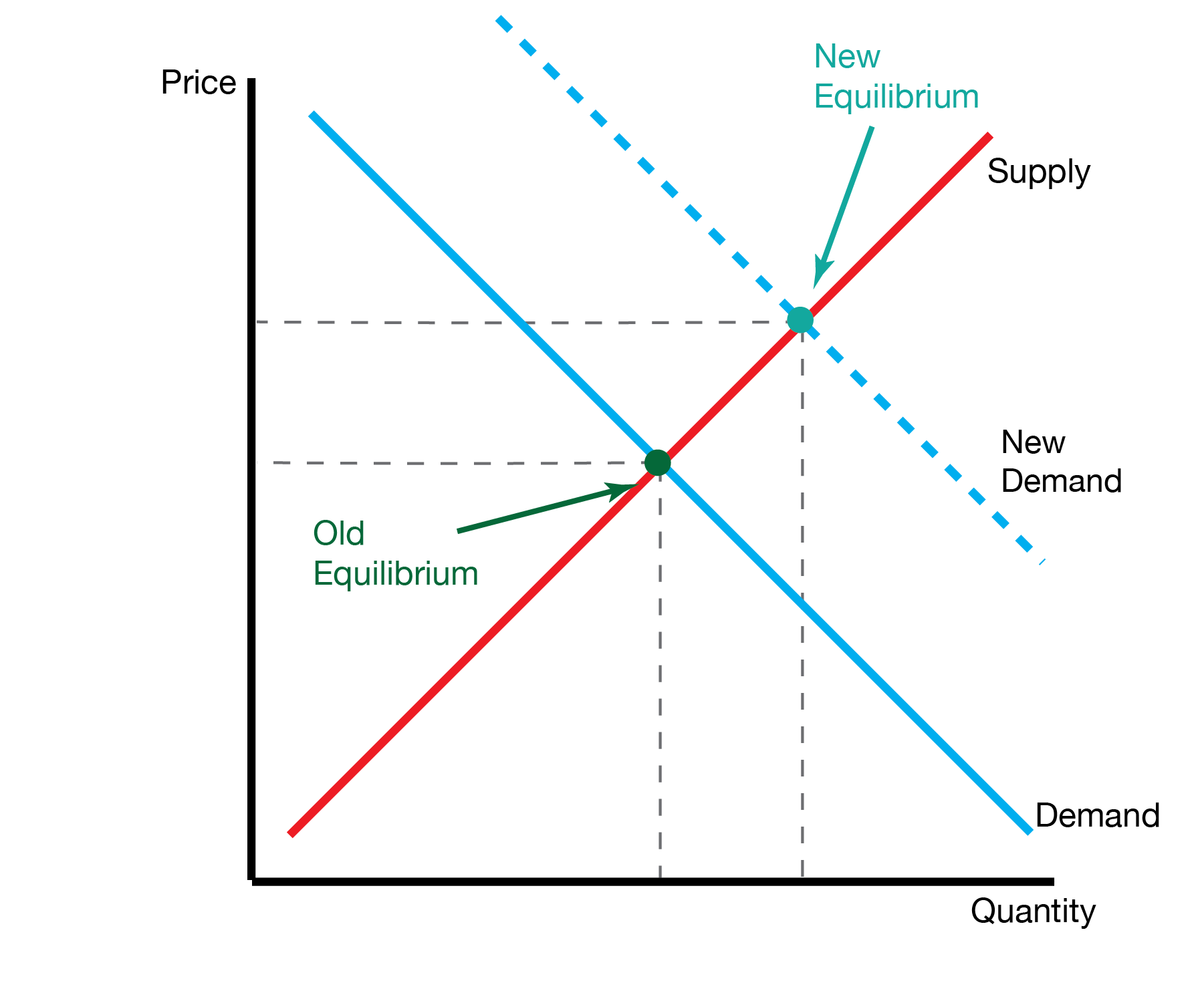

We start by introducing and categorizing shocks to the IS curve. Shocks can come from any of the components of GDP: consumption \(C\), investment \(I\), and government spending \(G\) (we will skip coverage of the trade balance).

When something other than the real interest rate changes, it shifts a component of GDP, and as a consequence it shifts the entire IS curve.

19.2.1 Consumption Shocks

| Consumption Shocks | ||

|---|---|---|

| Shifter | Change | IS Curve Shift |

| Wealth | Increase | Increase |

| Consumer Confidence | Increase | Increase |

| Taxes | Increase | Decrease |

| Government Assistance | Increase | Increase |

Wealth When household wealth increases (e.g., rising stock prices, home values), consumers feel richer and increase their spending at every interest rate level. This shifts the IS curve to the right.

Consumer Confidence Higher consumer confidence about future economic conditions leads to increased current consumption. Optimistic consumers are more willing to spend, shifting IS rightward. Pessimistic consumers reduce spending, shifting IS leftward.

Taxes Tax increases reduce disposable income, causing consumers to cut spending and shifting the IS curve left. Tax cuts have the opposite effect, increasing disposable income and shifting IS rightward.

Government Assistance Increases in unemployment benefits, stimulus payments, or other transfer programs boost household income and consumption, shifting the IS curve right. Reductions in these programs shift IS leftward.

19.2.2 Investment Shocks

| Investment Shocks | ||

|---|---|---|

| Shifter | Change | IS Curve Shift |

| Expanding Economy | Increase | Increase |

| Business Confidence | Increase | Increase |

| Lending Standards | Increase | Decrease |

| Uncertainty | Increase | Decrease |

Expanding Economy When businesses expect the economy to expand, they increase investment in new equipment, facilities, and technology at every interest rate level. This optimism about future profits shifts the IS curve to the right. Conversely, expectations of economic contraction reduce investment and shift IS leftward.

Business Confidence Higher business confidence about market conditions, regulatory environment, or profit opportunities encourages firms to invest more. Confident businesses are more willing to take on new projects, shifting IS rightward. Low confidence reduces investment appetite, shifting IS leftward.

Lending Standards When banks tighten lending standards, making it harder for businesses to obtain loans, investment spending falls and the IS curve shifts left. Looser lending standards increase credit availability, boosting investment and shifting IS rightward.

Uncertainty Increased uncertainty about future economic conditions, policy changes, or market volatility makes businesses more cautious about long-term investments. Higher uncertainty reduces investment spending and shifts the IS curve left. Reduced uncertainty has the opposite effect.

19.2.3 Government Shocks

| Government Shocks | ||

|---|---|---|

| Shifter | Change | IS Curve Shift |

| Government Purchases | Increase | Increase |

| Government Purchases | Decrease | Decrease |

Government Purchases (G) Government spending directly affects aggregate demand through its role in GDP. When the government increases spending on goods and services - such as infrastructure projects, defense spending, or public services - this directly boosts economic activity at every interest rate level, shifting the IS curve to the right.

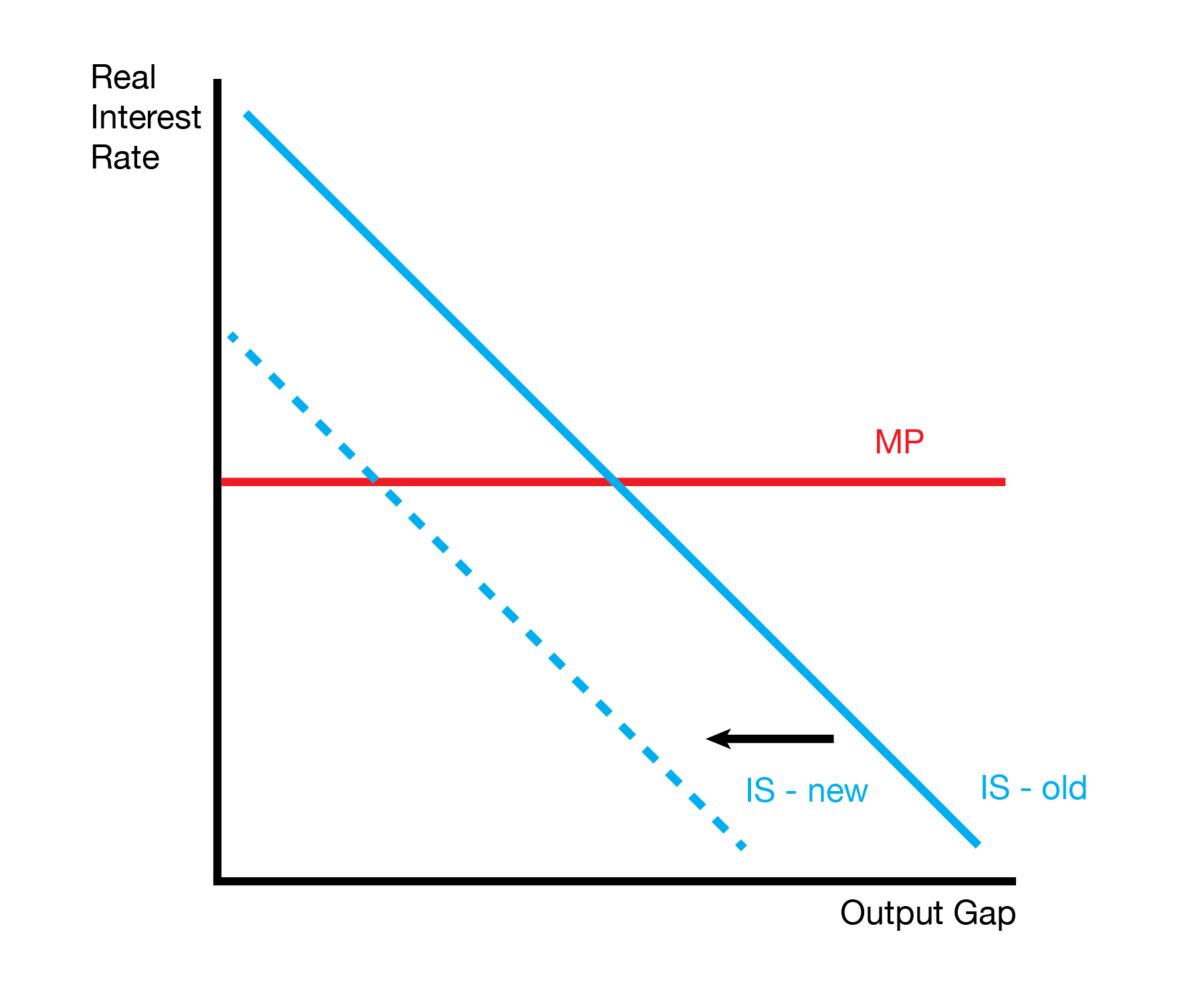

19.3 MP Curve - Shocks

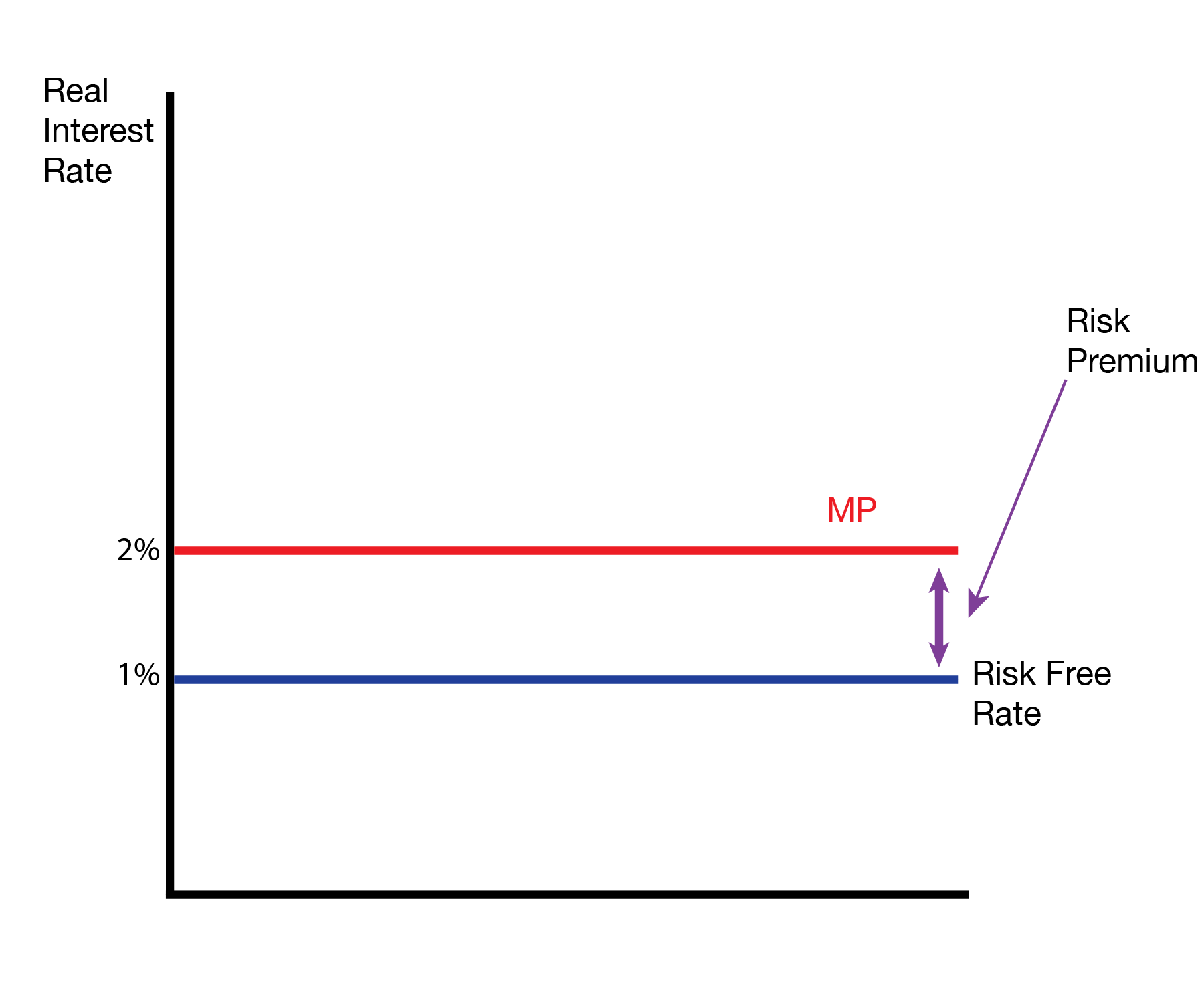

We now introduce shocks to the MP curve. MP shocks have two origins. The first is monetary policy which sets the risk free rate, the ‘baseline’ interest rate of the economy. The second is financial shocks, or shocks to the financial industry. The financial industry sets the risk premium, which consumers and businesses pay.

19.3.1 Monetary Policy

| Monetary Policy | |

|---|---|

| Policy | MP Curve Shift |

| Expansionary | Lower MP Curve |

| Contractionary | Higher MP Curve |

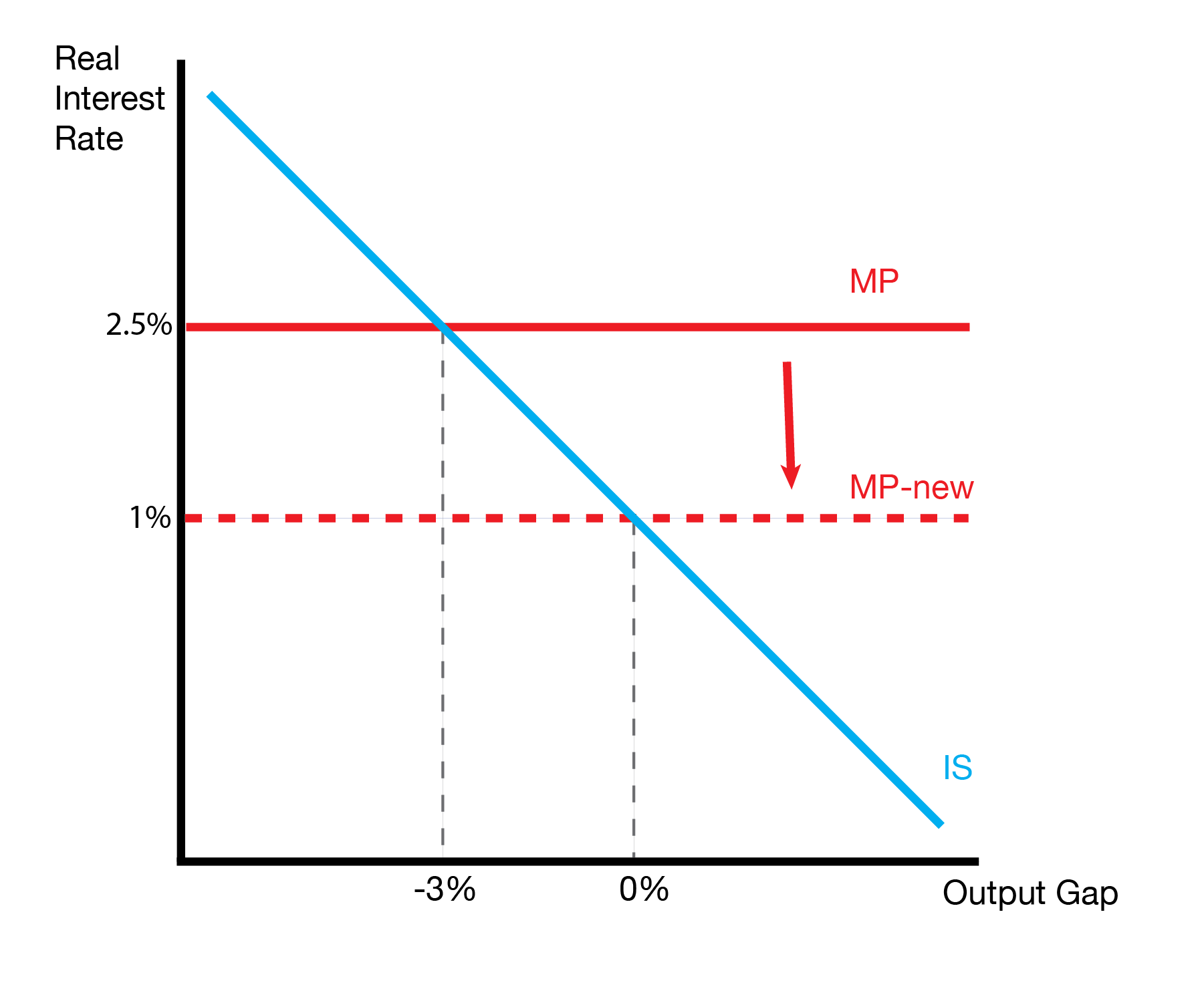

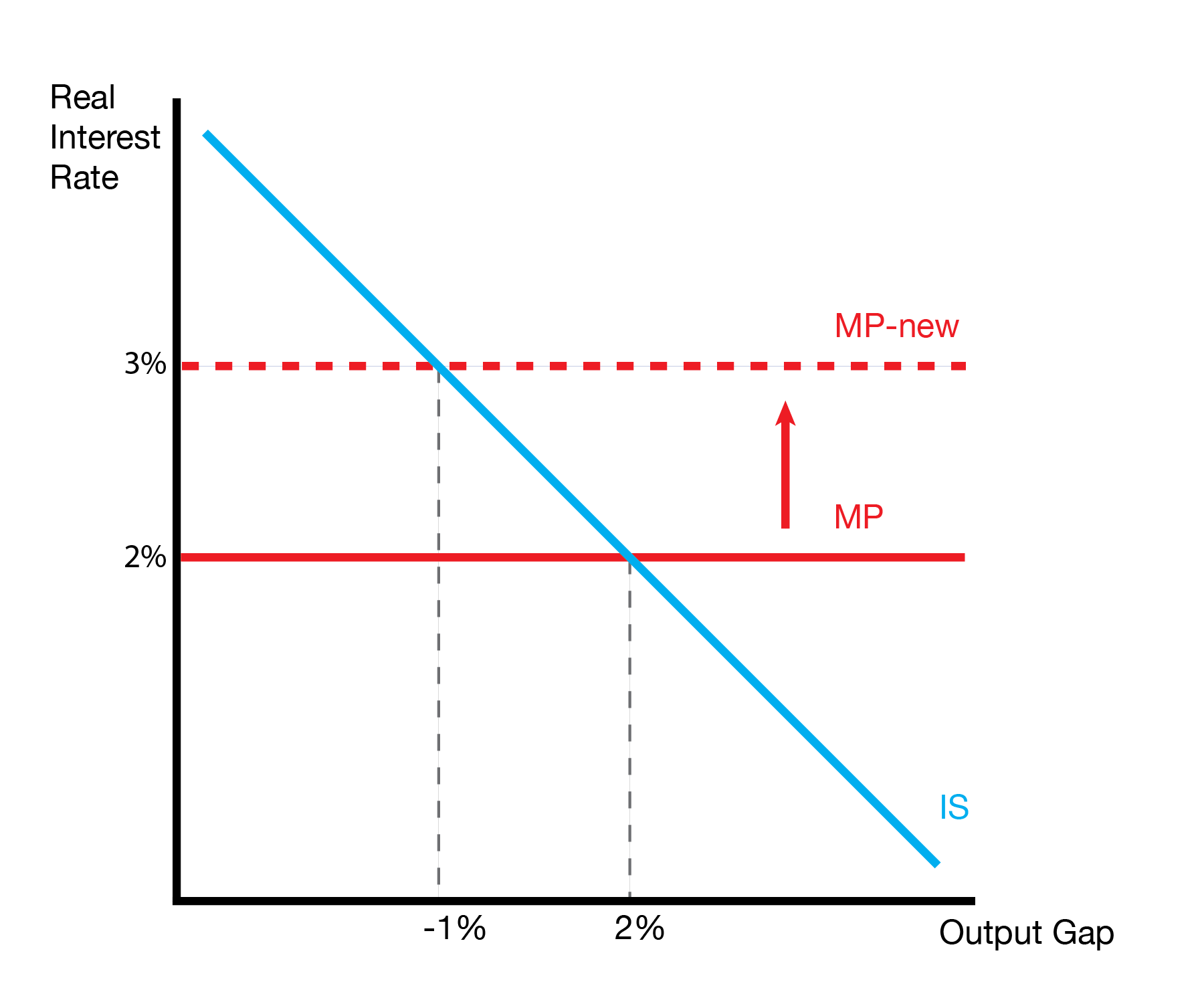

Monetary policy can take two forms: expansionary and contractionary. With expansionary monetary policy, the central bank lowers the risk free rate, which lowers the MP curve. With contractionary monetary policy, the central bank increases the risk free rate,

which increases the MP curve.

19.3.2 Financial Shocks

| Financial Shocks | ||

|---|---|---|

| Shifter | Change | MP Curve Shift |

| Default Risk | Increase | Higher MP Curve |

| Liquidity Risk | Increase | Higher MP Curve |

| Interest Rate Risk | Increase | Higher MP Curve |

| Risk Aversion | Increase | Higher MP Curve |

Financial shocks originate from changes in various types of risk that affect the risk premium borrowers must pay above the risk-free rate. Default risk increases when lenders perceive a higher likelihood that borrowers won’t repay their loans, leading to higher interest rates and an upward shift in the MP curve. Liquidity risk rises when financial markets become less liquid, making it harder to buy or sell assets quickly without affecting prices, which increases borrowing costs. Interest rate risk increases when there’s greater uncertainty about future interest rate movements, making lenders demand higher premiums to compensate for potential losses. Risk aversion reflects the general attitude of financial institutions and investors toward taking on risk - when risk aversion increases (often during economic uncertainty or financial crises), lenders demand higher risk premiums, shifting the MP curve upward and making borrowing more expensive throughout the economy.

19.4 Conclusion

- This lecture introduces shocks to the IS-MP model

- We feature shocks on both the IS curve (consumer, investment, government, net exports) and the MP curve (central bank + financial industry)

- Shocks lead to a new macroeconomic equilibrium