9 Balance of Payments 2

Objectives

- Solve goods market equilibrium and produce resulting IS curve

- Identify IS curve shifts

- Solve money market equilibrium and produce resulting LM curve

- Identify LM curve shifts

- Understand order of operations for floating and fixed exchange rate regimes

- Identify optimal fiscal response to booms and busts

- Identify optimal monetary response to booms and busts

- Understand the tradeoffs presented by the zero lower bound

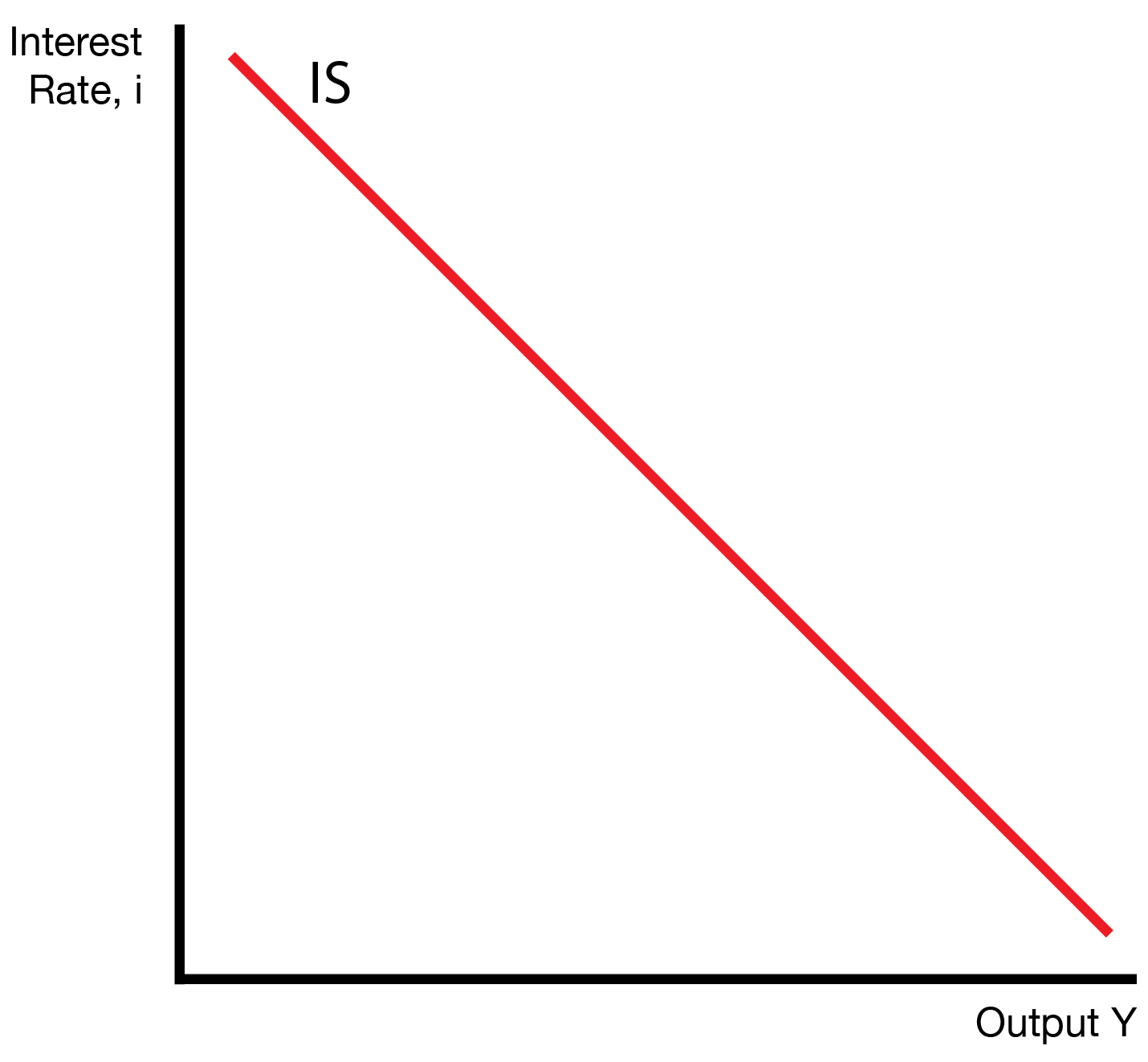

9.1 IS Curve

The IS curve represents the combinations of the interest rate \(i\) and output \(Y\) that are consistent with both the FX market and goods market clearing.

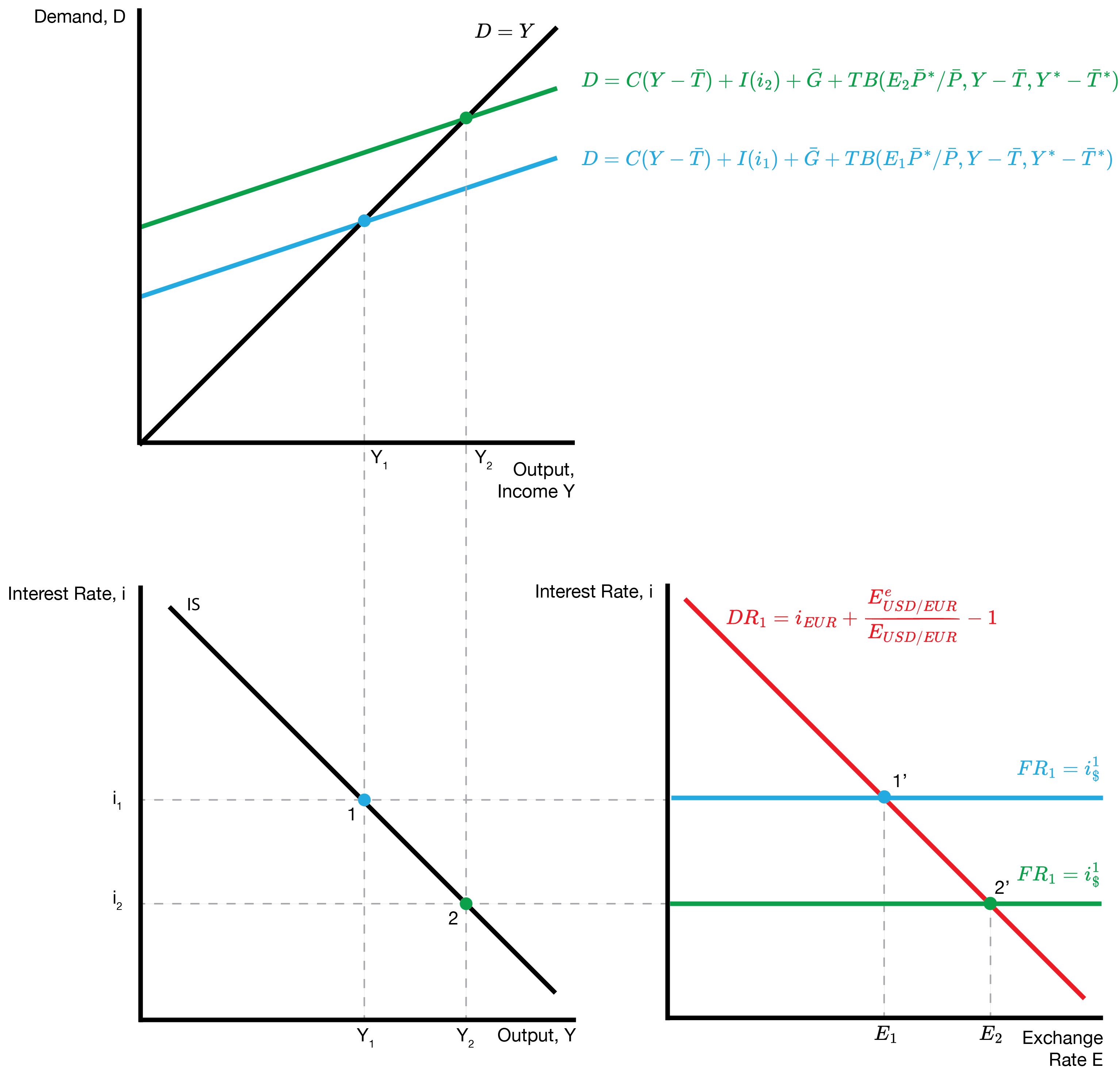

9.1.1 Derivation

For a single interest rate \(i_1\), we solve for the output \(Y_1\) that results if both the goods and FX market are in equilibrium. Notice that the goods market itself depends on the exchange rate \(E\). Because of this, we will visit the FX market first so that we know the exchange rate \(E_1\) ahead of time.

We then visit the goods market. Given our interest rate \(i_1\) and exchange rate \(E_1\), we find the unique output \(Y_1\) that is consistent with the goods market clearing. This provides a single point for our IS curve.

We derive the rest of the IS curve by solving for a new point given a lower interest rate \(i_2\). Revisiting the FX and goods markets provides a higher output \(Y_2\), which shows that the IS curve is decreasing.

9.1.2 Shifts

| IS Shifters (Increase) |

|---|

| Fall in taxes \(\bar{T}\) |

| Rise in government spending \(\bar{G}\) |

| Rise in foreign interest rate \(i^*\) |

| Rise in future expected exchange rate \(E^e\) |

| Rise in foreign prices \(P^*\) |

| Fall in home prices \(P\) |

| Any shift up in the consumption function \(C\) |

| Any shift up in the investment function \(I\) |

| Any shift up in the trade balance function \(TB\) |

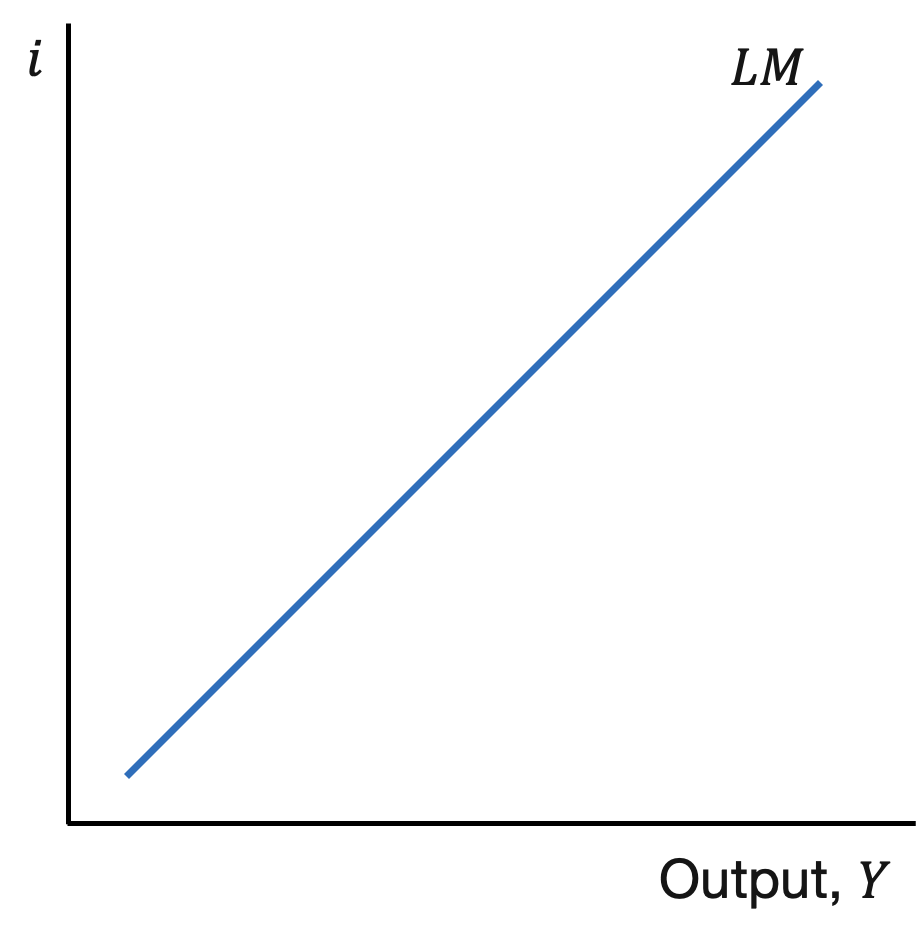

9.2 LM Curve

The LM curve represents the combinations of the interest rate \(i\) and output \(Y\) that are consistent with the home money market clearing.

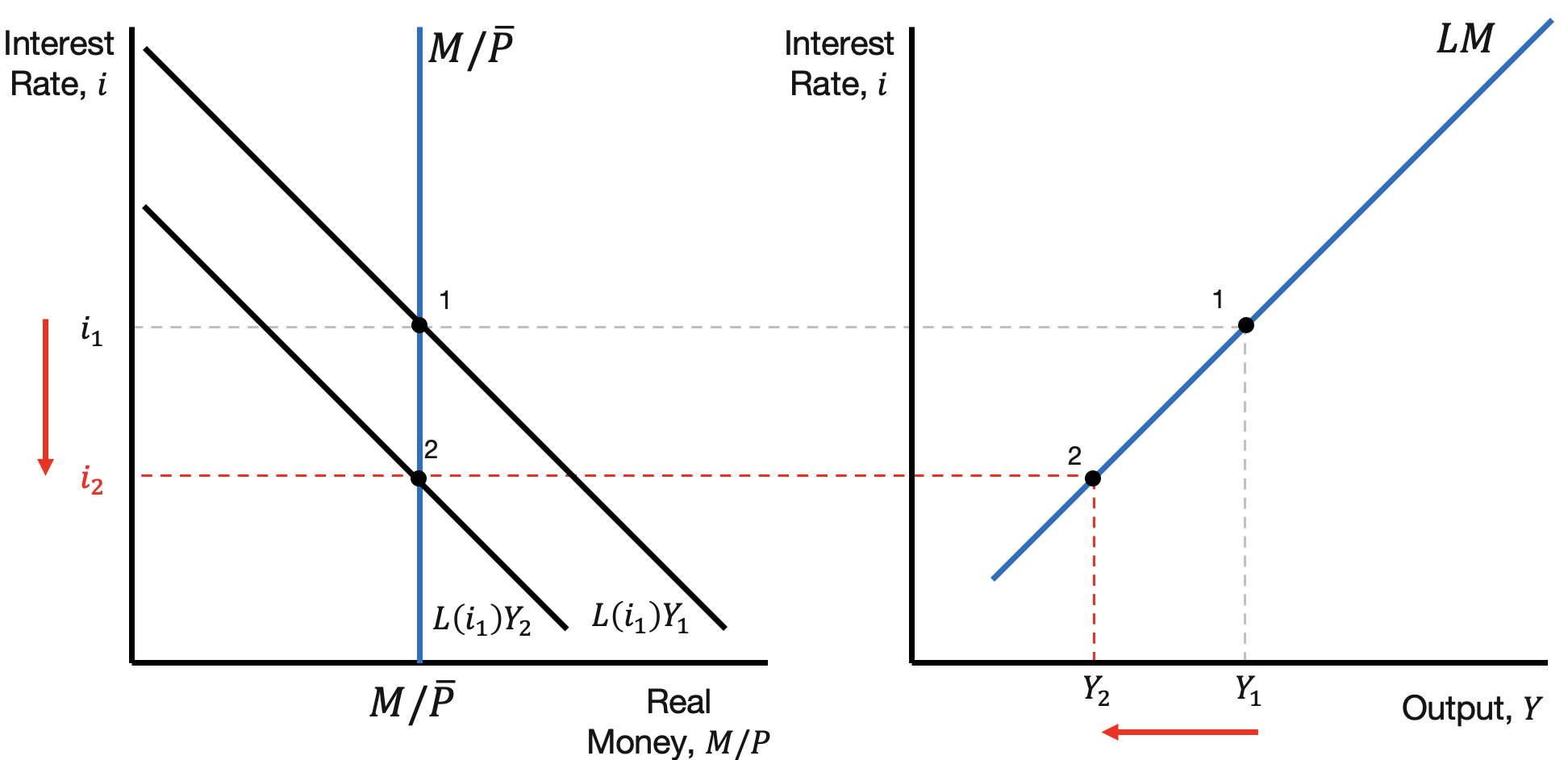

9.2.1 Derivation

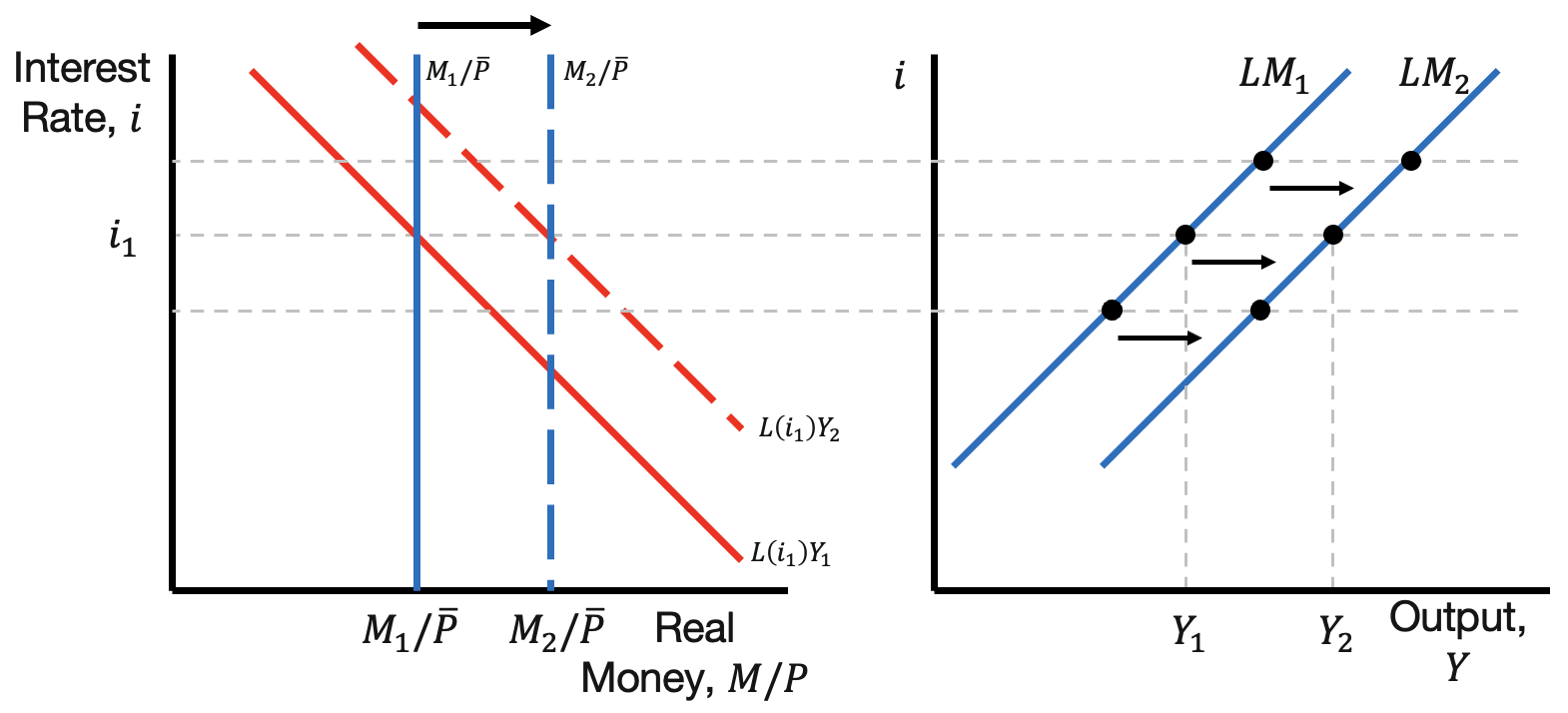

We first fix the interest rate \(i_1\) and find the unique output \(Y_1\) that clears the money market. Real money demand \(L(i_1) Y\) is increasing in \(Y\). This provides our unique output \(Y_1\). We solve for the rest of the LM curve by examining how \(Y\) changes for a decrease in the interest rate. This reveals that the LM curve is increasing.

9.2.2 Shifts

| LM Shifters (Increase) |

|---|

| Rise in (nominal) money supply \(M\) |

| Any shift left in the money demand function \(L\) |

We now examine shifts of the LM curve. Our methodology is as follows. For a given interest rate \(i_1\), there is a unique output \(Y_1\) that is consistent with the money market clearing.

Our next step is to introduce the shifter (change in money supply \(M\) or demand function \(L\)), and examine how \(Y_1\) changes for \(i_1\). Finally, because interest rate \(i_1\) is not ‘special’, the same shift happens for every interest rate: e.g. the entire curve shifts.

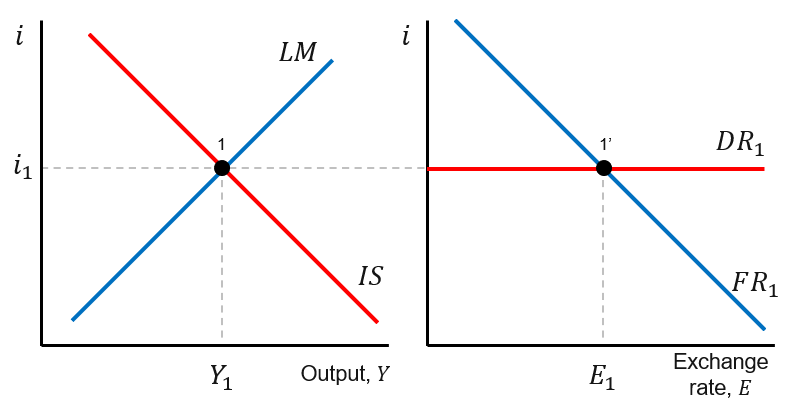

9.3 Equilibrium

We now combine the IS and LM curves to form our equilibrium. Their intersection represents the interest rate \(i\) and output \(Y\) that is consistent with the goods, money, and foreign exchange (FX) markets clearing.

9.4 Policy

This section examines policy in the IS-LM-FX model. The model features two forms of policy: fiscal policy, which controls government spending \(G\), and monetary policy, which controls money supply \(M\).

9.4.1 Fiscal

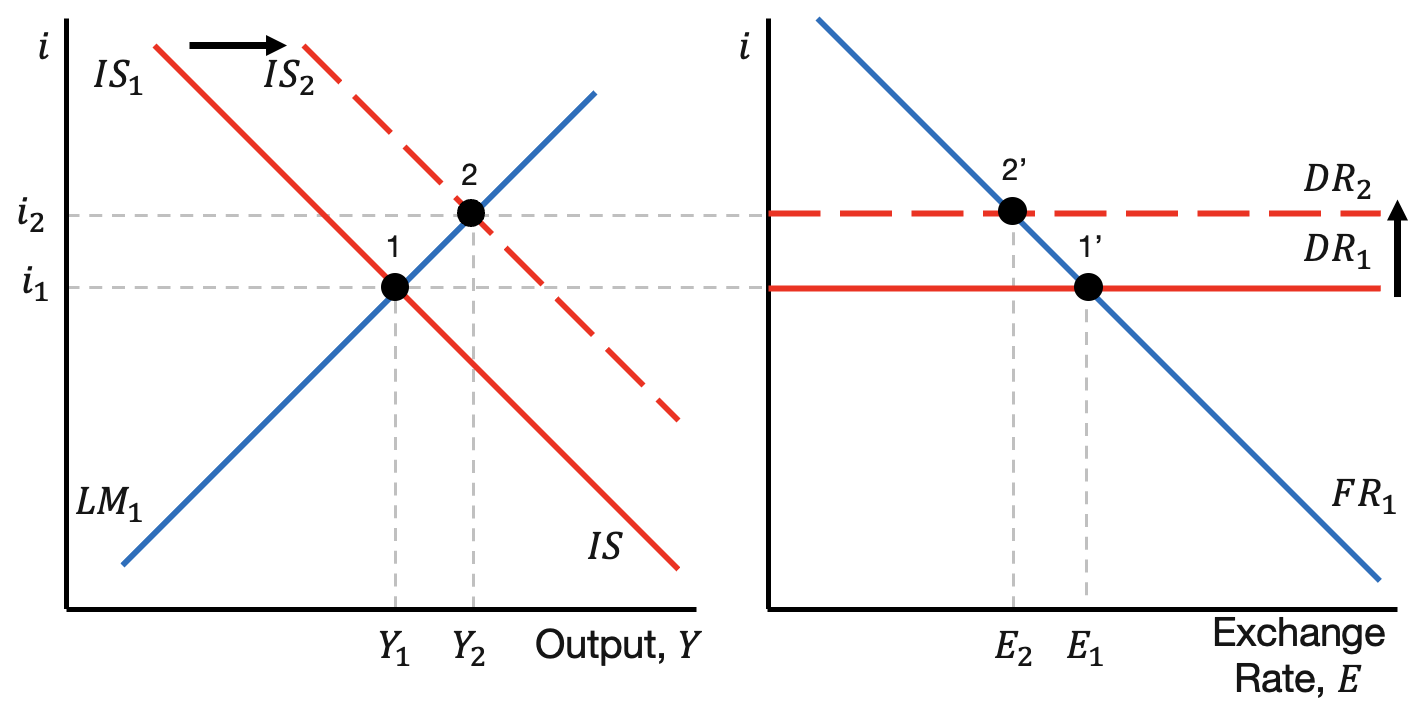

This sections examines a fiscal expansion under floating and fixed exchange rate regimes.

We first examine a fiscal expansion under a floating exchange rate. The increase in government spending \(G\) leads to a rightward shift (increase) of the IS curve. This drives an increase in the interest rate and increase in output. Next, we carry the higher interest rate to the FX market, which produces an increase in the domestic return \(DR\) curve. This leads to a decrease (appreciation) of the exchange rate \(E\).

We now examine a fiscal expansion under a fixed exchange rate regime. As before, the increase in spending drives an increase in the interest rate and output. The higher interest rate drives an exchange rate appreciation.

The fixed exchange rate differs in that it will respond to the exchange rate appreciation. That is, the central bank needs to get the exchange rate back to its target value \(\bar{E}\). Equivalently, the central bank needs to return the interest rate to its original lower value. Its tool to do this is the LM curve, which is influenced by the money supply. The central bank prints money to increase the LM curve. This lowers the interest rate, which restores the equilibrium exchange rate to its original value.

Under the fixed exchange rate, expansionary fiscal policy leads to a larger increase in output \(Y\). This occurs because the initial increase in government spending changes the exchange rate, which forces the central bank’s hand.

9.4.2 Monetary

This sections examines a monetary expansion under floating and fixed exchange rate regimes.

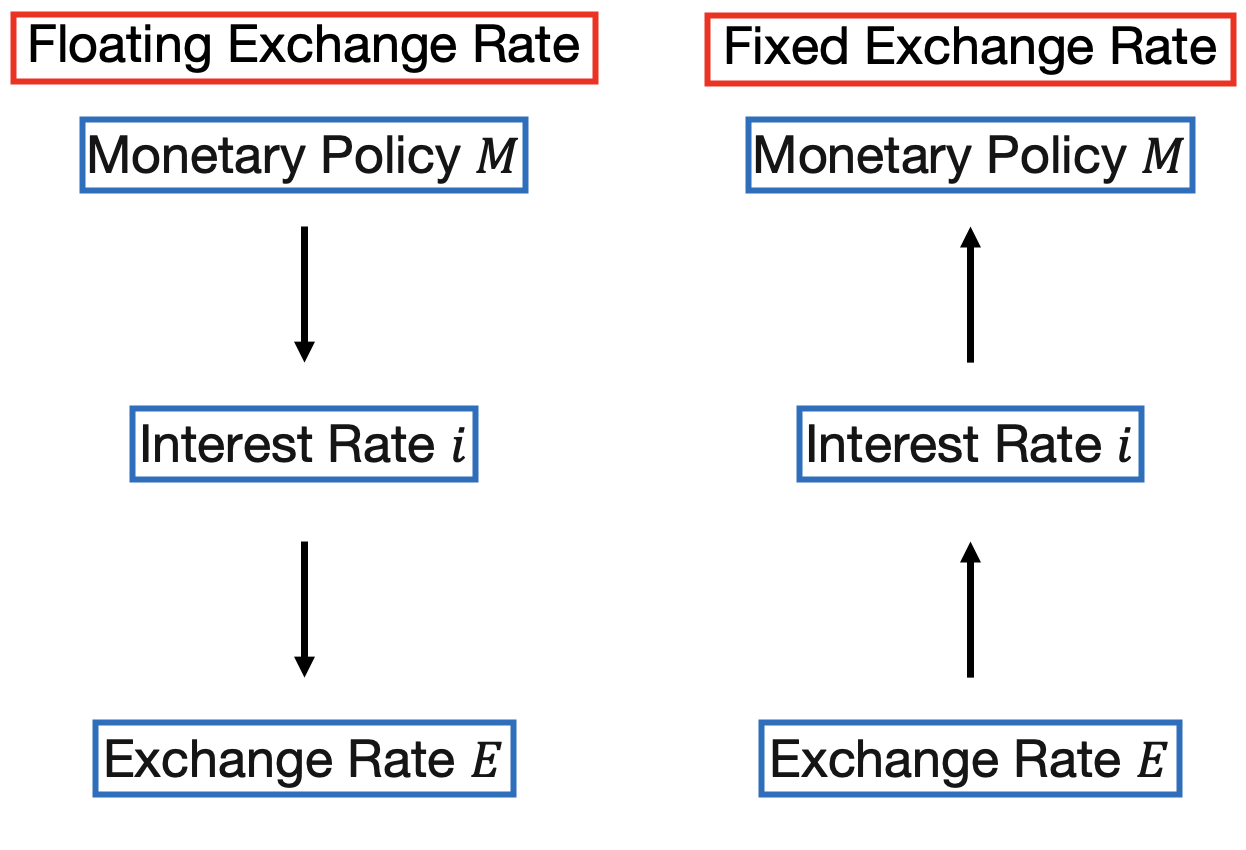

The primary focus is whether the economy is following a floating or fixed exchange rate regime. Under a floating exchange rate regime, the monetary authority sets the money supply. Within the IS-LM market, this determines the home interest rate. Within the FX market, the home interest rate determines the equilibrium exchange rate. Under a fixed exchange rate regime, we follow the reverse path. The monetary authority has an exchange rate target \(\bar{E}\). Examining the foreign exchange market, this forces them to have a certain interest rate \(i\). The monetary authority then has to manipulate the money supply \(M\) so that \(i\) is the resulting equilibrium interest rate.

The primary focus is whether the economy is following a floating or fixed exchange rate regime. Under a floating exchange rate regime, the monetary authority sets the money supply. Within the IS-LM market, this determines the home interest rate. Within the FX market, the home interest rate determines the equilibrium exchange rate. Under a fixed exchange rate regime, we follow the reverse path. The monetary authority has an exchange rate target \(\bar{E}\). Examining the foreign exchange market, this forces them to have a certain interest rate \(i\). The monetary authority then has to manipulate the money supply \(M\) so that \(i\) is the resulting equilibrium interest rate.

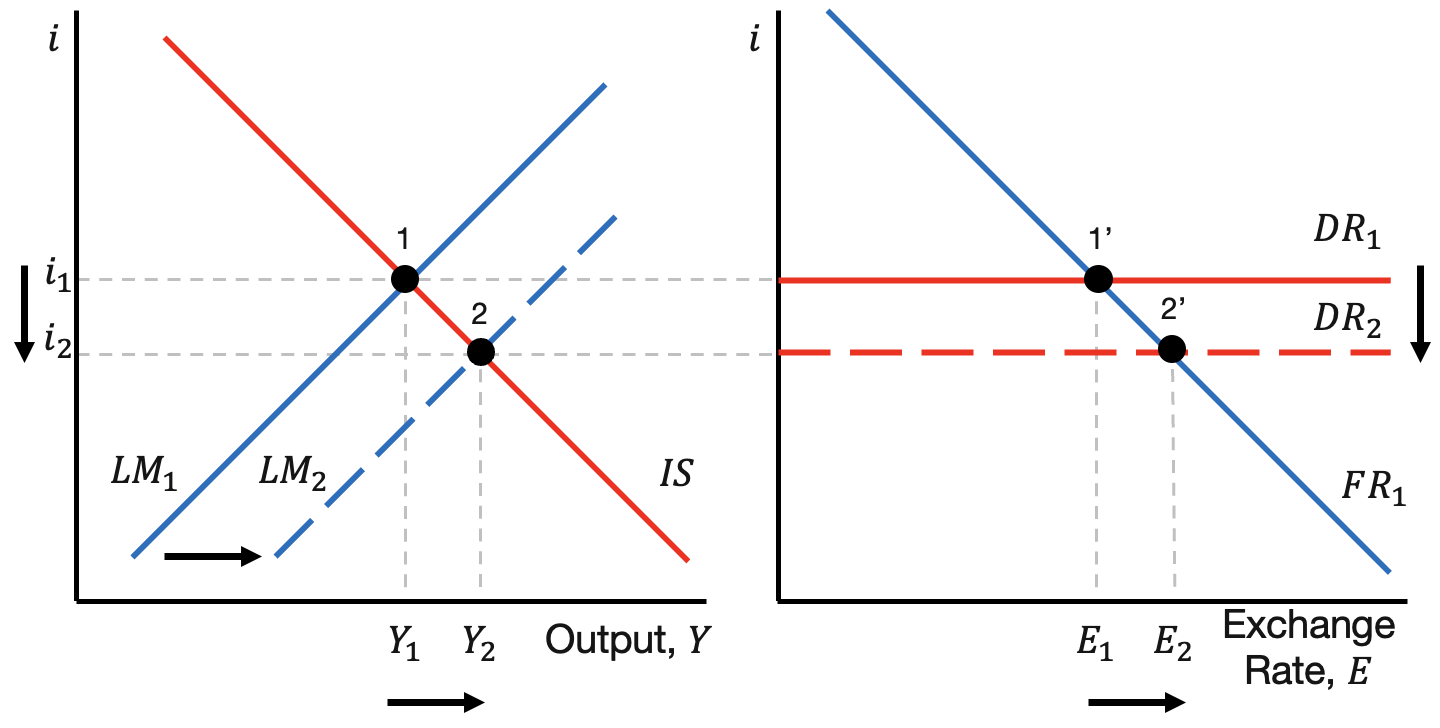

We first examine monetary expansion under a floating exchange rate regime. The increase in money supply leads to a rightward shift of the LM curve. This results in a lower equilibrium interest rate and higher level of output. We now carry the lower interest rate to the FX market. The lower interest rate produces an exchange rate depreciation (Home currency has a lower return, so Home currency is less valuable).

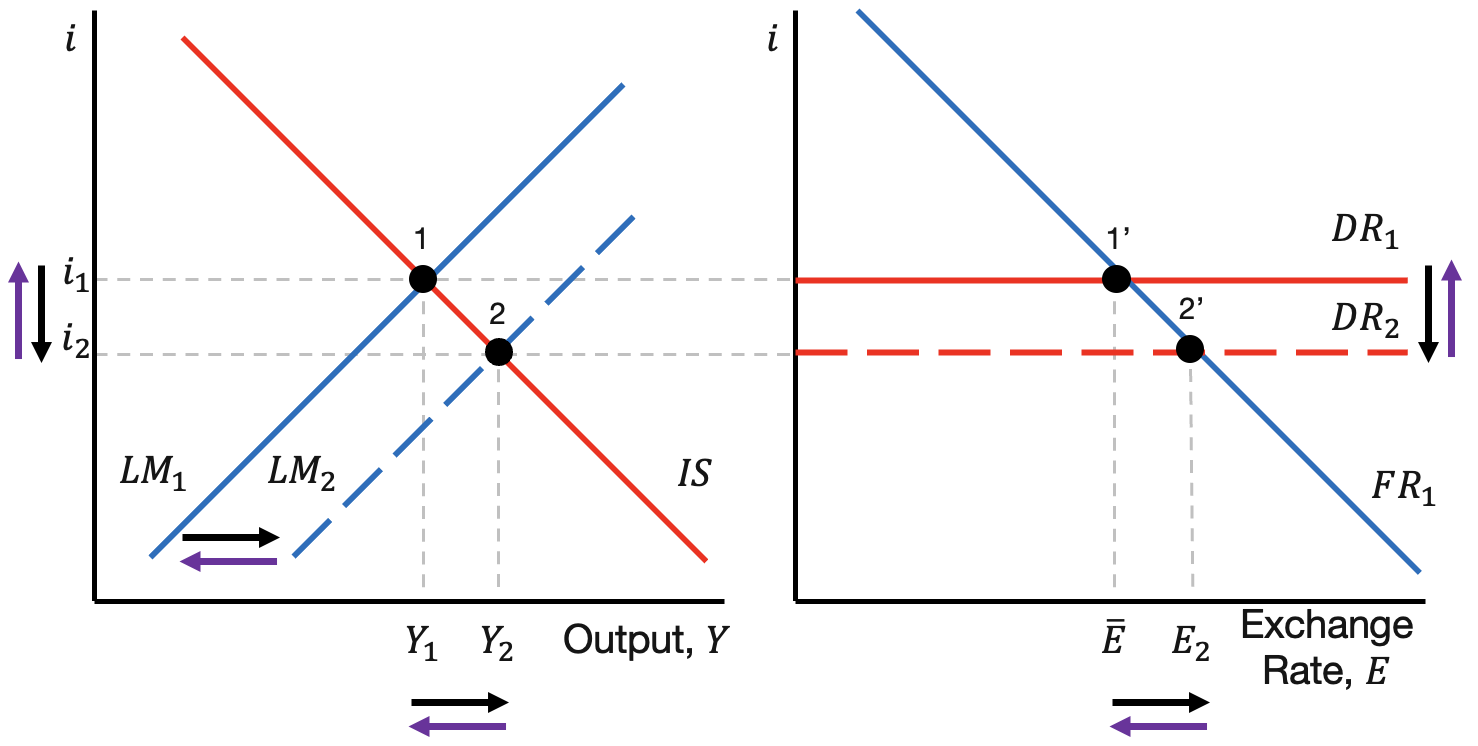

Next, we examine monetary expansion under a fixed exchange rate. The government increases the money supply \(M\), producing a rightward shift of the LM curve and decrease in the interest rate. The decrease in the interest rate leads to a depreciation of the exchange rate, breaking the fixed exchange rate.

This forces the central bank to revert course. The central bank then cuts back on the money supply to recover the interest rate and exchange rate.

9.5 Optimal Policy

This section studies optimal fiscal and monetary policy.

9.5.1 Bust

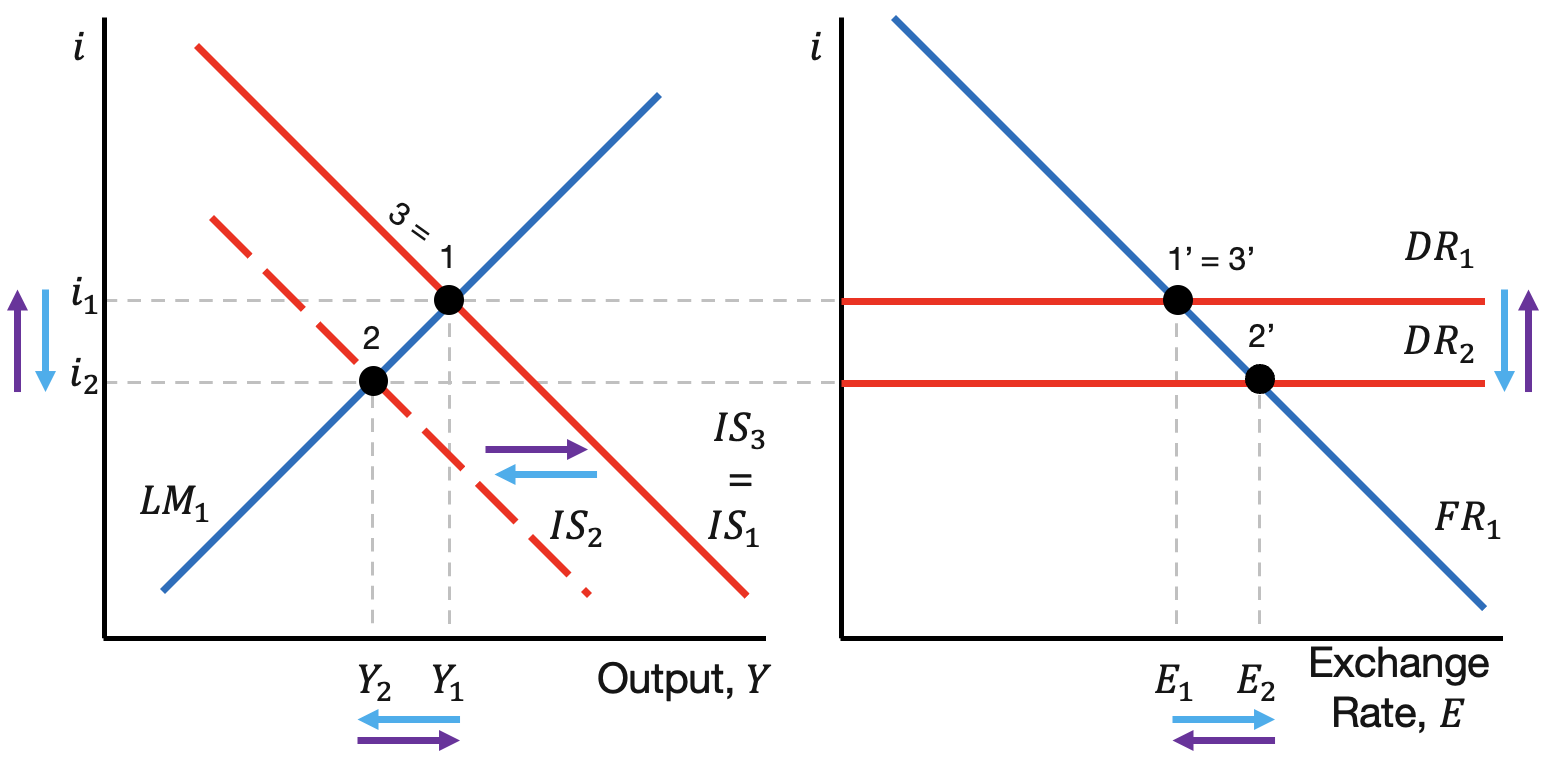

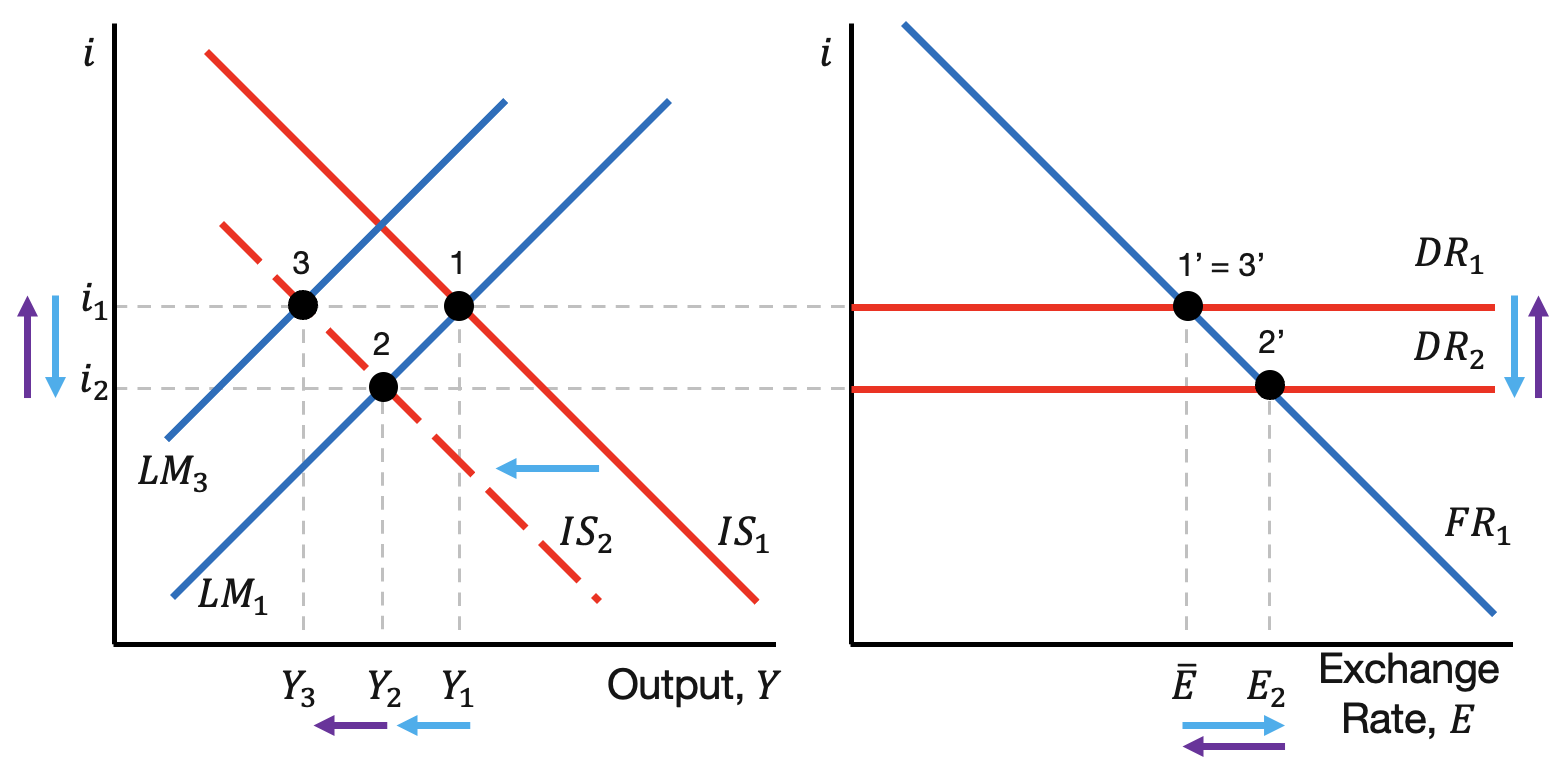

We first examine fiscal policy during a bust episode. The bust episode is represented by the leftward shift (contraction) of the IS curve to \(IS_2\). This puts the domestic market at equilibrium point 2 and the FX market at equilibrium point 2’. The government increases spending. Through the goods market, this shifts the IS curve rightward to the original equilibrium point 1. Similarly, the FX market returns to its original equilibrium point 3’.

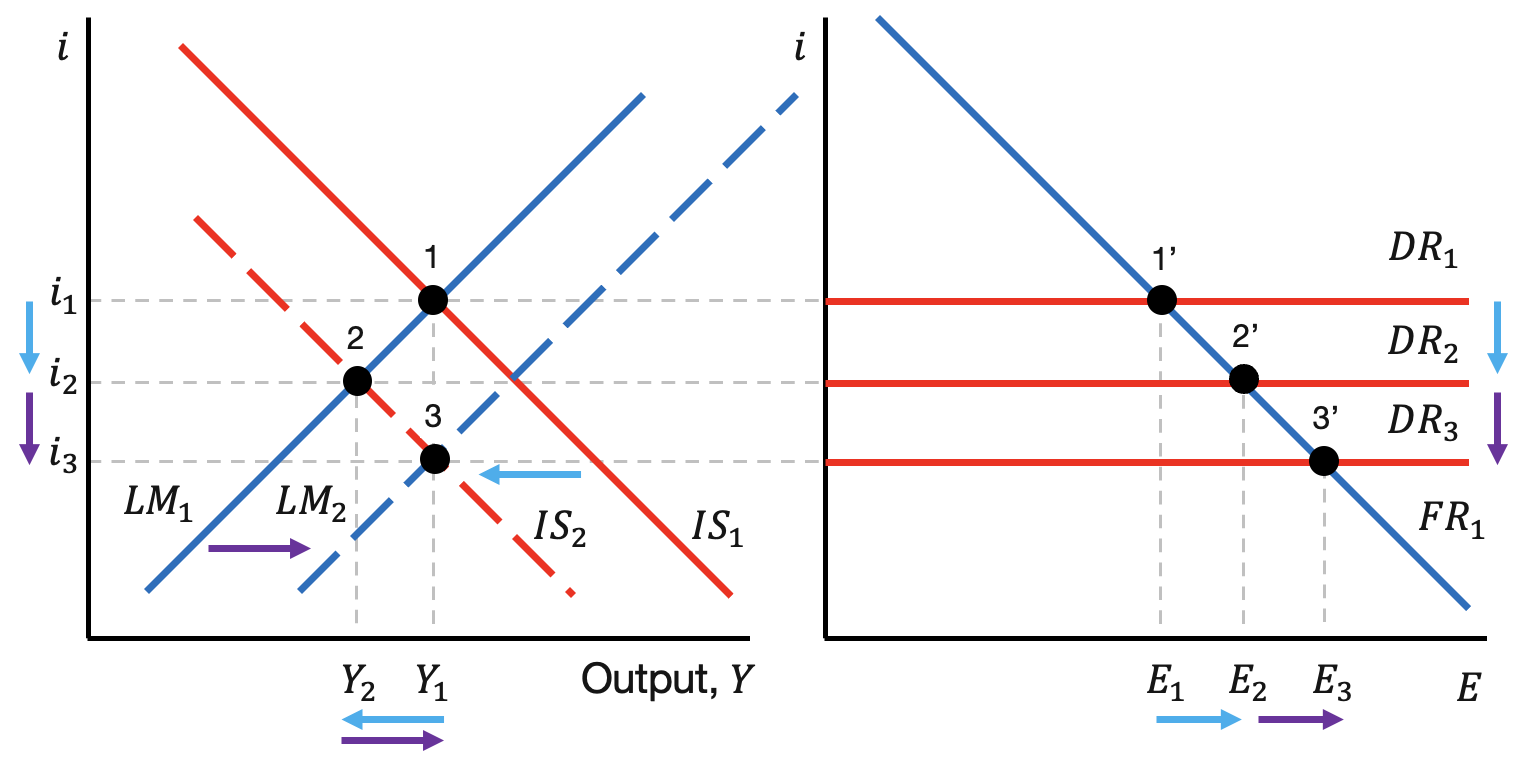

Next, we examine monetary policy during a bust episode with a floating exchange rate. The bust leads to a leftward shift of the IS curve, putting the economy at equilibria 2 and 2’, respectively. The monetary authority (central bank) increases the money supply to drive a rightward shift (increase) of the \(LM\) curve to \(LM_2\). This puts the economy at equilibrium point 3, which features a lower interest rate but brings the economy back to its original output level \(Y_1\).

Lastly, we examine monetary policy during a bust episode with a fixed exchange rate. The initial bust in the economy (\(IS\) moving to \(IS_2\)) leads to a depreciation in the exchange rate market. To return to the exchange rate target \(\bar{E}\) , the monetary authority needs to increase the interest rate to its original level \(i_1\). To do this, they contract the money supply, which produces a decrease in the \(LM\) curve and increase in the interest rate. This restores the exchange rate to its target \(\bar{E}\). Within the domestic market, this further decreases output to lower level \(Y_3\). Therefore, the monetary authority brings stability to the exchange rate market, but amplifies the downturn in the domestic market.

9.6 Conclusion

- This lecture develops the goods market to endogenize output.

- We combine the Goods and FX markets into the IS curve.

- We study the responses to different shocks within the IS-LM and FX markets.

- We study the optimal responses of fiscal and monetary policy under floating and fixed exchange rates.