6 Exchange Rates

Objectives

- Be able to define the exchange rate

- Understand the impact of exchange rate appreciation / depreciation on trade flows

- Compute the change (appreciation or depreciation) of an exchange rate

- Understand arbitrage conditions

- Two currencies, three currencies, covered and uncovered interest rate parity

| Exchange Rate | Appreciates | Depreciates |

|---|---|---|

| EUSD/EUR | Decreases ↓ | Increases ↑ |

| Verbal Intuition | ‘It takes less Dollars to buy a Euro → Dollar is more powerful’ | ‘It takes more Dollars to buy a Euro → Dollar is less powerful’ |

| USD Exchange Rate | Appreciates | Depreciates |

|---|---|---|

| E$/€ | Decreases ↓ | Increases ↑ |

| U.S. Exports | Decreases ↓ One Euro buys less stuff in U.S., so U.S. exports less |

Increases ↑ One Euro buys more stuff in U.S., so U.S. exports more |

| U.S. Imports | Increases ↑ Euros are cheaper, so U.S. imports more from Europe |

Decreases ↓ Euros are more expensive, so U.S. imports less from Europe |

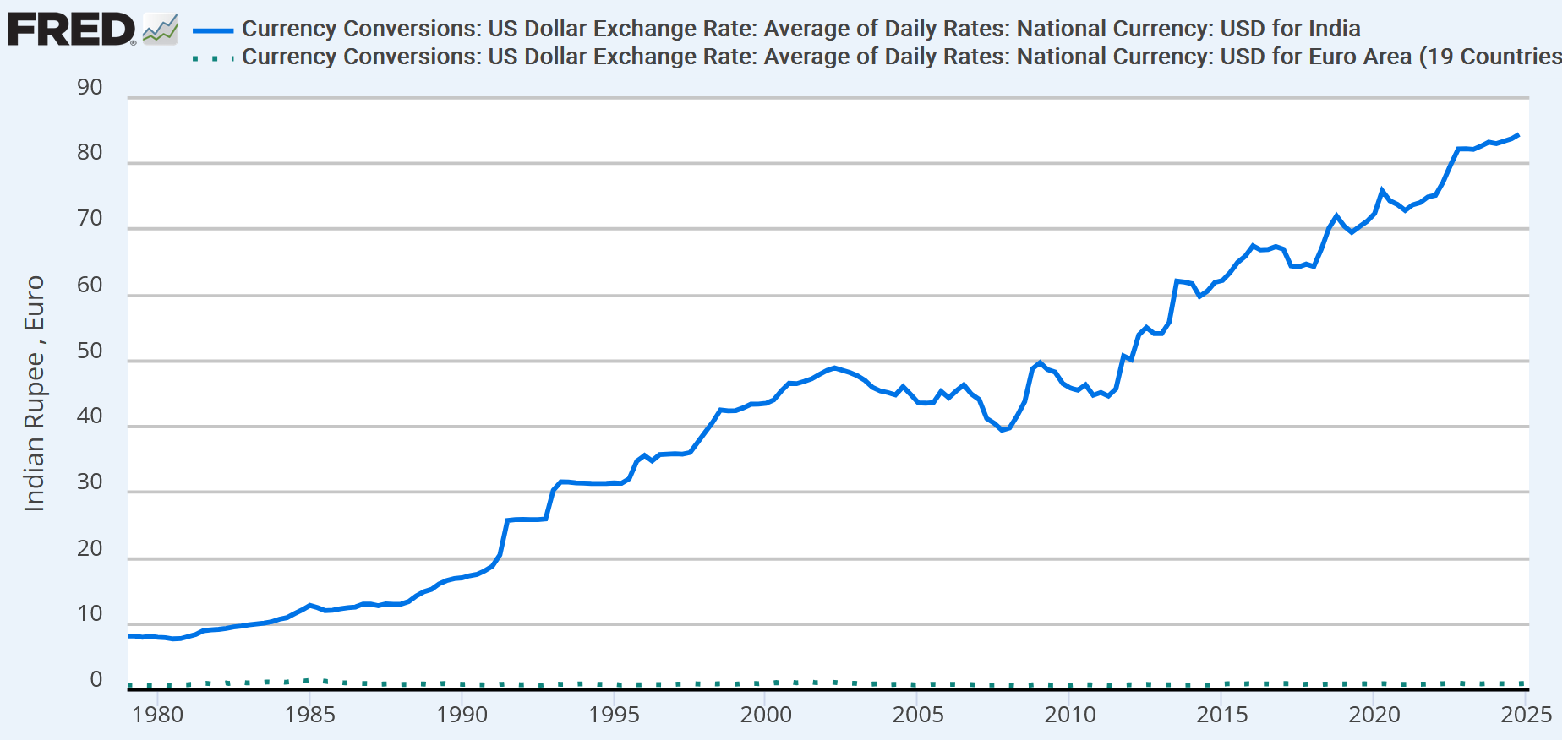

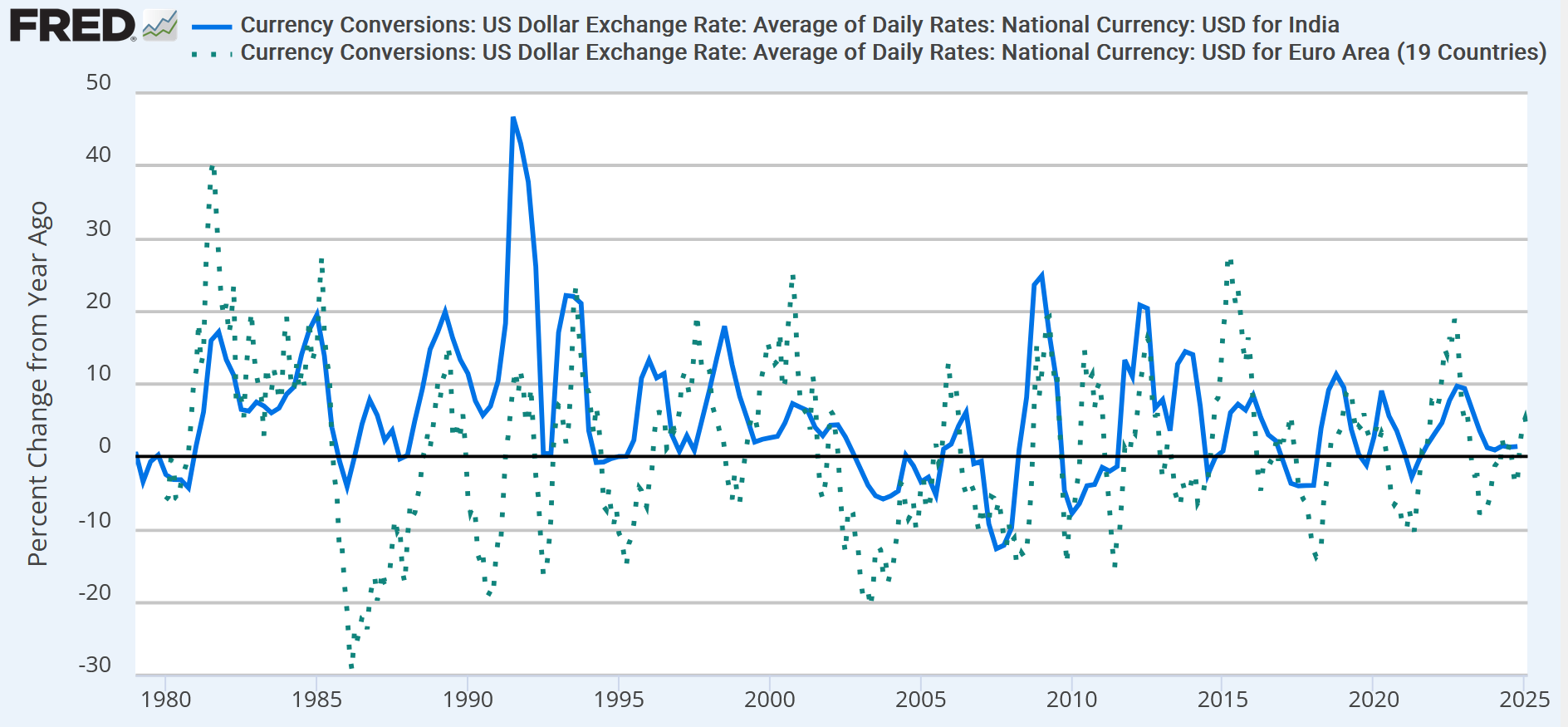

6.1 Growth Rate

We typically evaluate the ‘change’ of the exchange rate by looking at its growth rate over time. \[ \text{GR}_{E} = \frac{ E_{\text{new}} - E_{\text{old}} }{ E_{\text{old}} } \times 100 \]

The benefit of using the growth rate is it makes the change comparable i) over time and ii)across countries.

6.2 Arbitrage

| Term | Definition |

|---|---|

| Spot Contract | An exchange where the price is settled today and the exchange occurs immediately |

| Forward Contract | An exchange where the price is settled today and the exchange occurs in the future |

| Capital Control | A policy that seeks to stop, or substantially limit foreign exchange transactions |

6.2.1 Arbitrage: Two Currencies

We first consider the case of arbitrage with two currencies. Suppose we have two market to buy a Euro using Dollars, New York and Paris. In New York, the exchange rate is \(E_{USD/EUR}^{\text{New York}} = \$3\) \(E_{USD/EUR}^{\text{Paris}}= \$1\).

In this case, the ‘good’ is a Euro, and we have different ‘prices’ of the Euro in New York and Paris. Our strategy is to buy the Euro where it is cheap, in Paris. We then sell where it is expensive, in New York. Using this strategy, our initial dollar \(1\$\) turns to \(3\$\).