5 Tariffs and Quotas

Objectives

- Identify trade equilibrium in our simple ‘principles’ model of trade

- Identify effects of free trade on consumer and producer surplus

- Compute effects of tariff on trade

- Compute effects of quota on trade

- Identify welfare effects of tariffs and quotas

- Identify optimal tariff for a large country

This section studies the effects of government policies on trade. Our focus is on welfare: do people gain or benefit from imposing government distortions. To measure welfare, we use the concepts of consumer and producer surplus. We first build the autarky equilibrium as a baseline of how well off people are under free trade. We then introduce government distortions (tariffs, quotas) and examine how it impacts peoples’ welfare.

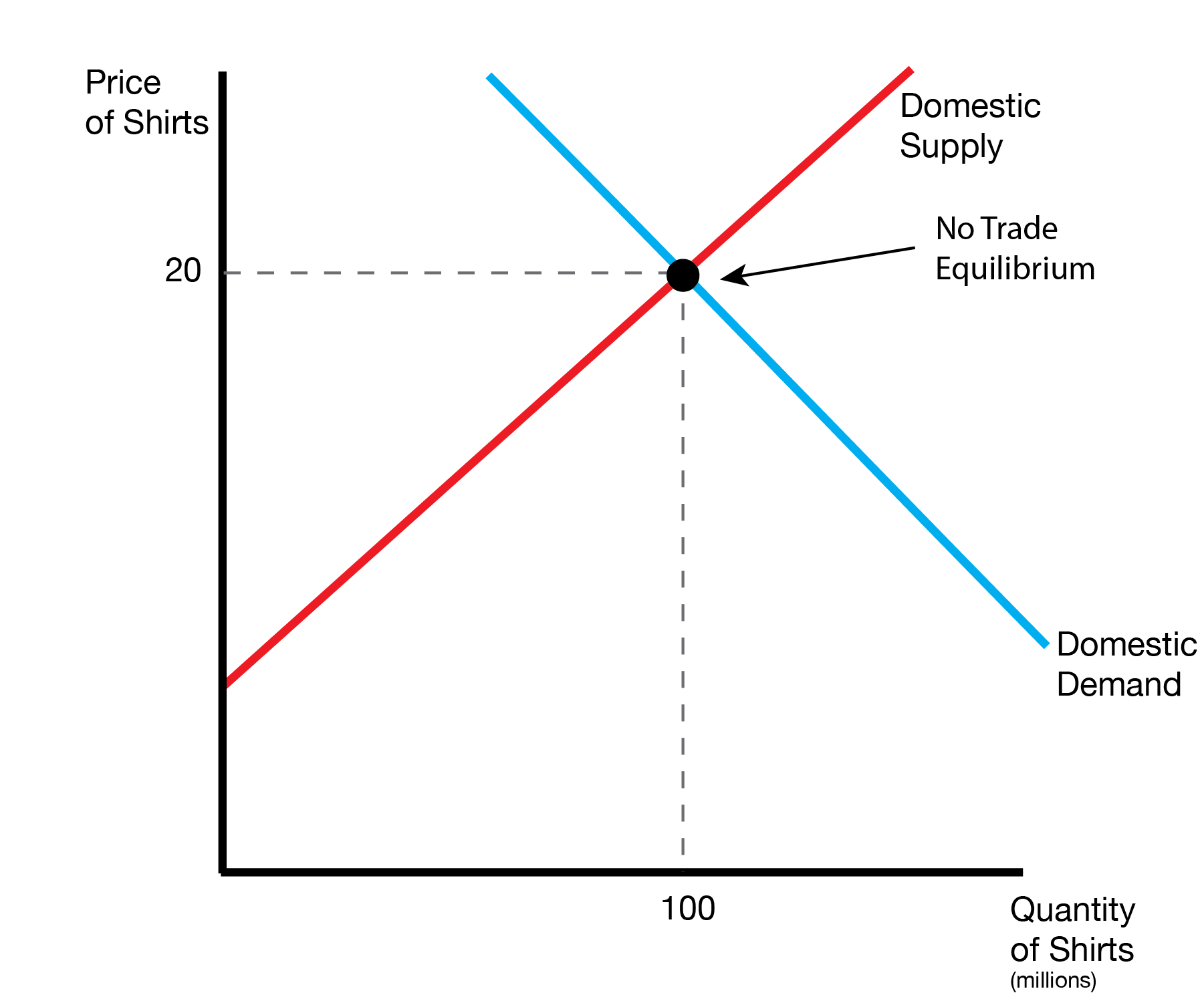

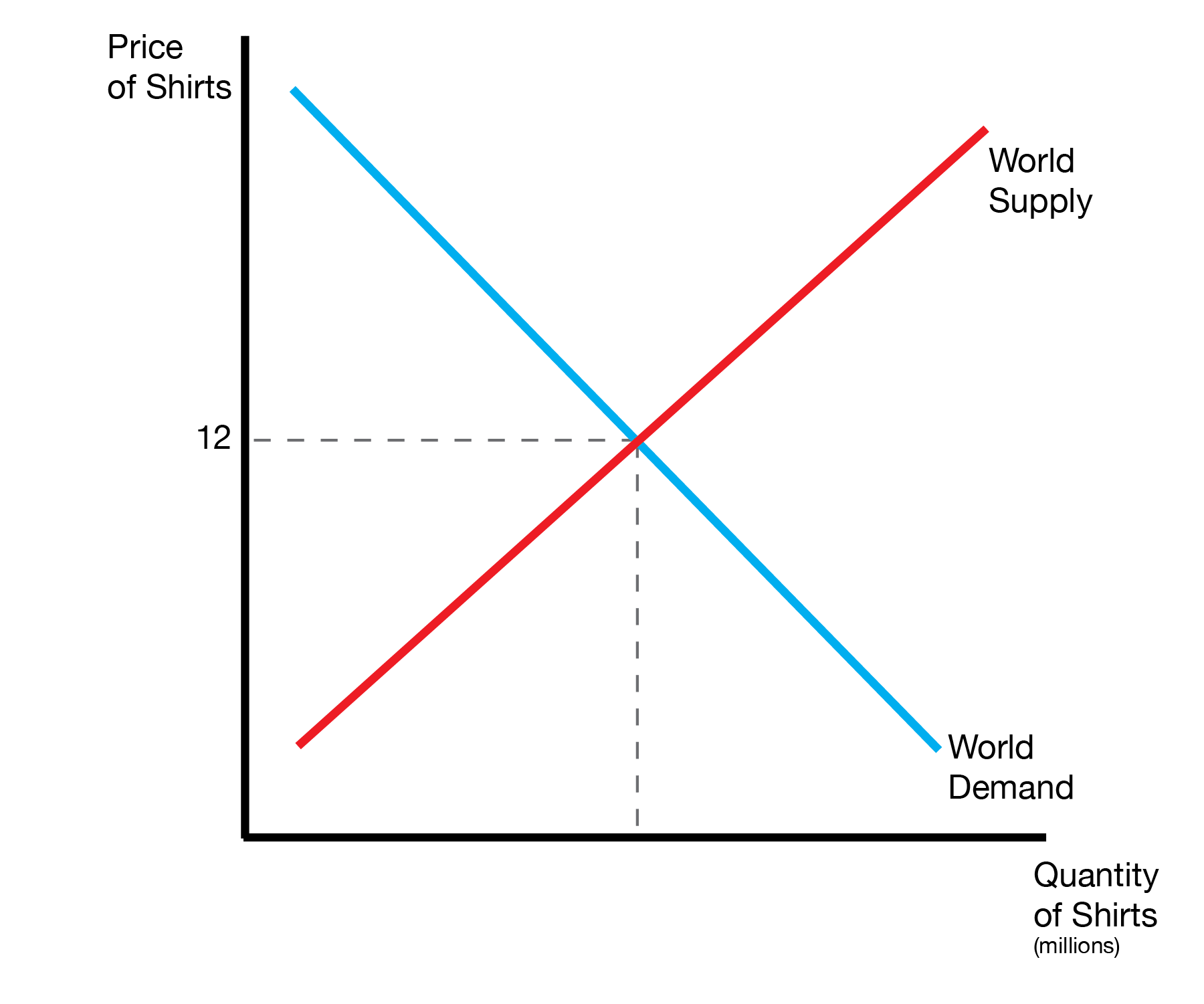

5.1 Autarky Equilibrium

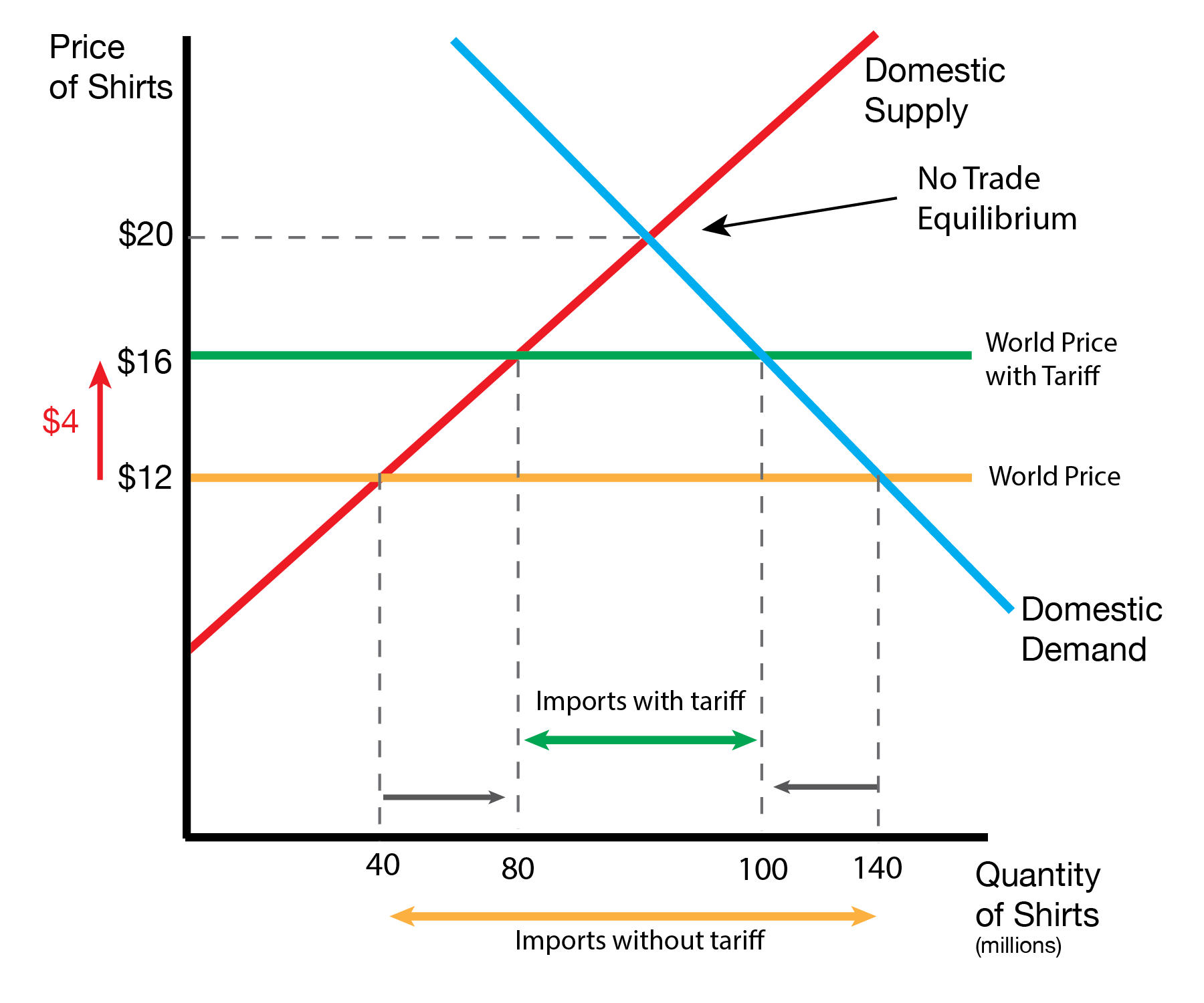

We first develop our autarky equilibrium in the market for shirts, which serves as our baseline. Given domestic demand and supply, we can identify the equilibrium price of $20 and quantity. The right figure displays the world market for shirts. Given world demand and supply, the equilibrium world price of shirts is $12.

5.2 Trade Equilibrium

We now introduce free trade into the model. We will consider two cases. In the first case, the economy imports a product. In the second case, the economy exports a product.

5.2.1 Imports

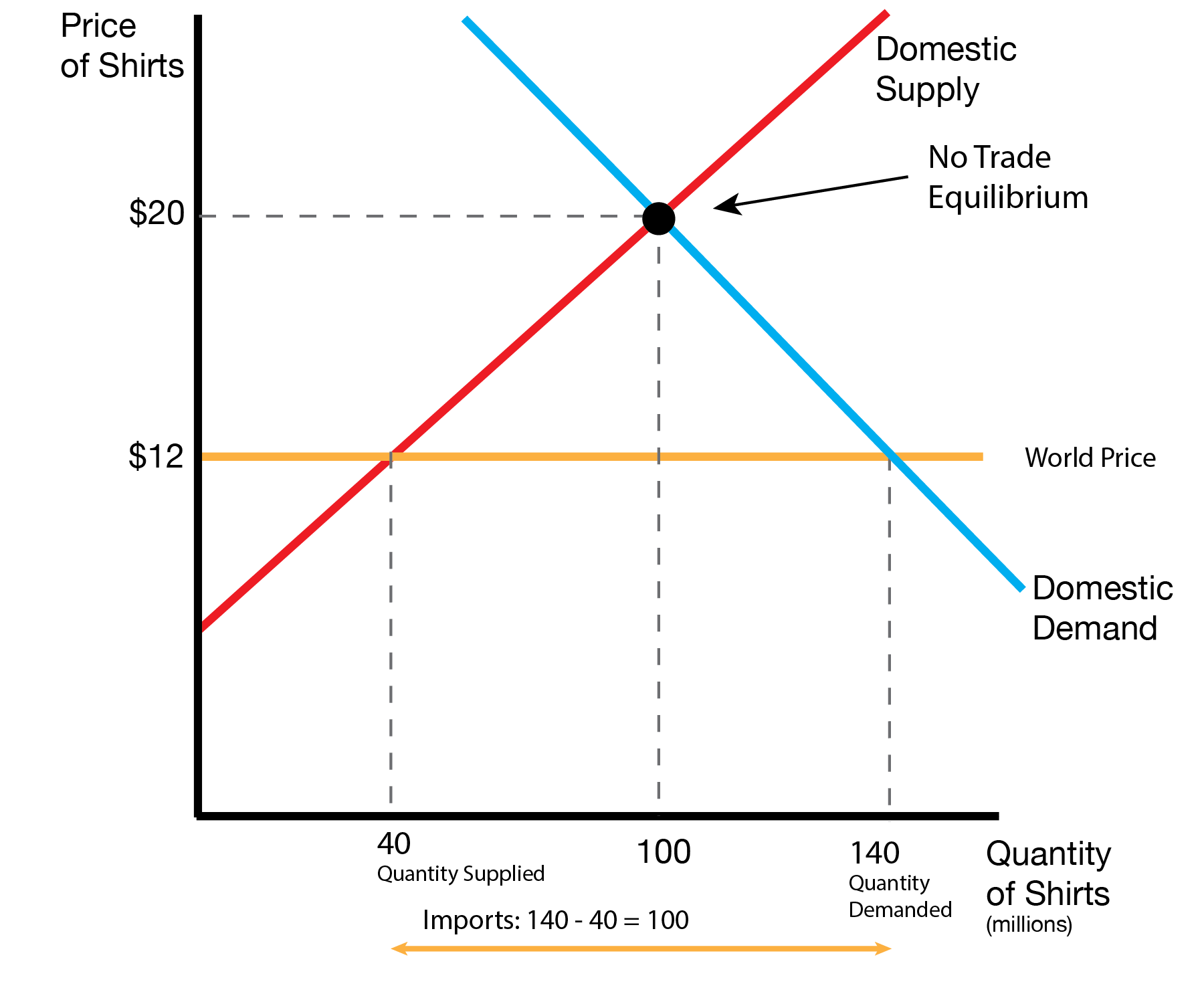

Consumers initially consider two prices: a domestic shirt for $15 and a foreign shirt for $12. Assuming the shirts are identical, consumers will purchase the foreign shirt. If we think carefully, domestic consumers will never purchase a domestic shirt for above $12. Simultaneously, domestic producers will never sell a shirt for below $12. The world price of $12 will therefore be the running price in the shirts market.

Given the price of $12, we can identify the quantity supplied and quantity demanded in the domestic market. Doemstic consumers demand 140 shirts, while domestic producers supply 40 shirts. In autarky this would be out of equilibrium, but domestic consumers simply import the difference, 100 shirts.

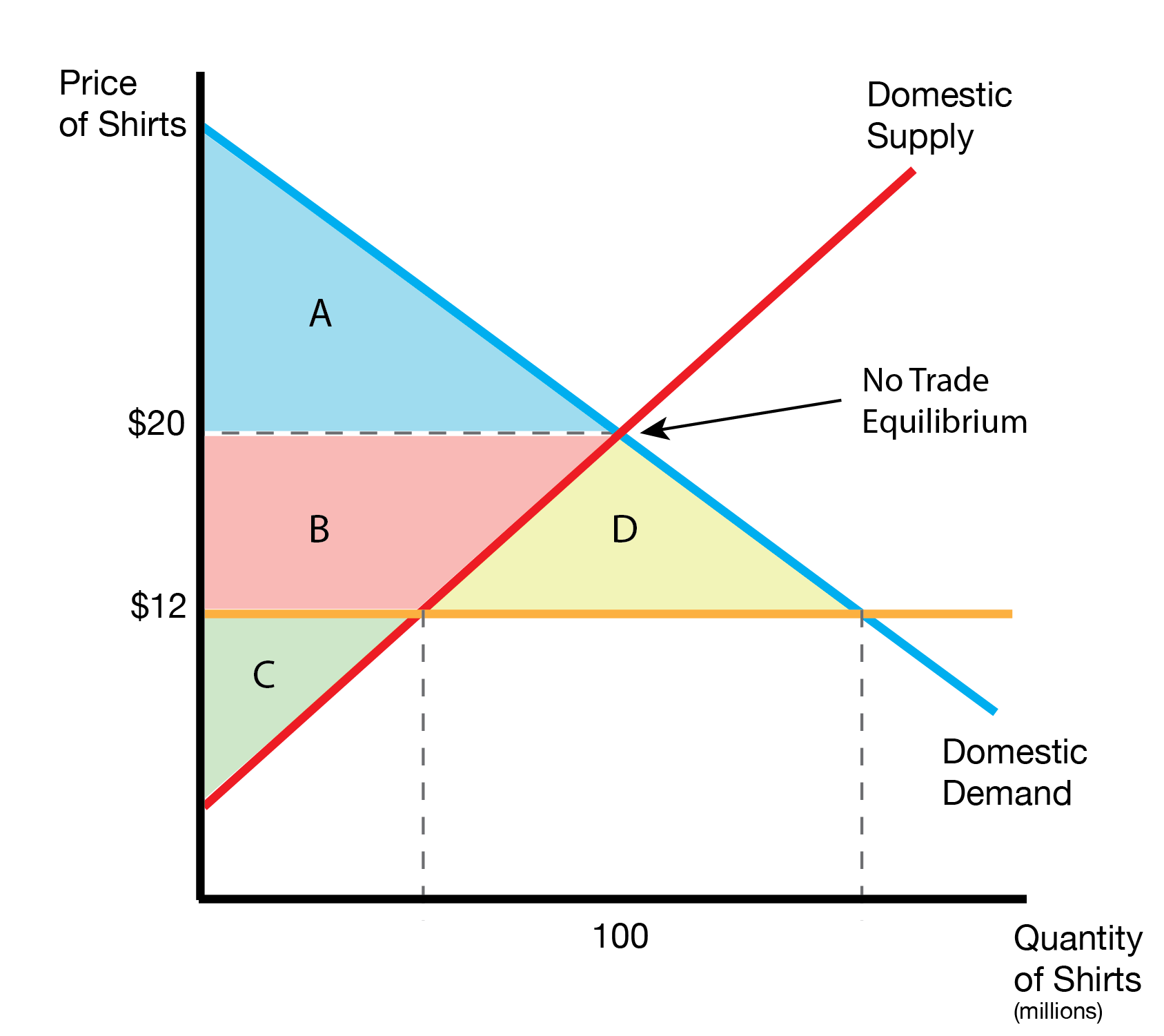

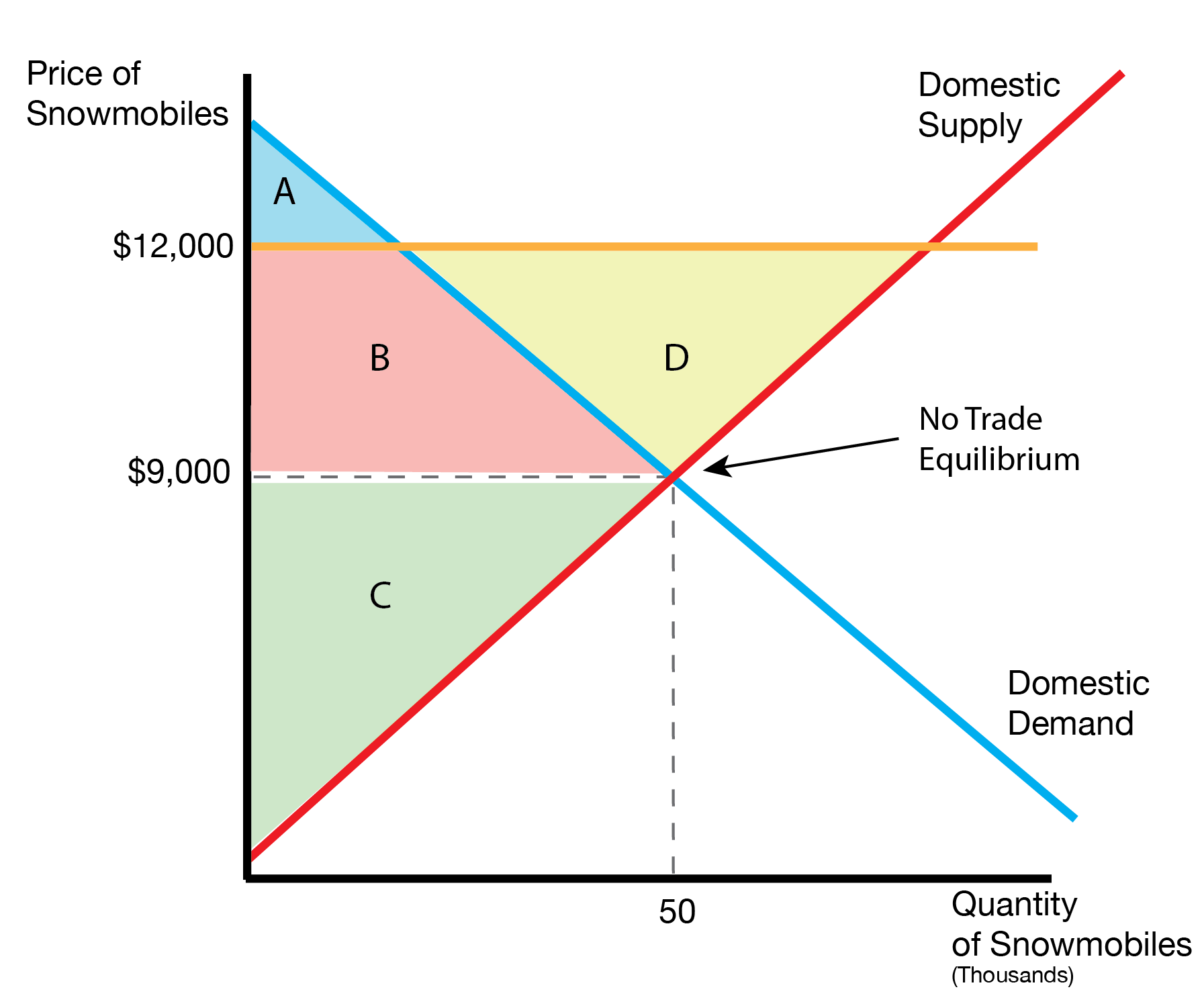

We now consider the welfare impacts of imports.

5.2.2 Exports

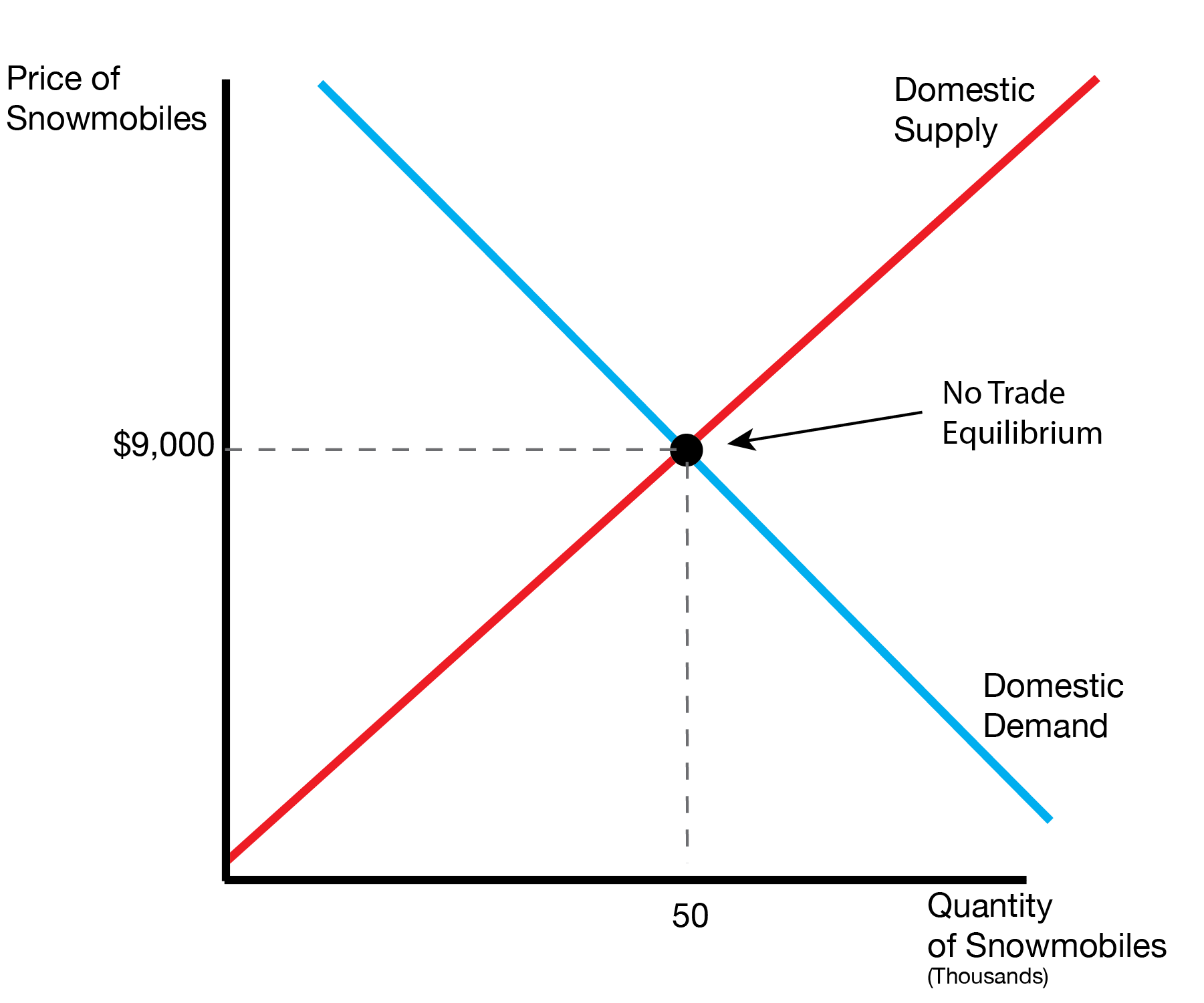

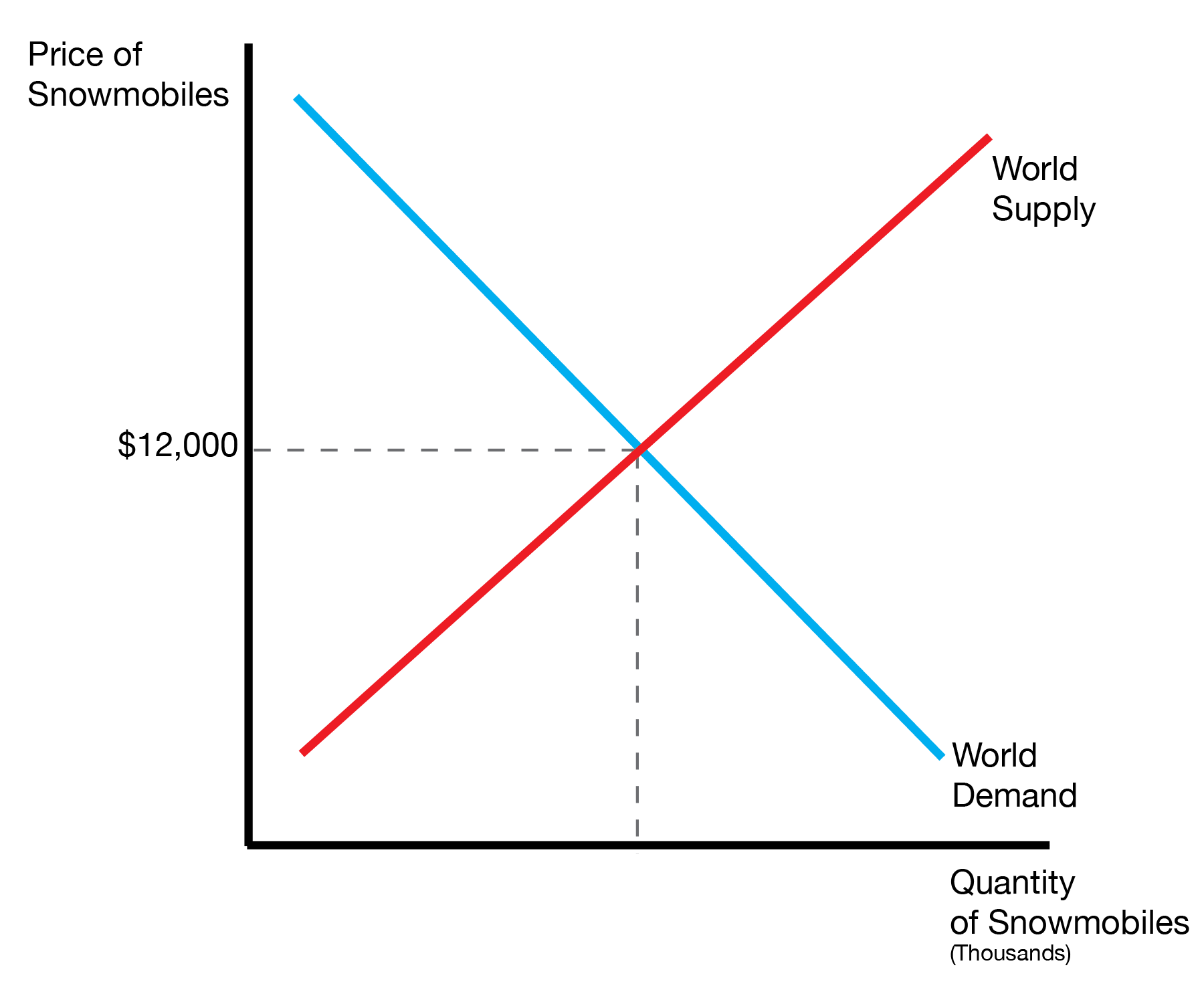

This section consider the case where the world price is above the domestic price. The domestic market features an equilibrium price of $9,000, and the world market features an equilibrium price of $12,000.

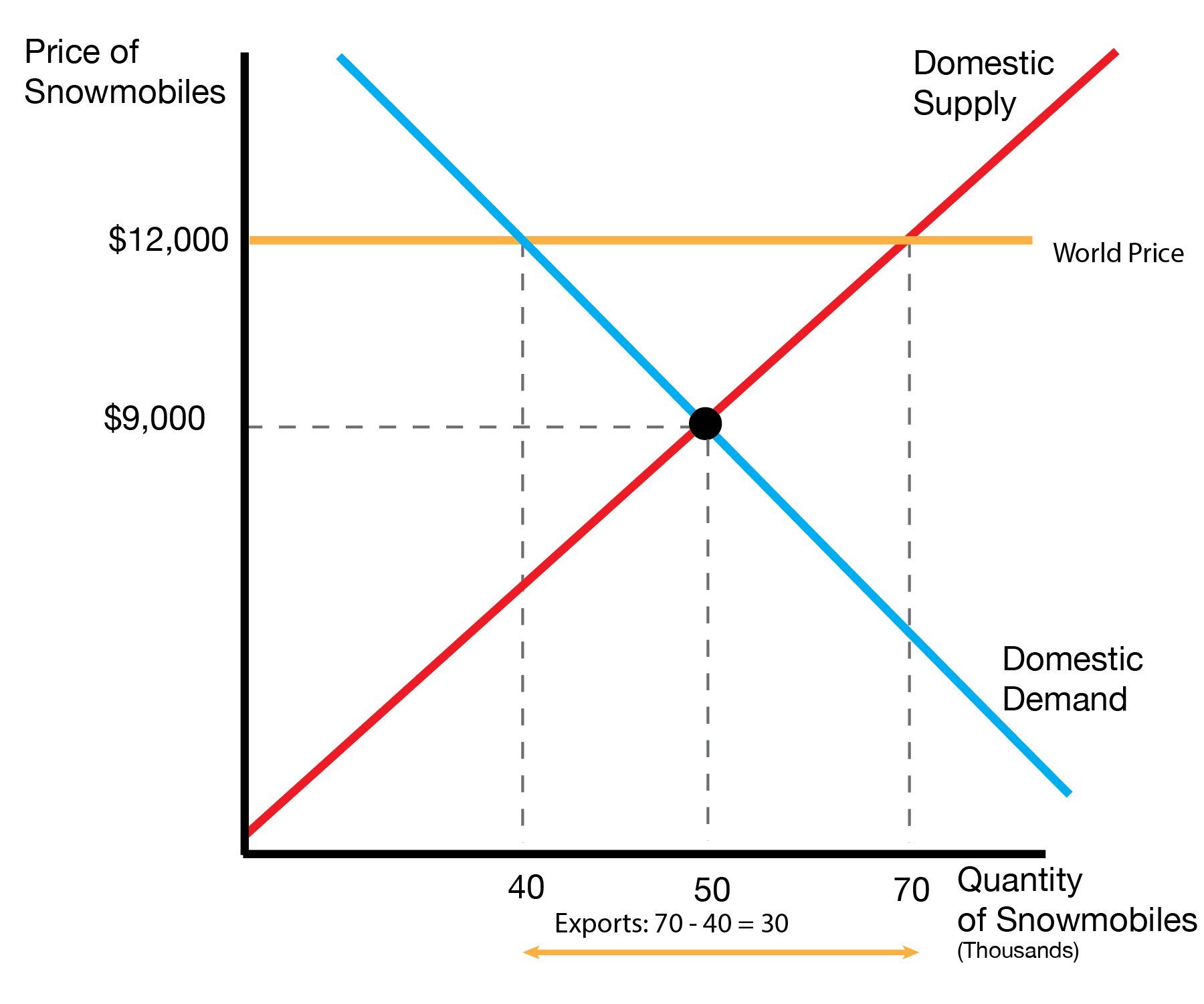

We now allow for free trade. Producers initially consider two prices: selling a snowmobile domestically for $9,000 or exporting it for $12,000 abroad. Assuming the snowmobiles are identical, producers will choose to export to the foreign market. Domestic producers will never sell a snowmobile for less than $12,000 if they can export at that price. Simultaneously, domestic consumers will not purchase snowmobiles for more than $12,000. The world price of $12,000 will therefore be the running price in the domestic snowmobile market.

Given the price of $12,000, we can identify the quantity supplied and quantity demanded in the domestic market. Domestic producers supply 70 snowmobiles, while domestic consumers demand 40 snowmobiles. In autarky this would be out of equilibrium, but domestic producers simply export the difference, 30 snowmobiles.

5.2.3 Summary

The following two tables summarize the effects of free trade on the domestic market.

| World Price | Trade Pattern |

|---|---|

| Above Domestic Price | Producers Export |

| Below Domestic Price | Consumers Import |

Trade Effect:

| Welfare | Import | Export |

|---|---|---|

| Consumer | Increase | Decrease |

| Producer | Decrease | Increase |

| Economic Surplus | Increase | Increase |

5.3 Tariffs for a Small Country

We now study the introduction of tariffs for the imports case. We focus on the case of a small country, which means that the country is too small to affect the world price. Graphically, this is represented by a horizontal (perfectly elastic) supply curve in the world market.

Suppose the world price is $12, and the government imposes a $4 tariff on imports. With the $4 tariff, the price of imported shirts rises from $12 to $16. We assume happens because we assume the country is small. If foreign producers have to pay any of the tariff, they would simply export to another country.

We now consider the welfare effects of the tariff:

| Group | Gains / Losses |

|---|---|

| Consumer | –(A + B + C + D) |

| Producer | +(A) |

| Government | +(C) |

| Total | –(B + D) |

| Tariff Welfare Effects: | |

|---|---|

| Agent | Effect |

| Consumer | Hurt |

| Producer | Benefits |

| Total Economy | Hurt |

5.4 Quotas

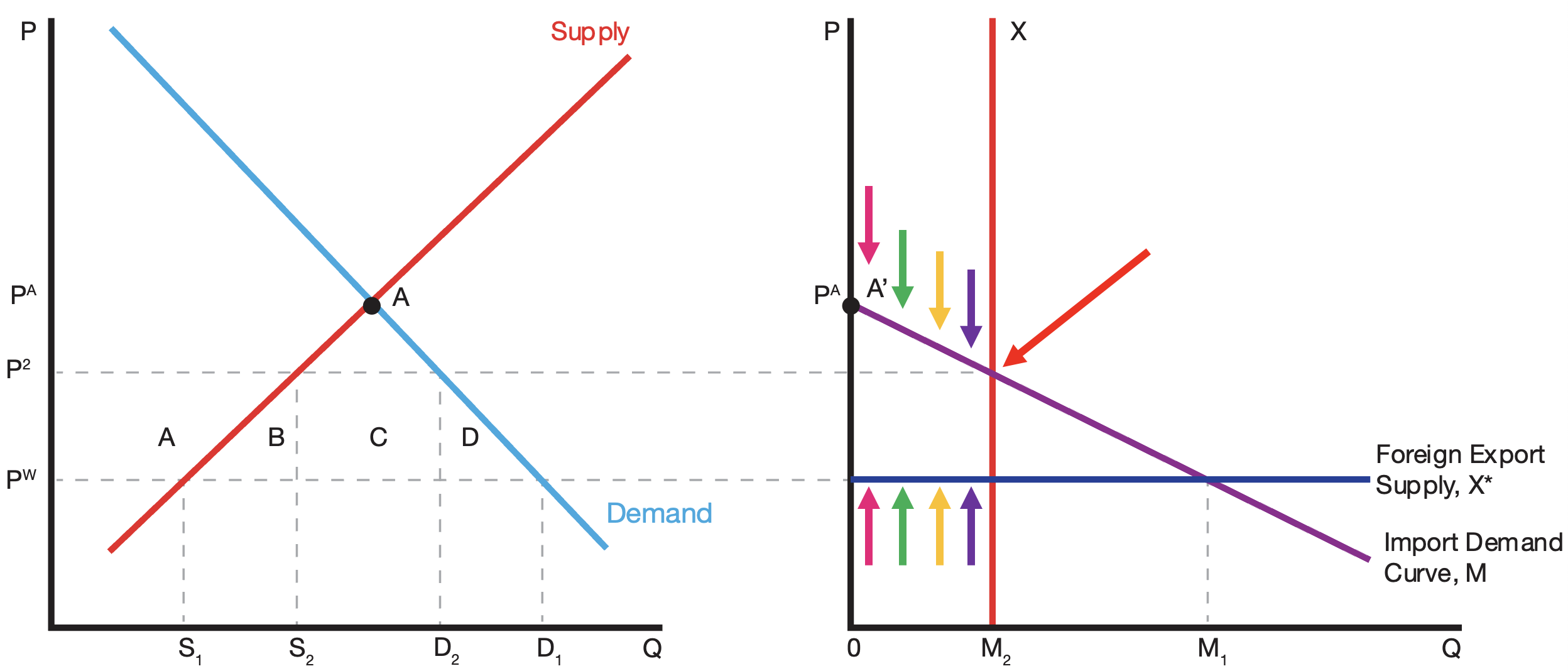

We will now study Quotas, which restrict the quantity of imports rather than the price of imports. We start with our initial setup where Home imports goods because the world price \(P^W\) is lower than the autarky price \(P^A\). This leads to an import demand curve \(M\) and equilibrium quantity of imports \(M_1\).

The goverment now introduces a quota quantity \(M_2\). We now need to search for the new equilibrium price and quantity of imports. What happens to the price? We work our way down from the top of the demand curve, where consumers have the highest willingness to pay. We start at the original autarky equilibrium A / A’ associated with price \(P^A\). The first consumer (red arrow) can import the good for a price lower than \(P^A\). The second consumer (green arrow) can import the good for an even lower price. This continues iteratively until we’ve reached the quota limit \(M_2\). At this point the price has decreased to \(P^2\).

Examining the graph, we can compute the welfare effects as follows:

| Group | Gains / Losses |

|---|---|

| Consumer | –(A + B + C + D) |

| Producer | +(A) |

| Total | –(B + C + D) |

We therefore find that quotas similarly create individual winners and losers but create an overall decline in welfare (economic surplus).

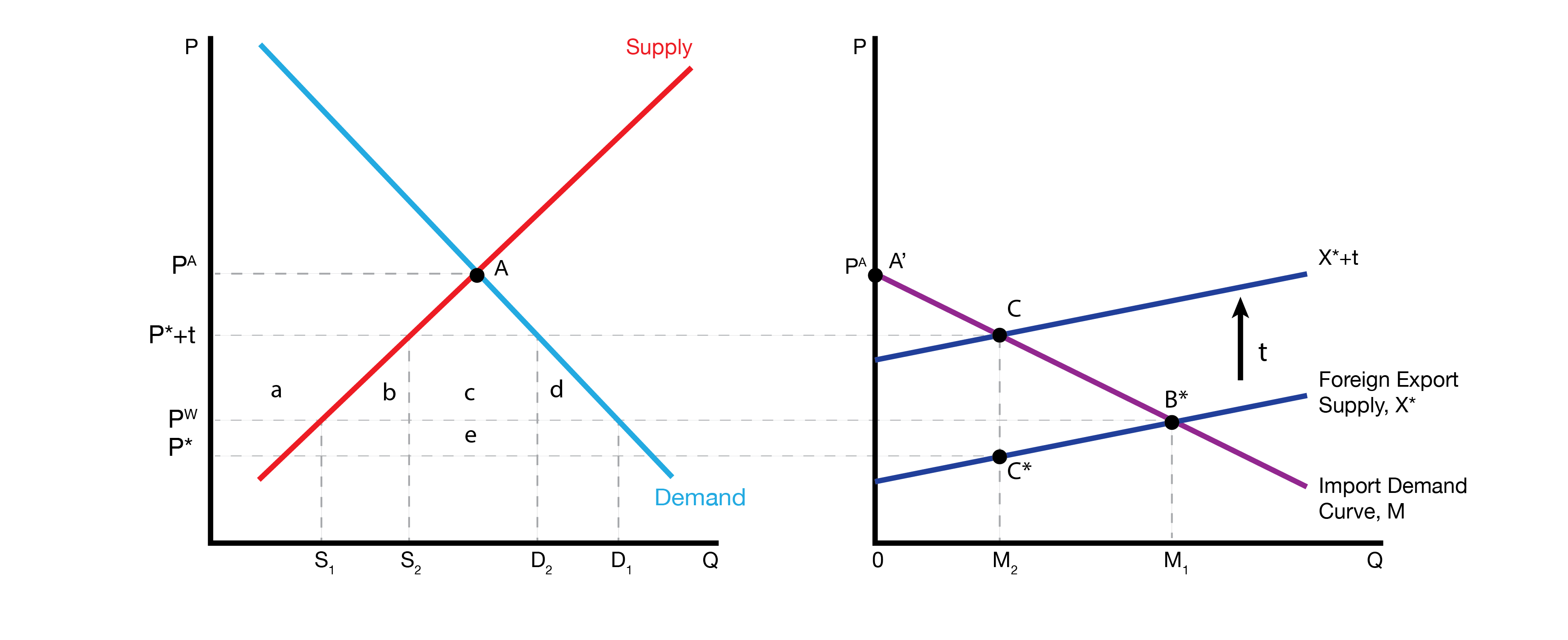

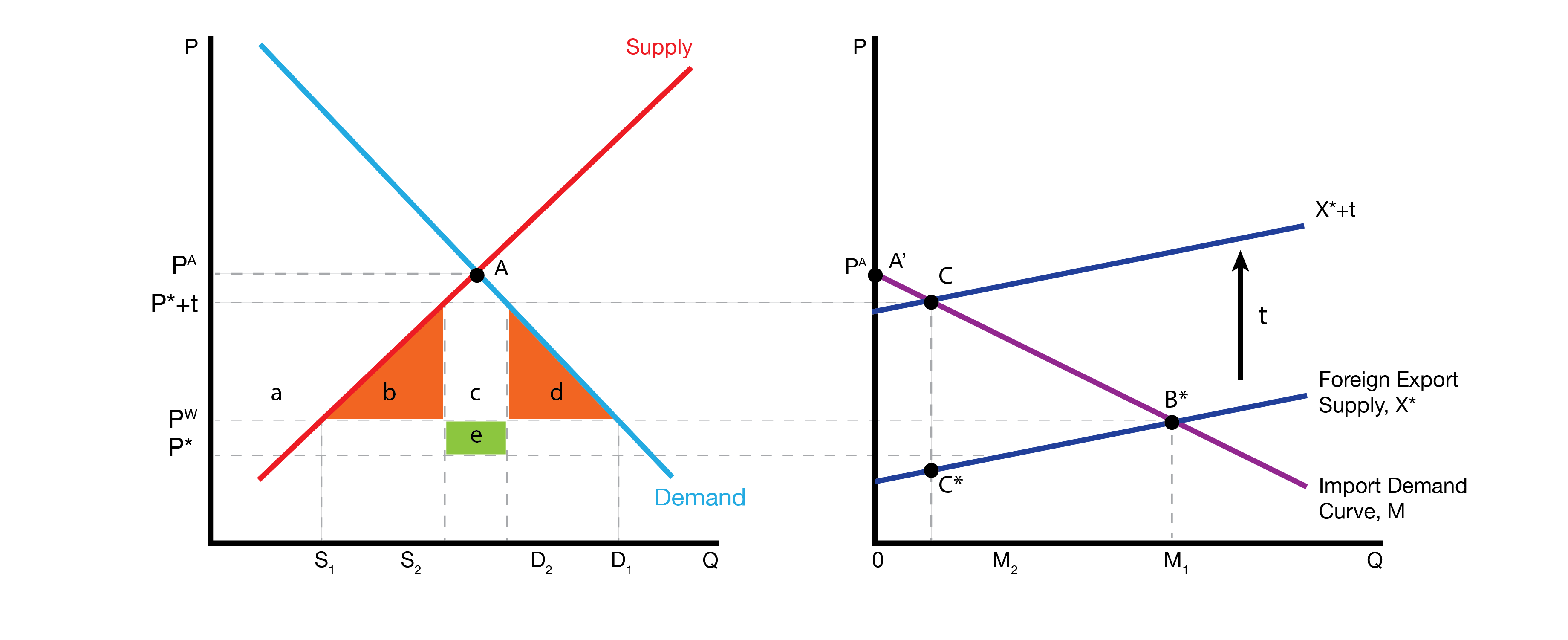

5.5 Tariffs for a Large Country

We now consider the case of a large country, like the United States. Graphically, this represented by an upward sloping supply curve in the world market. In this case, foreign producers cannot simply abandon the larger country if they have to pay a portion of the tariff because other countries do not feature large enough markets to sell to.

We now examine a simple tariff implementation. As a tax, this leads to a vertical increase \(t\) in the foreign export supply curve. Note the tariff does not impact the domestic supply curve because the tariff only applies to foreign producers.

We now examin the effects of a small tariff. The small tariff leads to welfare losses \(b\) and \(d\) and welfare gain \(e\). In this case, the welfare gain \(e\) outweight the losses \(b\) and \(d\).

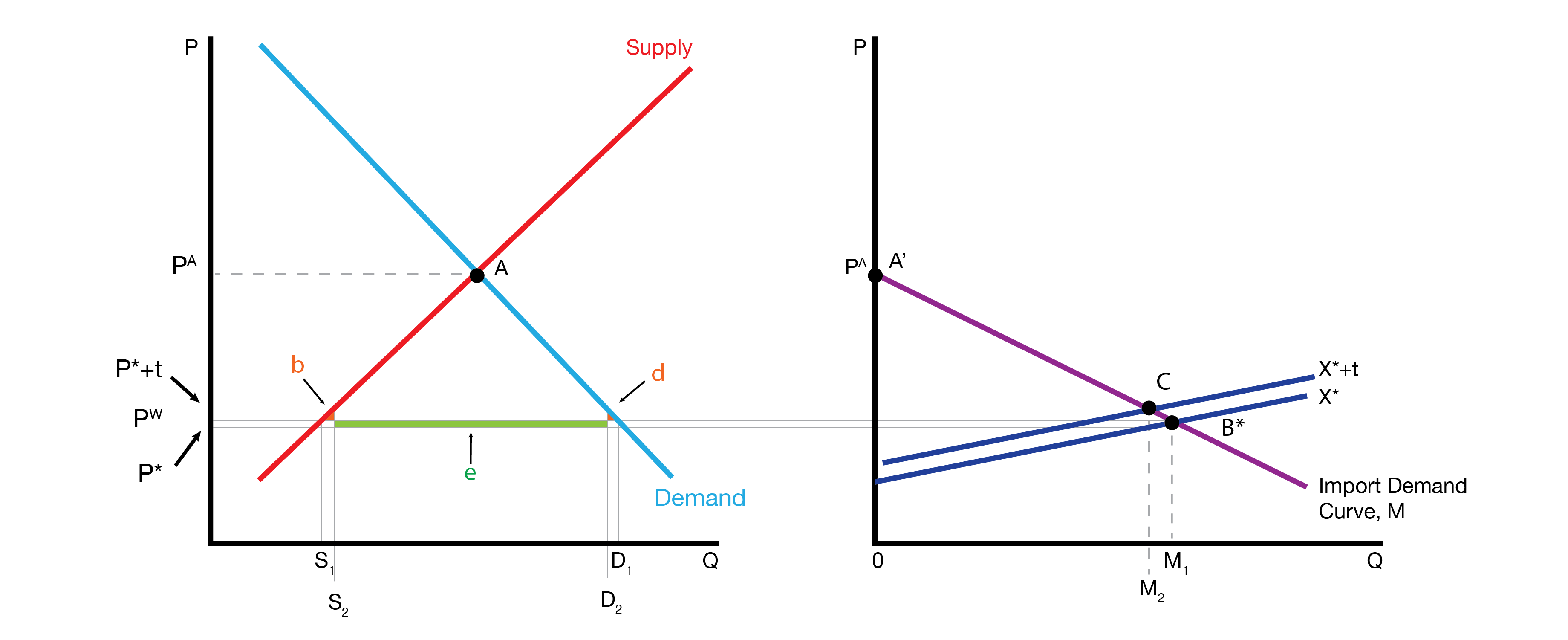

We now examin the effects of a large tariff. The small tariff leads to welfare losses \(b\) and \(d\) and welfare gain \(e\). In this case, the losses \(b\) and \(d\) outweight the gain \(e\), producing an overall welfare loss.

5.6 Conclusion

- This lecture studies the effects of government interventions (tariffs, quotas) in international trade

- Relative to the free trade benchmark, government interventions decrease welfare (overall) and create their own set of winners and losers

- We expand our analysis to the case of a large country that does not face perfect competition

- We show that the optimal tariff can be positive and too large of tariffs are still welfare reducing