7 Government Distortions

Objectives

- Implement taxes, subsidies, price controls, and quotas in the market equilibrium

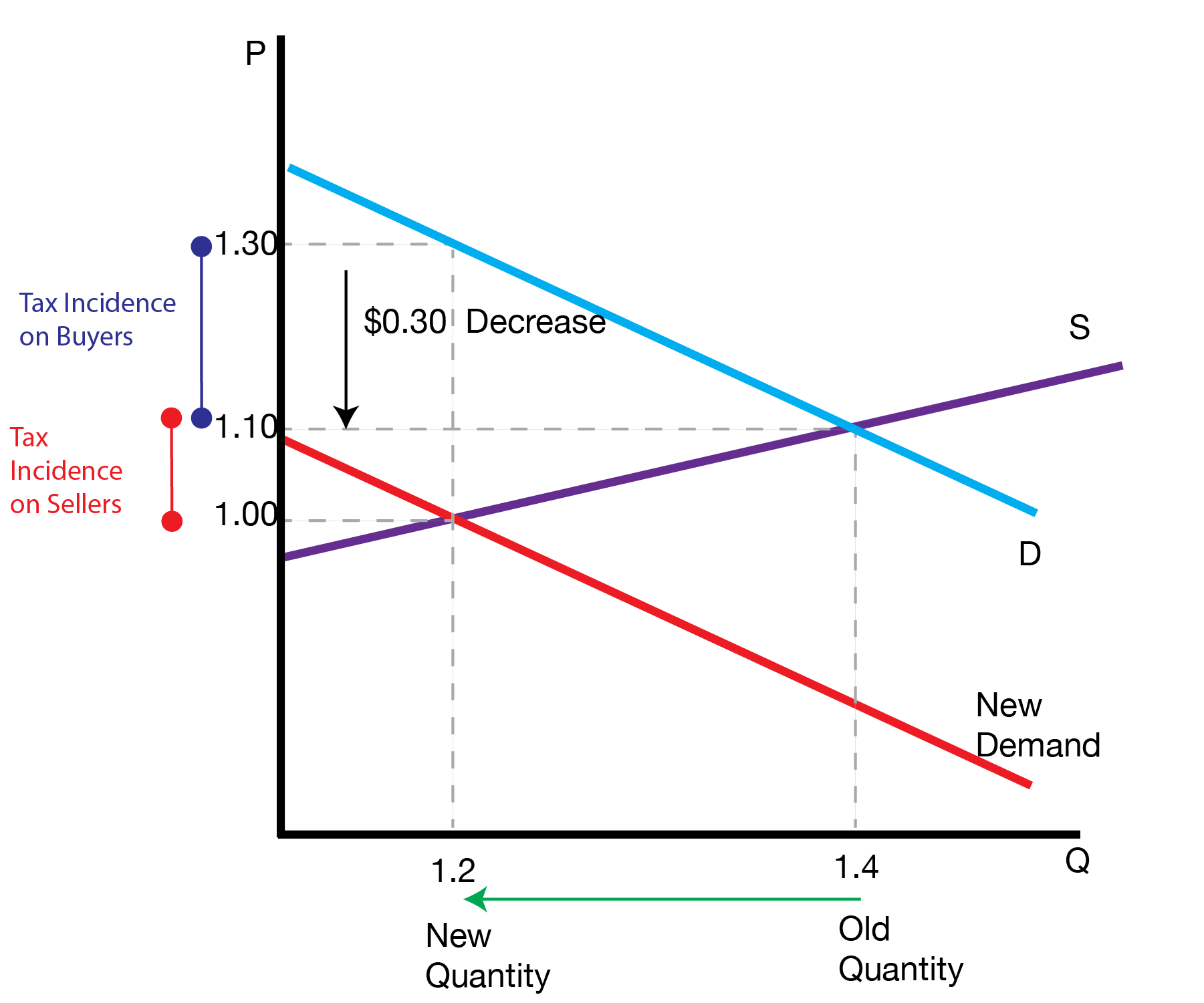

- Identify statutory and economic burdens, and the incidence of a tax

- Know relationship between policies and under or over production

This section studies the effects of ‘Government Distortions’: intervention by the government in the market. We will study five distortions: taxes, subsidies, price ceilings and floors, and quotas. Until now, the market equilibrium has not featured the government. Our core question is how government distortions affect the market equilibrium.

7.1 Taxes and Subsidies

7.1.1 Taxes

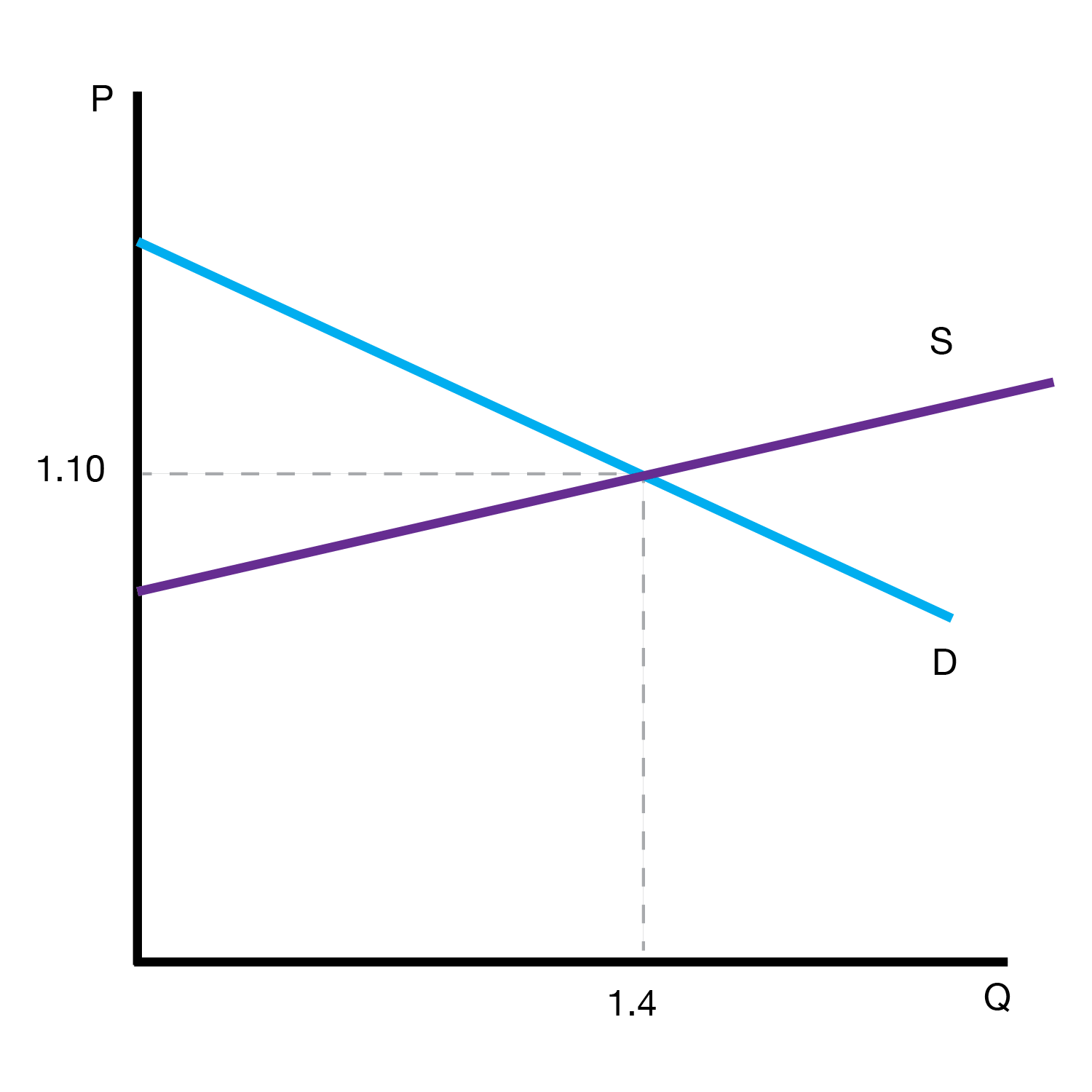

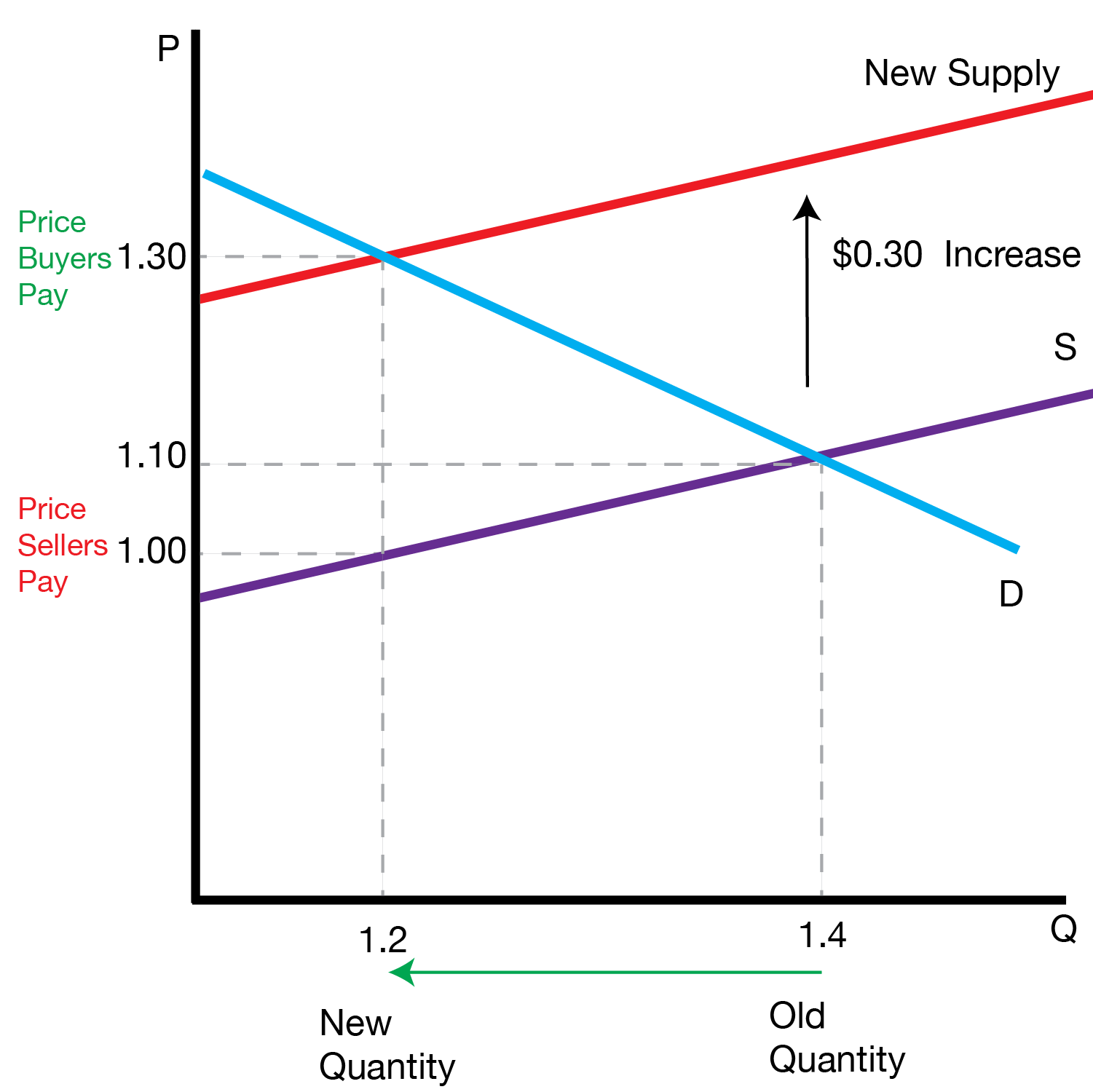

We consider two cases: a tax on buyers and a tax on sellers. We first consider a tax on sellers. How do we implement the tax? The key is to remember that the supply curve is equal to the marginal cost curve. When a seller has to pay a tax, their cost has increased for each quantity they produce. Therefore, the marginal cost curve and supply curve (vertically) increase.

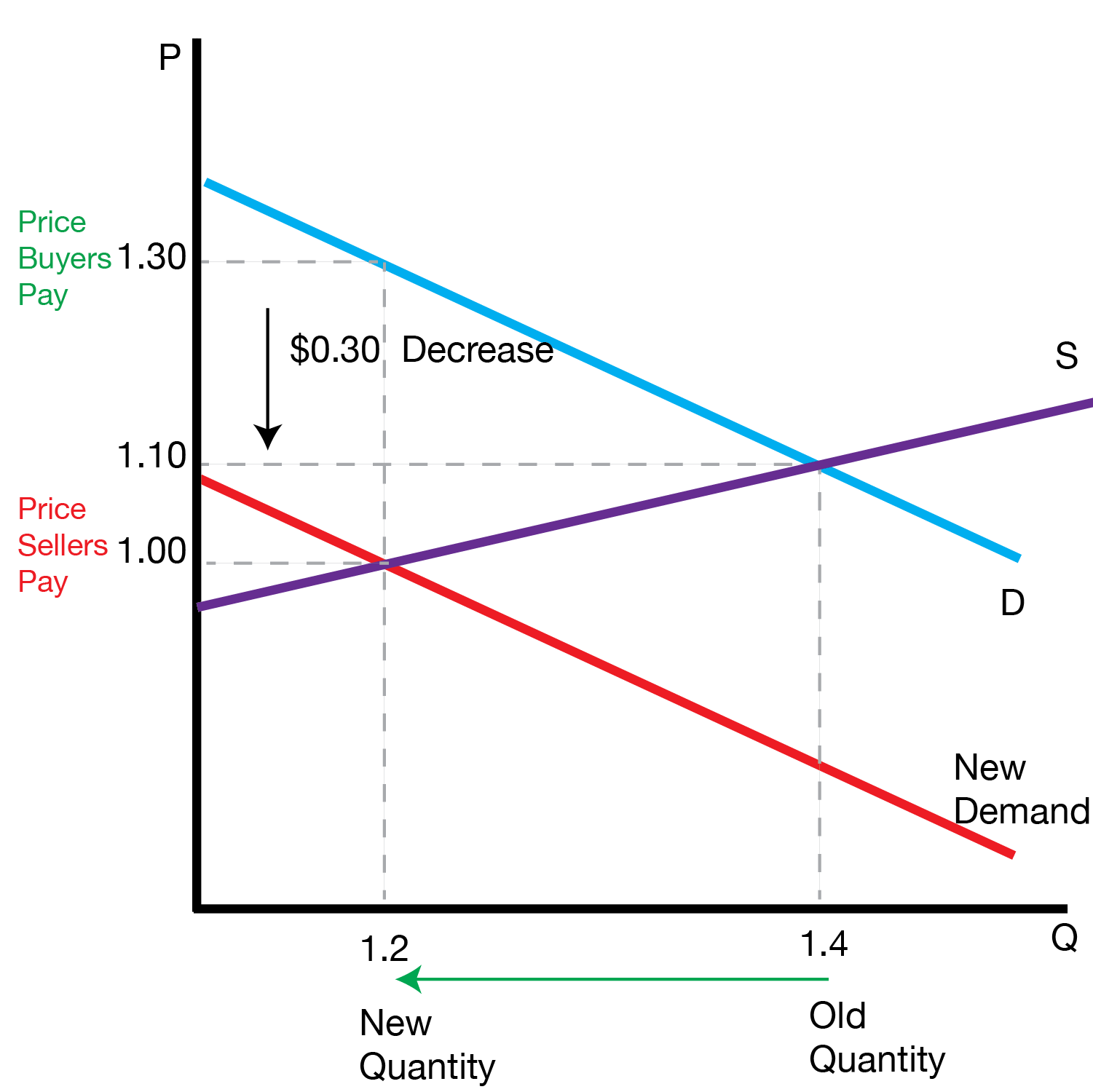

We now consider a tax on buyers. Recall that the demand curve is the marginal benefit curve. When the buyer has to pay a tax, their benefit has decreased for each quantity they produce. Therefore, the marginal benefit curve and demand curve (vertically) decrease.

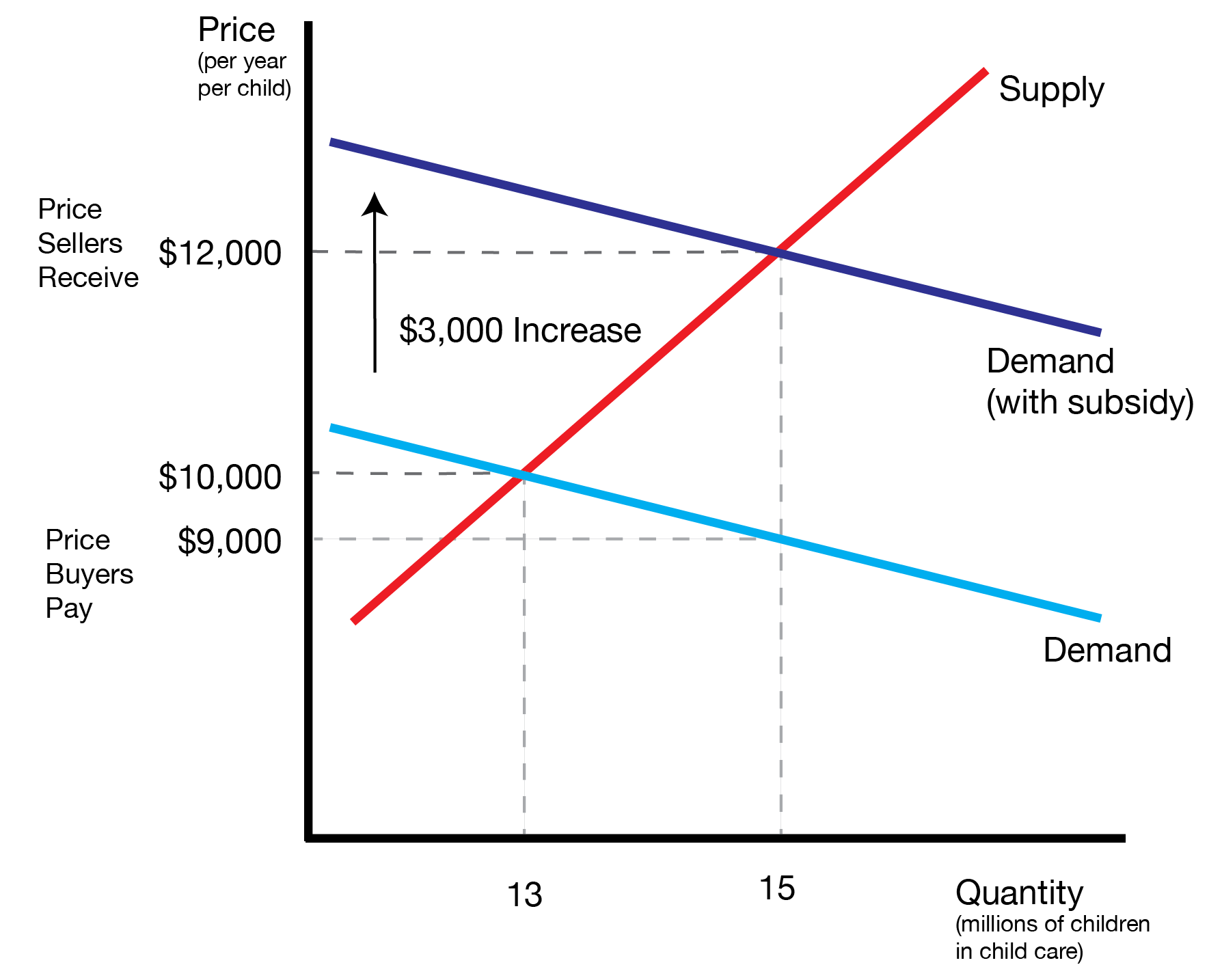

7.1.2 Subsidies

We now consider the effect of subsidies.

| Distortion | Effect |

|---|---|

| Tax | Lower Equilibrium Quantity |

| Subsidy | Higher Equilibrium Quantity |

7.2 Price Controls

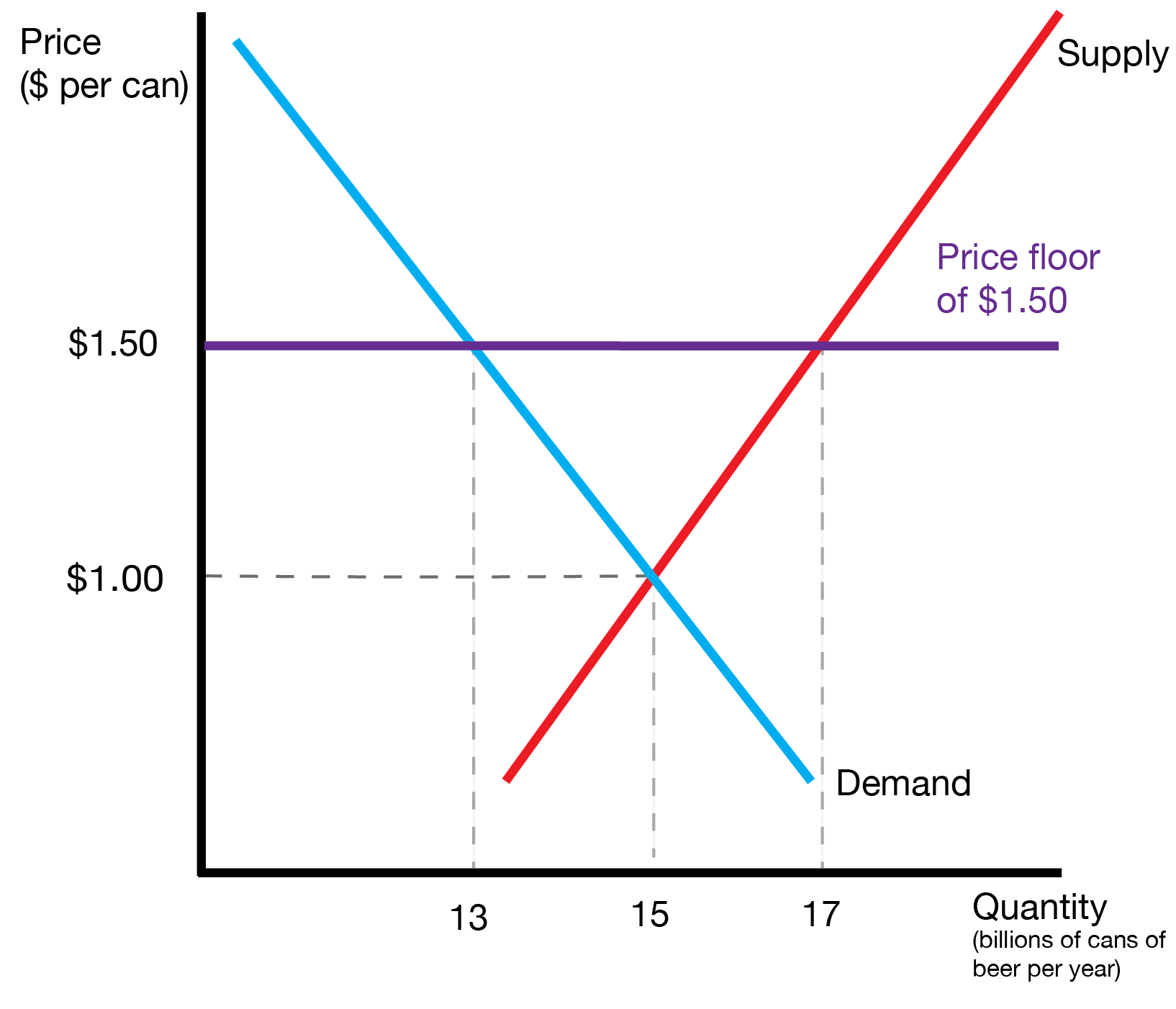

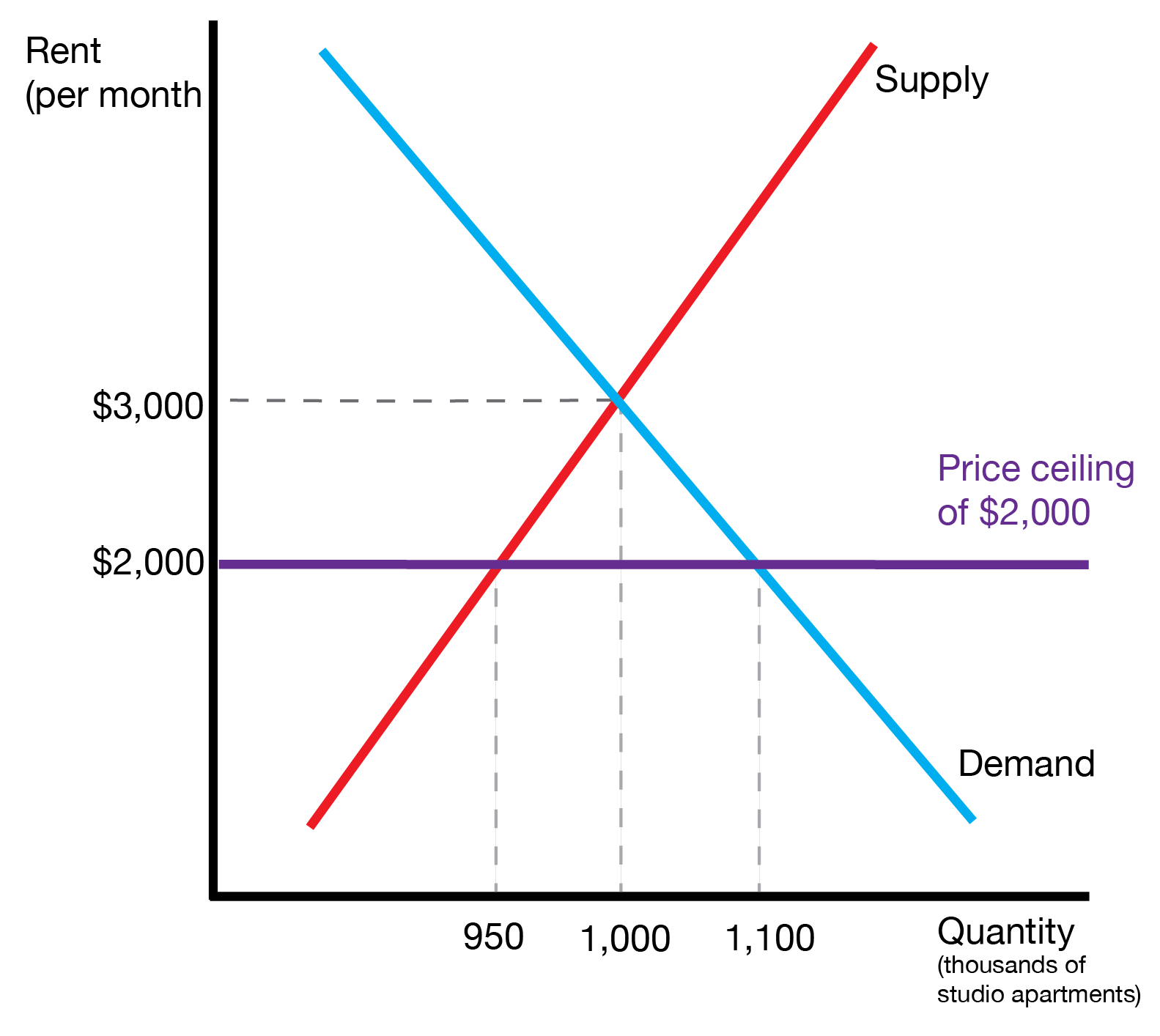

This section examines price controls, when the government mandates the market price either cannot go above or below a certain price level.

We first consider a price floor in the market for beer. The equilibrium price of beer is $1.00. The government imposes a price floor of $1.50, which forces the price to stay at $1.50. What are the results? Consumers now demand 13 billion cans of beer, while producers want to supply 17 billion cans of beer. Because of the price floor, the market is now in a surplus. Notice our analysis is no different than a standard surplus disequilibrium. The disequilibrium simply originates from the government mandate.

We now consider a price ceiling in the market for New York Apartment rentals. The equilibrium rental price if $3,000 per month, which produces an equilibrium 1 million apartment rentals. Now suppose the government imposes a price ceiling of $2,000. This leads to a higher quantity demanded of 1,100,000 units and lower quantity supplied of 950,000 units. The rental market now has a shortage. As with the price floor, the analysis is no different than a standard shortage disequilibrium. The disequilibrium simply originates from the government mandate.

| Distortion | Effect |

|---|---|

| Price Ceiling | Shortage |

| Price Floor | Surplus |

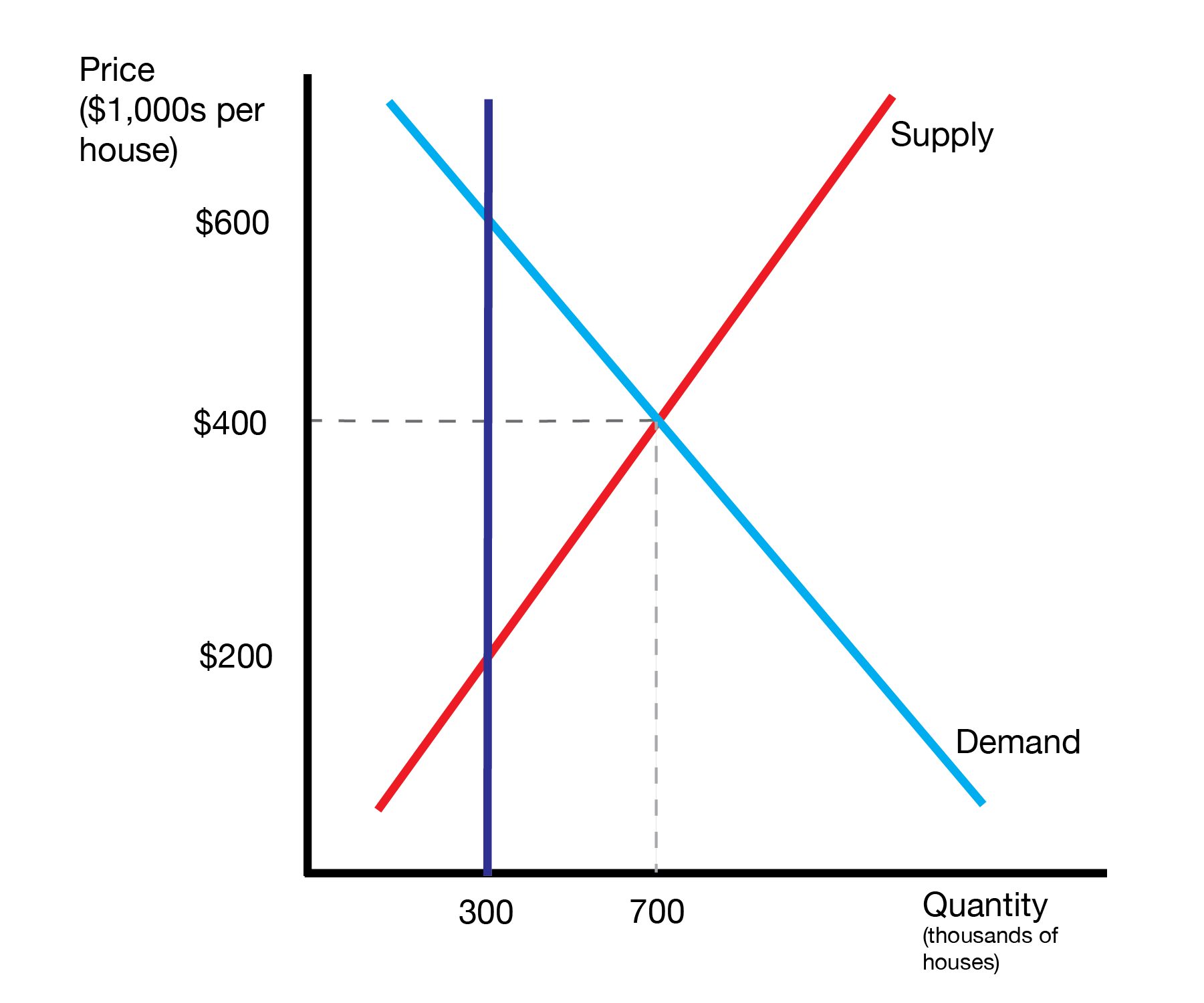

7.3 Quotas

This section studies quotas. Quotas are quantity restrictions where the government mandates a maximum amount of a good that can be bought or sold.

We consider the market for houses. What is the resulting market equilibrium? We can view the demand and supply curves as lines of people with different benefits and costs. The first person to demand a house strongly benefits and the first seller has a low cost, so they match and exchange a house. This continues until we reach the quota of 300.

It’s more challenging to identify the resulting price. Regardless, only 300 houses will be sold. We can view the demand to the left of the quota as the ‘high demand’ and the demand to the right as the ‘low demand’. Because they value it more, the ‘high demand’ will outbid the ‘low demand’, producing an equilibrium price of $600k.

7.4 Conclusion

- This lecture studies government interventions in the natural market equilibrium

- We study the effects of taxes and subsidies

- We show it doesn’t matter if it falls on the consumer or producer

- We introduce price distortions in the form of price ceilings and floors

- We introduce quantity distortions in the form of quotas